Are Dollar Stores Dying?

The stock prices of the two biggest dollar store chains have plunged more than 60%.

Are dollar stores dying?

Earlier this year, Family Dollar announced that it would be shutting down almost 1,000 of its stores. A month later, 99 Cents Only announced that it would close 371 stores and file for bankruptcy.

The stock prices of the two biggest dollar store chains— Dollar General and Dollar Tree— have plunged more than 60% from their peaks, sharply underperforming the broader retail industry.

What’s going on here?

Well, there seems to be a few main reasons for the struggles of dollar stores. The first is the economic strain that low-income consumers are feeling.

Dollar General, the largest dollar store chain in the U.S. with 20,000 locations, recently said that its customer base has been feeling the pinch of higher prices, softer employment levels and increased borrowing costs.

The company gets 60% of its sales from low-income households making less than $35,000 per year, and these are the consumers that seem to be faring the worst in today’s economy.

Another reason these companies are struggling is due to theft, also known as “shrink” in the retail industry.

99 Cents Only Stores blamed its bankruptcy earlier this year in part on elevated levels of theft and crime. The company tried to pass on these costs to its customers in the form of higher prices, but customers pushed back and stopped shopping as much at its stores.

I mean, you can’t fault the customers. The promise of dollar stores used to be that you could walk in and buy anything for a dollar or less. Today, that’s a rarity, as the majority of items cost well over a dollar.

Higher prices and crime aren’t the only things turning customers off from shopping at dollar stores. In general, the shopping experience at these stores can be pretty lousy.

A scathing Bloomberg article on the conditions of Dollar General stores described them as “dirty, miserable and dangerous.”

Items stay on the shelves passed their expiration date, the stores are cluttered, and sometimes infested with pests.

One especially egregious example that the article talks about is when birds created a nest in the ceiling of a Dollar General store in Oklahoma.

Apparently, these bids started to regularly poop on the store’s merchandise. But rather than throw the items out, managers of the store ordered the workers to clean them up and put them back on shelves.

Really bad stuff.

So, this miserable shopping experience at many dollar stores may be why consumers have been turning to alternatives— like Walmart.

The world’s largest retailer has increasingly been taking customers away from dollar stores with its low prices and superior shopping experience.

Walmart also has another key advantage over dollar stores: a robust e-commerce operation through which consumers can get countless low-priced items delivered straight to their doors.

That’s helped Walmart, along with e-commerce giant Amazon, siphon away some of the customers that dollar stores have traditionally catered to— and the dollar stores haven’t had much success responding without strong e-commerce operations of their own.

The contrast between the fortunes of Walmart and the dollar stores couldn’t be starker. Just look at how their stock prices have performed over the past five years— a huge divergence.

Which brings us back to the original question: are dollar stores dying? The answer to that depends on who you ask.

The stock market is currently suggesting that the dollar store model might be broken.

Maybe because there’s too much competition, there’s too many of these stores already out there, or because of their lack of online sales— they just might not be able to thrive like they once did.

As you might expect, the companies have pushed back on that narrative, arguing that their problems are temporary or fixable.

They say they’re working on cleaning up their stores, reducing theft, and keeping prices as low as possible. And they’ve partnered with companies like DoorDash and Instacart to help compete with Walmart and Amazon when it comes to e-commerce.

If those initiatives work, then maybe there’s a chance to turn things around, especially once low-income consumers start to feel better about their finances.

At least that’s what the companies are saying.

My feeling is that despite all their issues, some consumers do still like these stores.

Four in five Dollar General stores are in towns of fewer than 20,000 people. Many of these small towns don’t have a Walmart or anywhere else to go to where people can buy the wide range of products that Dollar General sells.

Nor can they get products through Amazon, which doesn’t deliver to many rural areas.

We also can’t paint all dollar stores with the same brush.

You have Dollar General, which is primarily located in rural areas; you have Dollar Tree, which is more of a suburban chain that caters to middle income customers.

And you have Family Dollar—which is owned by Dollar Tree—but which primarily serves low-income consumers in urban areas.

(Dollar Tree and Dollar General are still opening new stores, while Family Dollar is shutting down stores. Dollar Tree has said that it might be interested in selling Family Dollar, which it bought for $8.5 billion in 2015)

All of these U.S. dollar store chains have issues, but they’re not exactly the same.

Whether their businesses can recover or not is going to come down to how well they’re managed and their specific business models.

Most of their items might not cost a dollar any more, but they still need to provide very low prices and a decent shopping experience, with the right products at the right locations.

Going head-to-head with Walmart is probably not a good idea, but finding the right market and catering to that market has worked for them in the past and could potentially still work in the future.

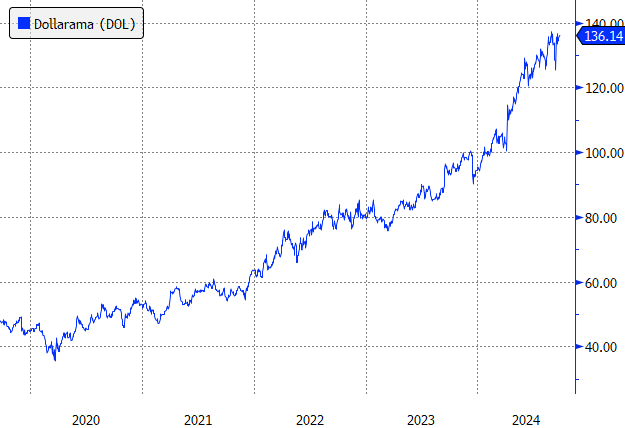

A great example of a dollar store model that’s working is Dollarama, which operates more than 1,500 stores in Canada. It’s been performing very well and its stock has been hitting record highs as a result.

Anyway, we’ll see what happens.

Personally, I’m not investing in dollar stores. But investors who want to make the bold bet that this industry will eventually turn around can scoop up these stocks at their lowest levels in quite some time.