Bear Market Incoming? What Investors Should Do

If your head is spinning after the last few days in the market, that’s completely understandable. The S&P 500 dropped a stunning 12.1% in just four trading sessions through Tuesday.

That’s the 11th-largest uninterrupted decline going all the way back to 1940.

From its highs, the market is now down around 19% (based on Tuesday’s close)—just a hair away from entering official bear market territory.

So what’s an investor supposed to do in a moment like this?

First things first: Don’t panic.

Yes, markets are spiraling. Yes, Trump’s trade policies are single-handedly driving this chaos. But before you make any emotional moves, let’s take a step back.

This is one of those gut-check moments.

A chance to look at your portfolio and ask: Am I invested the right way?

As I said, the market is down 19%. Maybe it hits 20%. Maybe it doesn’t.

Honestly, that 20% number is kind of arbitrary. If we cross that line, headlines will scream about how we’re in a bear market, but it doesn’t necessarily mean anything about what happens next.

For all we know, we’re close to the bottom right now. The market could rebound tomorrow and never look back.

Or… it could drop another 10%, 20%, or more.

No one knows. Not me, not your favorite financial influencer, and definitely not the guy yelling on TV. Anyone who claims to know what happens next is lying.

That said, let’s look at some historical context to help frame the possibilities.

The Last Three Bear Markets

If you go back a few years to 2022, surging inflation and interest rates caused the S&P 500 to drop 25% before it bottomed out. It took about 14 months for the market to get back to its highs.

A couple years before that in 2020, COVID cashed the market, leading to a 34% decline in the S&P 500. But the rebound was extremely fast; within five months the market was back to its highs.

Now let’s rewind all the way back to 2008. This was one of the most brutal bear markets of all time. The financial crisis caused the S&P 500 to drop 57%, and it took about four years for the market to fully recover.

So yeah—there’s a wide range of outcomes. That’s the nature of stocks: volatile and unpredictable in the short run.

But over the long run, they’ve consistently rewarded patient investors. Risk and reward go hand in hand.

So, with that said, what should you do right now?

Well, step one is to check your exposure to stocks.

You don’t want to panic-sell. But you also don’t want to be investing money you’ll need soon (or money you can’t afford to lose).

Make sure your portfolio matches your risk tolerance and your time horizon. Stocks are long-term investments, so don’t park your short-term cash in the stock market.

Once you’ve done that gut check, you can think about potential moves. And what you do depends on what kind of investor you are.

For Passive Investors

If you mostly hold broad index funds, like those tied to the S&P 500, you’re probably fine doing… nothing.

That’s the whole point of passive investing. Stay the course. Let the market do its thing.

But even passive investors have a few options right now:

1. Put idle cash to work

If you’ve got money sitting on the sidelines that you won’t need for several years, this could be a good entry point. Something like the Vanguard S&P 500 ETF (VOO) is a solid long-term bet.

2. Rebalance your portfolio

If you hold both stocks and bonds, recent market moves have probably skewed your allocations.

Rebalancing means selling some bonds (which have held up better) and buying stocks (which have plunged). It’s a disciplined way to buy low and sell high.

3. Reconsider international exposure

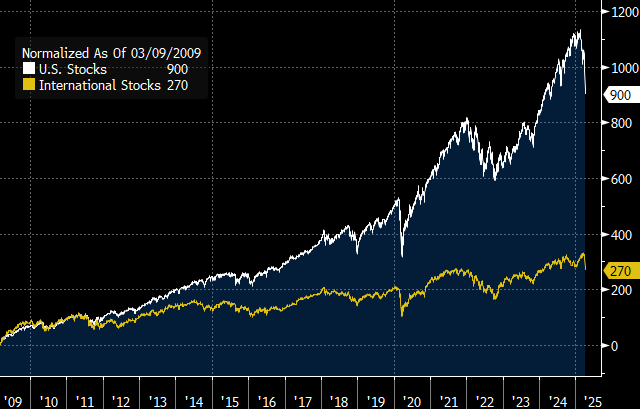

This is a very hot topic in the investing world right now. For nearly 15 years, U.S. stocks have trounced international ones.

But this year, that trend has flipped. International stocks are outperforming, as investors worry that Trump’s trade policies will hit the U.S. harder than other countries.

Now, I’m not saying you should chase performance, but it’s worth asking: Going forward, do you want more international exposure than what you get through U.S. multinationals in the S&P 500?

If the answer is yes, you might consider adding something like the Vanguard Total International Stock ETF (VXUS), which holds a broad, diversified mix of stocks from developed and emerging markets around the world.

You could also take a more targeted approach. Europe, for example, has become a popular destination for some investors this year. Two well-known funds in that category are the iShares MSCI Eurozone ETF (EZU) and the iShares MSCI Germany ETF (EWG).

On the other hand, maybe you believe U.S. stocks will continue to dominate. Or you’re comfortable with the international exposure already baked into the S&P 500 (about 30% of revenue for companies in the index comes from overseas). In that case, you might not feel the need to add more.

4. Take a look at gold

The yellow metal is up 13% this year, on top of a 27% gain last year. It’s proven to be a solid hedge and portfolio diversifier, especially in times of uncertainty.

Just like with international stocks, I’m not saying you should run out and buy gold today just because it’s been outperforming. But building a small position—say 1–2% of your portfolio—over time is a totally reasonable long-term strategy.

Personally, I don’t own gold right now, but I can definitely see the benefits.

For More Active Investors

Now let’s shift gears and talk about some more aggressive plays you might consider in this market.

This part isn’t for passive investors. It’s for folks who like taking a more hands-on approach to investing and don’t mind taking on a bit more risk.

1. European defense stocks

One narrative gaining traction lately is that Europe is ramping up defense spending—largely in response to President Trump urging NATO allies to contribute more, while also signaling that U.S. military support might not be guaranteed.

European governments seem to be taking that seriously, and it’s been a major tailwind for defense stocks across the region.

A fund that’s benefited from this trend is the iShares STOXX Europe Aerospace & Defense ETF (EUAD), which is up roughly 30% this year.

I don’t own it, but I can definitely see why it’s been popular.

2. Big tech

European defense stocks are the hot trade right now, but not long ago, the spotlight was somewhere else entirely.

All anyone could talk about was Big Tech, the Magnificent Seven, and AI.

Those stocks have cooled off recently, with most of the big names taking big hits. But in my view, there’s still a ton of long-term promise there.

This is where I’ve personally been putting money to work.

If you want broad exposure to tech, one option is the Invesco QQQ Trust (QQQ), which tracks the Nasdaq-100. It’s packed with names like Apple, Microsoft, Nvidia, and other tech giants.

There’s also a dedicated Mag-7 ETF, the Roundhill Magnificent Seven ETF (MAGS), that equally weights the seven mega-cap stocks and rebalances them quarterly.

3. Individual stocks

Of course, you can also go the direct route and buy individual stocks—whether it’s one of the Magnificent Seven or other names you’ve been watching.

Many are well off their highs, so now could be a chance to scoop them up at more attractive prices.

For what it’s worth, here are a few picks I’ve made recently:

Chipotle (CMG) and Cava (CAVA) – I think both of these companies are filling a real need for healthier fast food options.

Axon Enterprise (AXON) – The maker of Tasers, bodycams, drones, and software for law enforcement has been doing an impressive job weaving AI into its platform. There’s a lot of opportunity for growth ahead.

Anyway, I hope this gives you a few ideas as we hover on the edge of a bear market. The key is to have a strategy you can stick with. And remember: Don’t take on more risk than you can handle.

As always, thanks for your incisive analysis!

Could you please write one up to analyze who exactly will end up footing most of the bills of tariff? Will they be the vendors in China, the importers, or the average American consumers? Thank you!