Meme Stocks Are Here To Stay

Meme stocks are here to stay.

GameStop is back in the news. Shares of the video game retailer nearly quadrupled over two days, bringing them to their highest level since 2021.

Meme stocks don’t really follow logic, but if you want an explanation for the move, here it is.

Keith Patrick Gill, better known as Roaring Kitty, made this tweet on Sunday, May 12th.

It was his first tweet in nearly three years and as you can see, there are no words, just the “things are starting to get serious” meme, which I guess is Roaring Kitty’s way of reintroducing himself to the world.

Anyway, if you aren’t aware, Roaring Kitty is synonymous with GameStop. He’s credited with kicking off the meme stock frenzy that pushed GameStop stock to unbelievable heights back in 2021.

They even made a movie about it called Dumb Money last year.

So, Roaring Kitty is THE GUY when it comes to the whole GameStop meme stock phenomenon, and him becoming active online for the first time in three years was enough to cause people to pile into GameStop stock.

But I think there’s a much bigger story here than just the fact that GameStop is going up again.

It’s this idea that meme stocks— or meme coins in the case of crypto— are becoming a normal part of our financial markets.

A lot of people thought that when the bubble burst in 2021, it was over and we’d never see something like GameStop or Dogecoin happen again.

But here we are almost three years later and a lot of the same types of things are happening again.

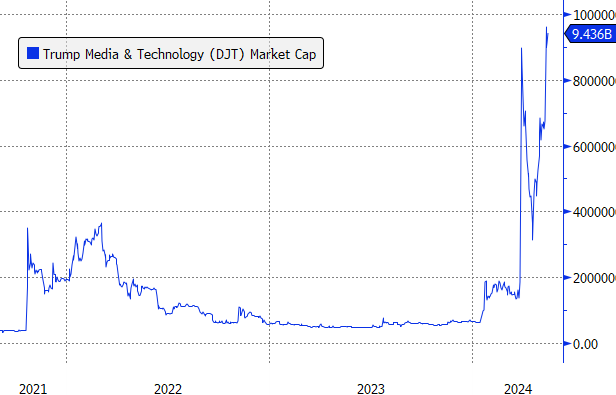

GameStop is spiking; Dogecoin is back to a $20 billion valuation; and Trump Media— the meme stock associated with the former President— is worth $10 billion, even though the company has no profits to speak of.

So, I think we’re starting to see meme assets become normalized. And that’s something new.

Sure, we’ve seen financial market bubbles all throughout history. A typical bubble is when investors bid asset prices to levels well beyond what they’re worth based on fundamental factors— but it’s because of those fundamentals that investors are so excited about those assets in the first place.

The dot-com bubble and the housing bubble are great examples of this. People might have been overly exuberant about internet stocks and real estate back in the late 1990s and early 2000s, but there were real, fundamental reasons to be excited about those assets.

In the case of meme stocks and meme coins, there often aren’t any traditional fundamental factors underpinning their value.

The buyers of these assets know that and yet, they don’t care. To them, it’s a game or a form of gambling where people who buy in early get rich, while latecomers end up with huge losses.

Speculative Waves

So, this might be something that’s here to stay. When people in the financial markets are feeling good and they have money to risk, we might see more activity in meme assets.

And when the markets are going down and people aren’t feeling so great, we might see less meme asset activity.

I also imagine that every time we get one of these speculative waves, we’ll see a combination of new and old meme assets.

GameStop and Dogecoin are obviously old meme assets that are going up. But there’s new ones as well, like Pepe and Dogwifhat, that are surging as well.

I also think that a lot of assets that become meme assets will only remain in that category for a short period of time—like the stock of AMC.

AMC was a big winner and a big meme stock in 2021, but this year, it’s not really doing anything. Yeah, it went up a little bit this week in sympathy with GameStop, but it’s well off its highs and it’s lost a lot of its meme stock luster.

That’s probably going to be what we see for most meme assets. They’ll have their moment in the sun and then they’ll flame out and they won’t be meme assets again.

But a small number of assets might maintain their meme status for a long time.

And if they do it for long enough, they might graduate to become something bigger with lasting value—like bitcoin.

If you think about it, bitcoin is a lot like other meme assets. People buy it with the hope that they can sell it to someone else at a higher price later.

It’s valuable because it represents a powerful idea: that you can own a digital currency with a fixed supply that can’t be controlled by any one entity.

This idea, or this meme, is what has enabled bitcoin to stand the test of time and bounce back every time that it’s been knocked down.

We’re seeing something similar happen to Dogecoin. Yes, it has a much less serious meme associated with it than bitcoin and people are buying it for different reasons, but its value is proving to be durable all the same.