A Run On Silvergate Bank

A U.S. bank is on the verge of collapse because of a bank run.

We don’t see this very often anymore. A U.S. bank is on the verge of collapse because of a bank run.

Last week, Silvergate Bank said that it could have trouble staying in business after racking up big losses over the past few months.

On the surface, this was pretty shocking news because most of the bank’s assets were made up of super safe securities like U.S. Treasury bonds, municipal bonds, and mortgage-backed securities. You usually don’t lose a lot of money by holding those types of assets.

But the situation Silvergate got into was far from usual.

To understand what happened, let’s rewind a little.

Silvergate Bank is a regional bank based in the San Diego area. It was founded in 1988 and for most of its history, it was a relatively small bank serving local customers in Southern California.

But that started to change around a decade ago. You see, Silvergate’s CEO Alan Lane was a big proponent of cryptocurrencies.

He bought bitcoin in 2013 and was very enthusiastic about this new technology, which he believed could revolutionize the banking industry and the broader finance industry.

Lane also saw an opportunity. To get their hands on cryptocurrencies, people needed to buy them using traditional currencies, like U.S. dollars.

If you want to buy bitcoin, you go to a crypto exchange like Coinbase, deposit dollars into your account, and then exchange those dollars for bitcoin.

But the dollars you put into your Coinbase account don’t actually exist on Coinbase. Behind the scenes, they’re in a bank somewhere.

That’s how the modern monetary system works. Currencies like dollars are held either in the form of physical banknotes and coins or they’re held in accounts at banks.

So you send dollars from your bank account to Coinbase’s bank account, and then the company credits your Coinbase account with that same amount of money.

The problem is, several years ago, crypto companies didn’t have easy access to the banking system. The industry had a little bit of an unsavory reputation and there was a lot of legal uncertainty about whether banks were allowed to deal with these types of companies.

As a result, many big banks shied away from serving crypto companies.

That’s where Silvergate stepped in. It said, “Hey, there’s this fast-growing industry that’s in desperate need of banking services, why don’t we cater to them?”

So it did that and all of these crypto companies started to put their customers’ money into the bank.

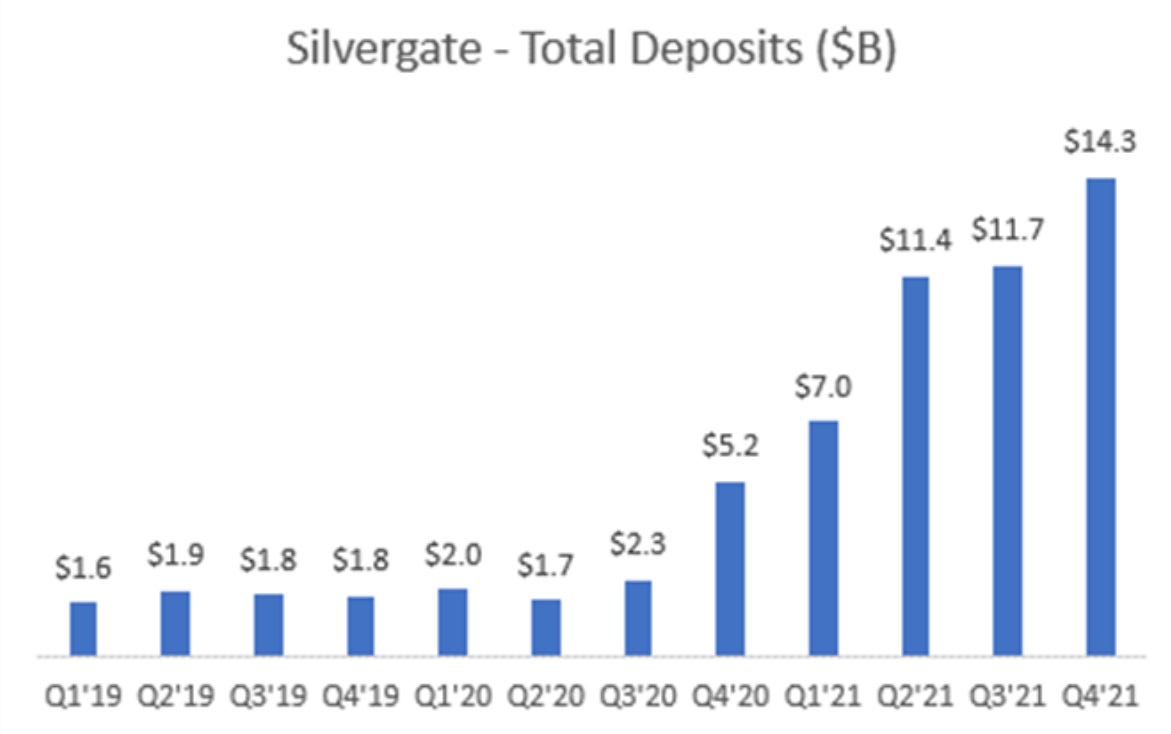

Silvergate’s deposits grew from $500 million in 2014 to $600 million in 2015 to $800 million in 2016.

And then in 2017, it introduced something called the Silvergate Exchange Network, or SEN.

What this network did was allow Silvergate’s customers to send and receive dollars, 24 hours a day, 7 days a week, instantaneously.

Crypto companies loved this. The crypto markets are also open 24/7 and the transactions are usually completed really fast.

But the traditional banking system doesn’t work that way. Bank transfers are only available in certain hours on the weekdays and the transactions usually take one or more days to complete.

The Silvergate Exchange Network changed that— at least for Silvergate Bank’s customers.

As long as it was facilitating transactions between its own customers, Silvergate could take money from one customer’s account and deposit it into another customer’s account, all within its own system.

It didn’t need to interact with the broader banking system and so these transactions could happen anytime, instantaneously.

It was a big selling point for the crypto companies because they were doing business 24/7; their customers were sending dollars in and out of their accounts all the time— so they wanted a bank that could keep up with that.

And that’s exactly what Silvergate offered.

This attracted a lot crypto companies into the Silvergate Exhange Network because they wanted to be able to transact with other crypto companies already on the network.

For Silvergate, this was a stroke of brilliance and for several years, things couldn’t have gone any better for the firm. Silvergate was the leading bank for crypto companies just as a massive crypto bubble was inflating.

From 2020 to 2021, the price of bitcoin increased from around $7,000 to almost $70,000, while the price of ether increased from around $100 to almost $5,000.

Everyone wanted to buy these assets, so they were pumping dollars into crypto exchanges, which in turn kept those dollars at Silvergate.

By 2020, the bank’s deposits grew to more than $5 billion and in 2021, customer deposits hit $14.3 billion—18x what they were five years prior.

Silvergate was over the moon, especially since it didn’t pay any interest on those deposits.

But, like any bank, it used those deposits to fund its own investments and to generate profits.

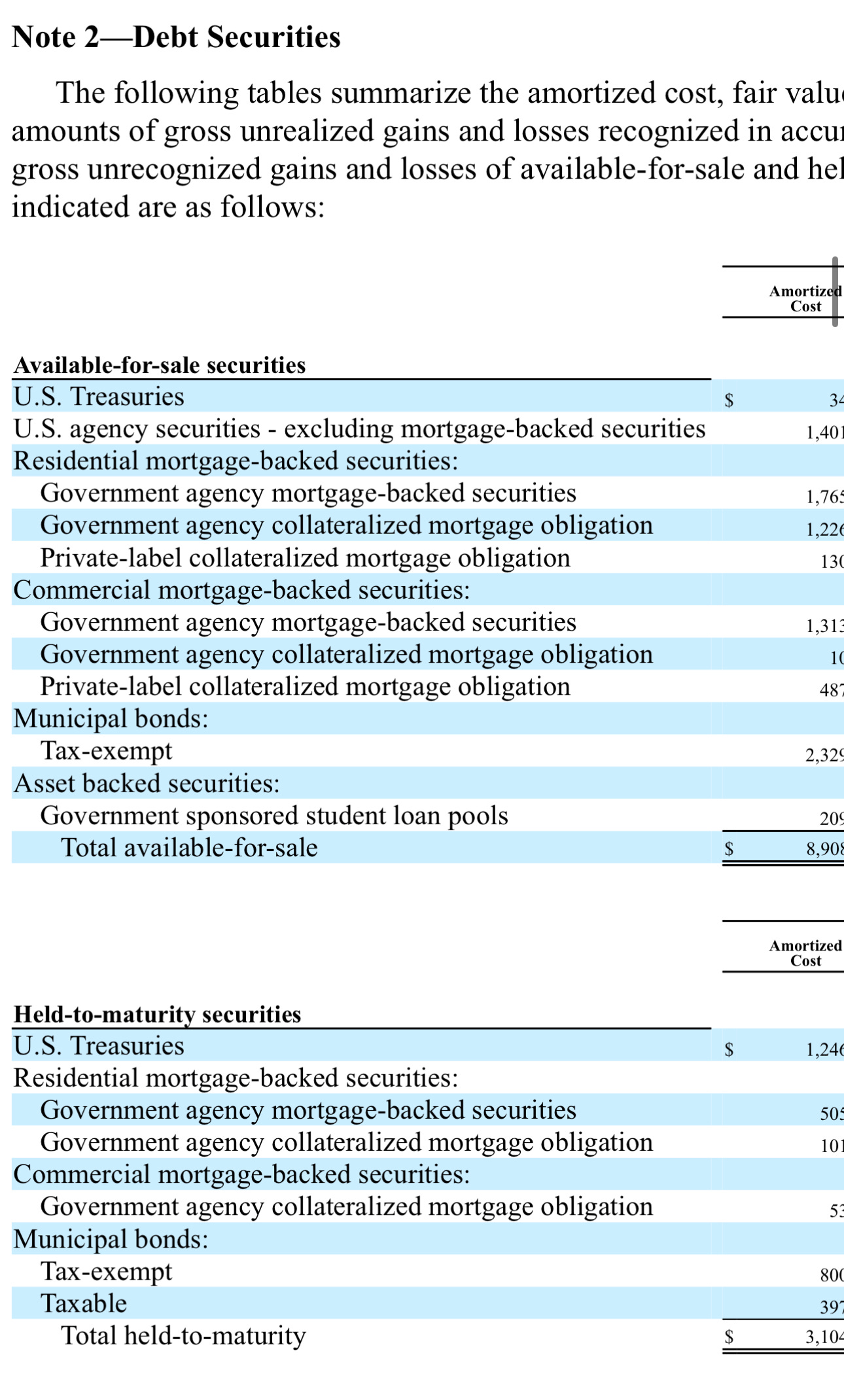

It didn’t do anything too crazy with the money. The vast majority of its assets were made up of super safe securities— like I said, Treasuries, munis, and mortgage backed securities.

So everything looked great for many years until 2022. That’s when things started to unravel.

As you might know, the crypto bubble popped spectacularly last year. Bitcoin lost as much as three-quarters of its value, bottoming out around $15,000. Ether fell 80% to less than $1,000.

It was a bloodbath. So what did people do? They sold their crypto and moved their money back into dollars. And not only that. In many cases, they took those dollars completely out of their crypto accounts.

That meant that the crypto exchanges had to take money out of Silvergate so they could give it back to their customers.

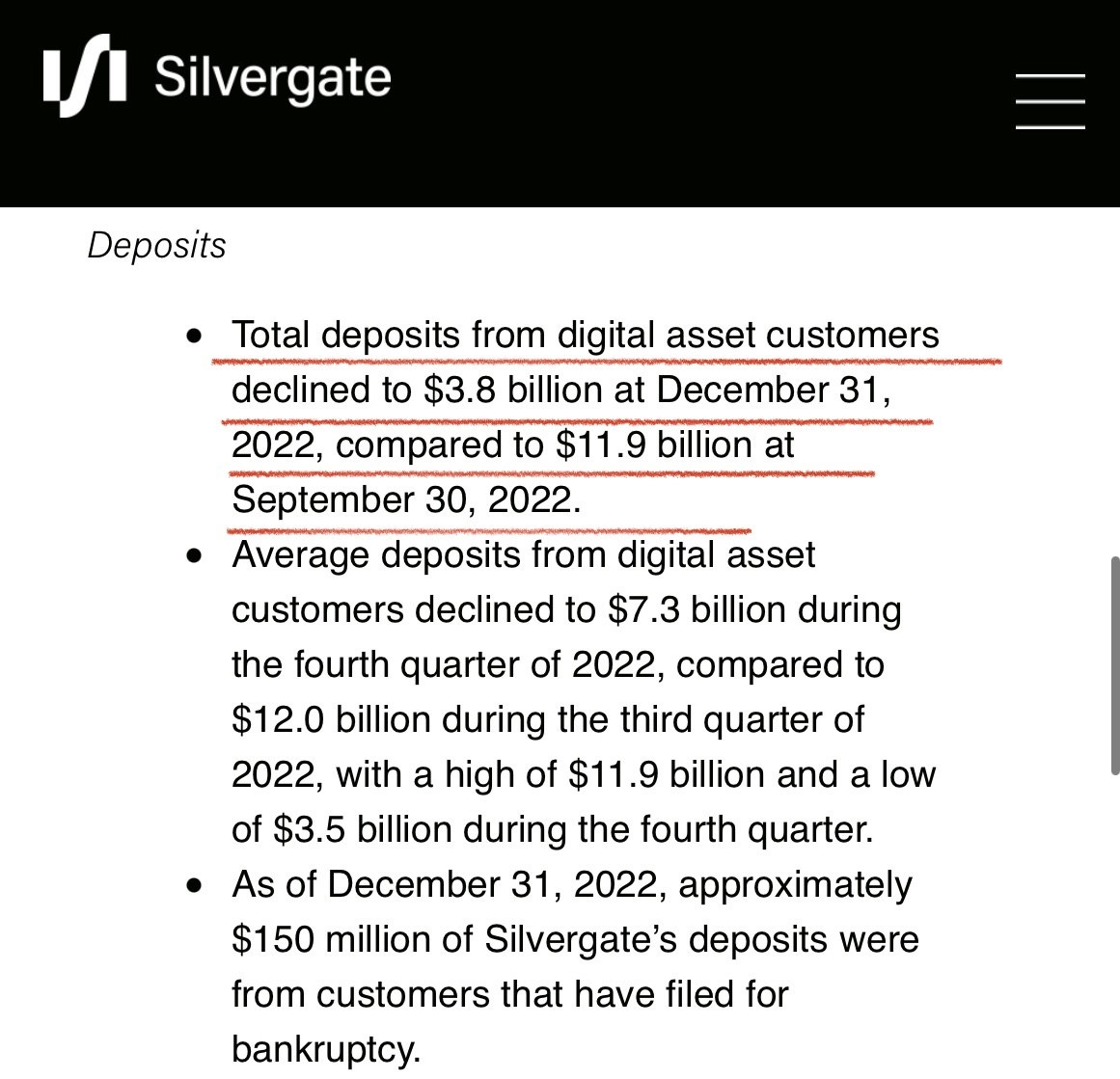

All of a sudden, billions of dollars were flowing out of the bank really, really fast. And those outflows were compounded by the implosion of some high-profile crypto companies, most famously FTX, which was a customer of Silvergate.

As FTX went under, it pulled billions of dollars out of Silvergate to repay its customers.

At the same time, FTX’s implosions caused customers of other crypto companies to panic and pull money out of their accounts, which in turn caused those companies to take money out of Silvergate.

In the fourth quarter of 2022 alone, Silvergate depositors pulled a whopping $8.1 billion out of the bank.

Silvergate had to come up with this money on very short notice. How did it get the money?

Remember those Treasuries, munis and mortgage-backed securities I talked about earlier? Silvergate sold a lot of them.

Now the thing about those type of bonds is, yes, they are generally some of the safest investments in the world. But there’s many flavors of safe bonds. You have everything from T-bills, which get paid back in under a year, to 30-year Treasury bonds, which don’t get paid back for decades.

The problem is, bonds that get paid back well in the future are very interest rate sensitive. If interest rates go up, their prices temporarily go down, and they can go down a lot depending on how fast interest rates go up.

In 2022, interest rates went up a lot and very fast as the Federal reserve hiked rates to fight inflation.

So the price of these bonds dropped significantly at the worst time for Silvergate.

In total, the bank sold $5.2 billion worth of debt securities in the fourth quarter and lost $1 billion on the sales.

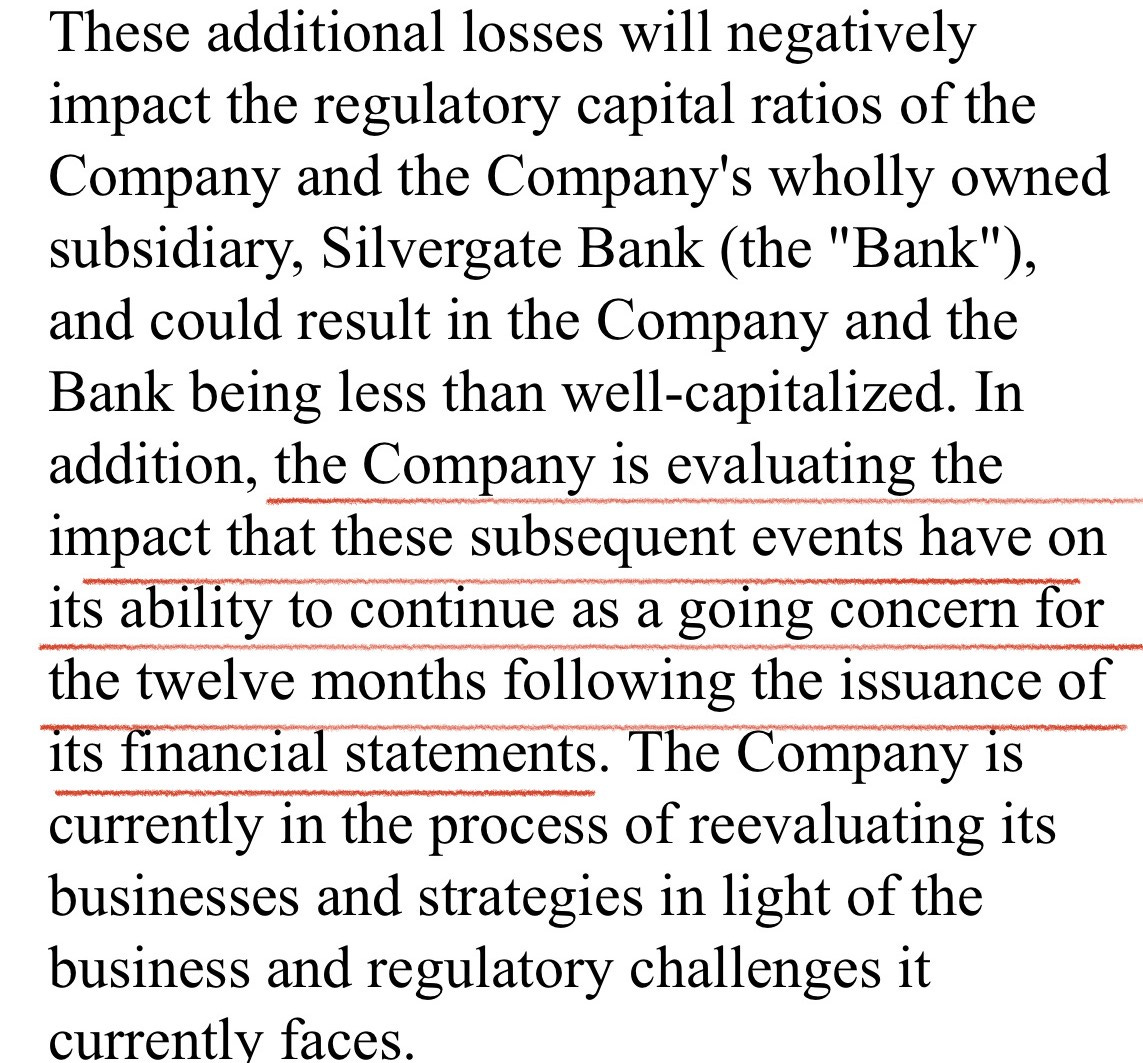

Then last week, Silvergate came out with even more bad news.

It said that the way things were going, it wasn’t sure whether it could stay in business over the next 12 months.

That ignited a firestorm. The stock was cut in half in a single day and many of Silvergate’s biggest customers—including Coinbase, Galaxy Digital and others— announced that they would be taking their money out of the bank.

This means that Silvergate will most likely be forced to sell even more assets at fire sales prices in order to pay its customers back, leading to more losses for the bank.

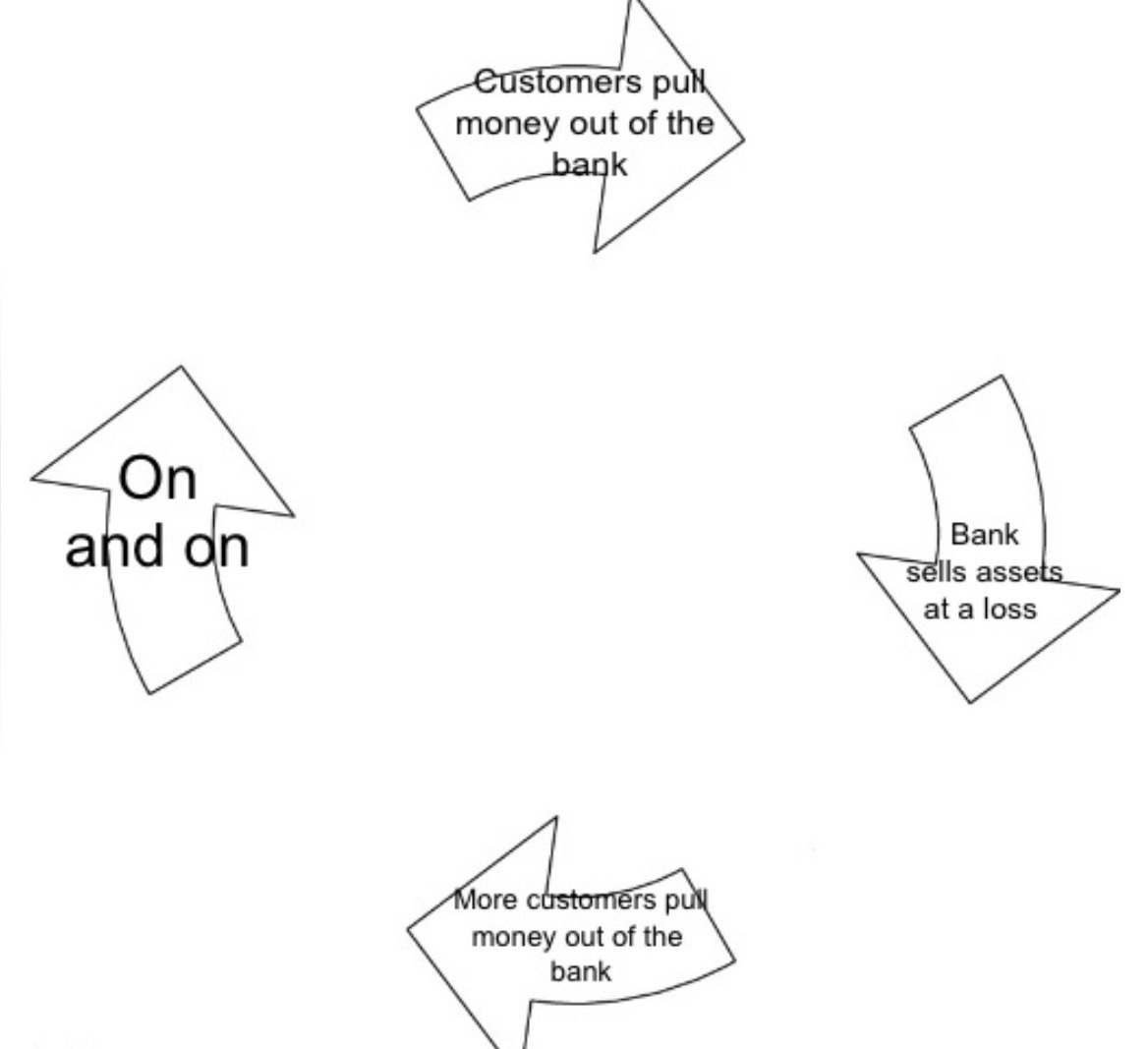

What’s essentially happening to Silvergate is a bank run. Customers are pulling money out of the bank, the bank is selling assets at a loss, which causes more customers to pull money out of the bank, on and on in a vicious cycle.

But instead of a classic bank run, where the customers are individuals like you and me, it’s crypto companies who are fleeing the bank.

This is a pretty interesting situation because nowadays, bank runs aren’t very common. They used to be, but then we got something called deposit insurance, which guarantees that if a bank fails, depositors will be reimbursed up to a certain amount by the government.

That, along with other government backstops, pretty much put an end to the classic bank runs that were common decades ago, and which were a major cause of the Great Depression.

But every now and then, we still have unique situations like these, where you have a different type of bank run.

It all started with the crypto companies taking their money out of Silvergate not because they were worried about the bank, but because their customers were worried about them and were asking for their money back.

In other words, it started with a run on the crypto companies.

But then eventually, all that money coming out of Silvergate caused its financial health to deteriorate as well, and it was forced to sell assets at the worst time at a loss.

That in turn caused the remaining customers of the bank to worry about Silvergate itself, so they pulled more money out of the bank, causing further asset sales in a vicious cycle that’s similar to a classic bank run.

This has been a perfect storm for Silvergate and it was essentially done in by the fact that its customer base was very fickle. Unlike ordinary people who keep their money in banks for the long haul, the deposits in Silvergate were hot money.

When the crypto bubble burst, everyone headed for the exits at once.

Since Silvergate knew that it had a very fickle customer base, it probably should have been more careful about where it invested its money.

It might have been fine if it kept the money in less volatile, short-term investments, like T-bills—which don’t fluctuate much in price.

Instead, it made a mistake of buying assets that are really interest rate sensitive at a time in which rates were rising rapidly.

So we’ll see what happens. A few days ago, Silvergate shut down the Silvergate Exchange Network, which was the main reason a lot of customers kept money at the bank.

If the stock price is any indication, this bank is probably not going to be around for much longer. If Silvergate fails, this would be the first bank failure since 2020.