Hindenburg Takes Down A Wall Street Legend

One of the world’s richest men lost two-thirds of his wealth in a matter of days after a small research organization accused him of running a ponzi-like scheme.

One of the world’s richest men lost two-thirds of his wealth in a matter of days after a small research organization accused him of running a ponzi-like scheme.

The man is Carl Icahn—a Wall Street legend who made a name for himself as a corporate raider.

A month ago, Carl Icahn was worth $25 billion, making him the 58th richest person on Earth. Today, his net worth is $8 billion and falling.

It’s all because Hindenburg Research, a tiny 10-person research firm headed by Nate Anderson, released a scathing report against Icahn.

Here’s what’s going on.

Carl Icahn runs a company called Icahn Enterprises. It’s essentially a holding company that owns a mix of assets— things like private businesses, real estate, and publicly traded stocks.

But the biggest holding of Icahn Enterprises is a stake in Carl Icahn’s private investment fund. This fund only has three direct investors: Carl Icahn himself, his son Brett and the company, Icahn Enterprises.

The fund’s goal is to make money through activist investing, which is a more modern version of what used to be known as corporate raiding.

This is when an investor takes a significant stake in a company and then actively pushes for changes in its management, operations, or strategic direction in order to unlock value and generate higher returns for shareholders.

Now, Carl Icahn has a reputation of being a fierce activist investor who corporate executives fear. When he buys into a company, he usually pushes for aggressive changes that sometimes include the firing of CEOs and other executives.

Over the years, he’s tussled with companies including eBay, McDonalds, and Texaco and he’s made a lot of money doing it.

There’s even been movies made about Carl Icahn’s exploits.

So that’s a big part of why people invest in Icahn Enterprises stock. By investing in the stock, you get exposure to the activist fund that’s run by Carl and you get exposure to the other assets that he invests in— like I said, real estate and various public and private businesses.

It’s essentially a way to invest alongside Carl Icahn, who has this iconic reputation on Wall Street.

But you see, Carl Icahn isn’t the only reason people invest in Icahn Enterprises stock. It also offers a massive dividend to investors.

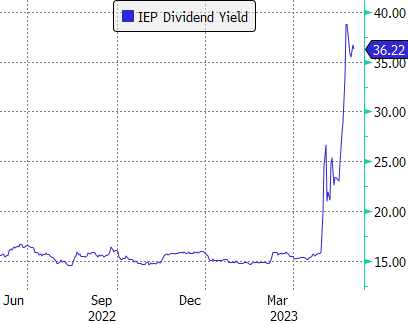

This dividend is $2 per quarter, which, if you use the price that Icahn Enterprises stock was trading at before Hindenburg’s report came out, equals a 15% annualized yield.

At today’s lower stock price, the yield is 36%.

Now obviously, that sounds like a very attractive dividend yield, and you can see why people would want to invest in something that’s paying 15% or more per year.

But what Hindenburg discovered is that the yield on Icahn Enterprises stock was funded not by profits as dividend yields usually are, but by stock sales.

Since 2014, Icahn Enterprises has had negative free cash flow of $4.9 billion, but it’s paid out $1.5 billion in cash dividends.

How did it do it? By selling stock.

This is what Hindenburg referred to as a ponzi-like structure.

Icahn Enterprises sold stock to new investors in return for cash and then it turned around and used that cash to pay dividends to existing investors.

No value was created; it was just cash going from one set of investors to another set of investors.

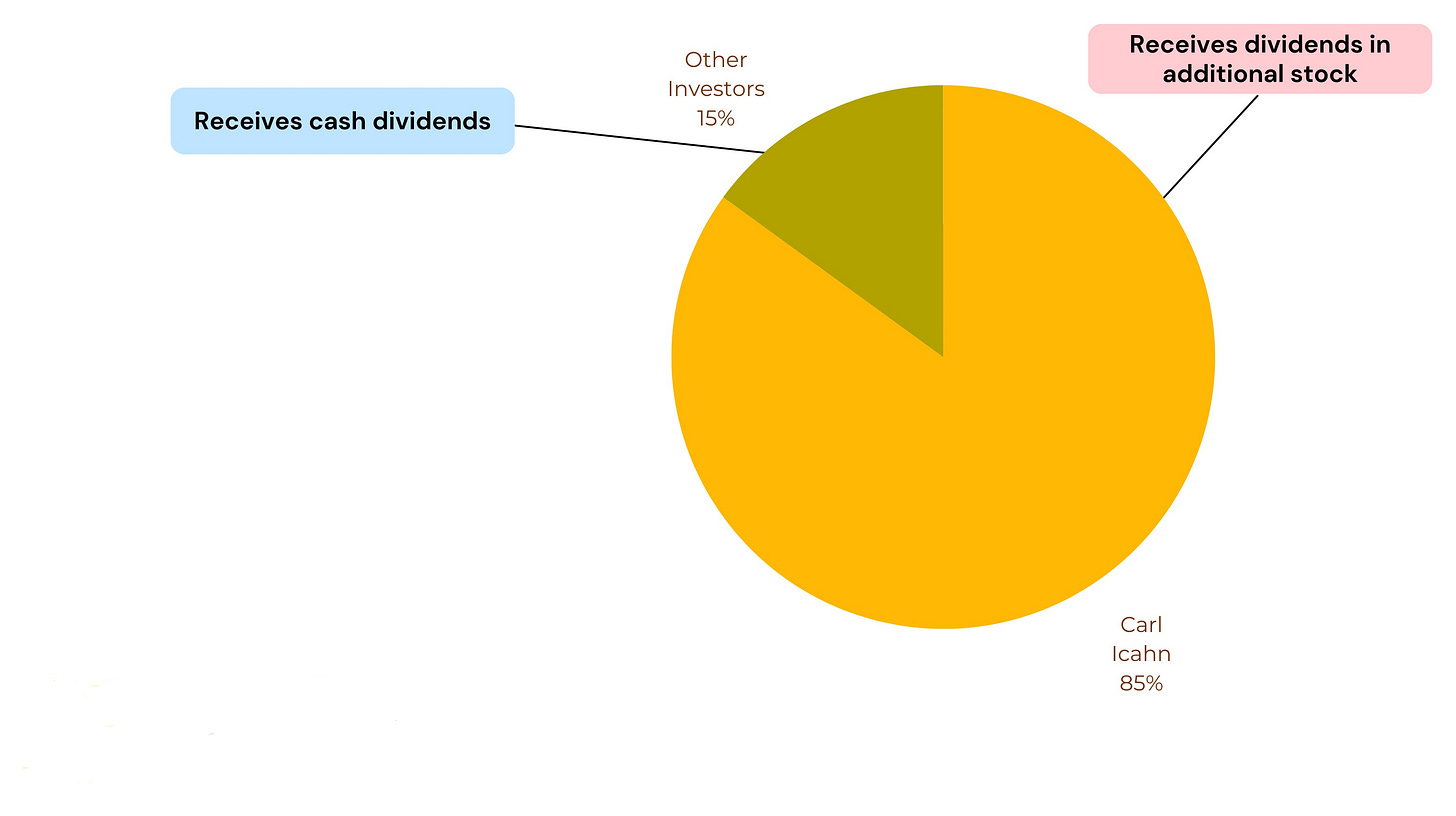

Now, this worked for a couple of reasons. One is that Carl Icahn himself owns 85% of Icahn Enterprises stock and he’s agreed to take his dividends not in cash, but in additional stock.

This meant that the company only had to raise enough money through stock sales to pay cash dividends to the other 15% of shareholders—which is a much smaller amount of money than if it had to pay cash dividends to 100% of shareholders.

But Icahn wasn’t foregoing cash dividends out of the goodness of his heart.

He was getting additional stock to make up for the cash he was foregoing and because Icahn Enterprises was paying such a high dividend yield, it attracted a lot of individual investors who bid the stock up to exorbitant levels.

Before the Hindenburg report came out, Icahn Enterprises stock was trading at more than three times its net asset value, which was perfect for the company because it could easily sell stock and keep this scheme going.

But that raises the question, why was it doing this? Why bother selling stock to raise cash only to send that cash right back into the hands of shareholders?

Well, Hindenburg argues that Carl Icahn wanted an inflated stock price because he could use it as collateral to borrow money.

The higher the stock price, the more money that lenders like Morgan Stanley would let Carl Icahn borrow.

Now, it may seem odd that a billionaire would need to borrow money, but there are a couple of reasons why Carl Icahn might want to or need to do that.

First, most of his net worth—85% of it— is tied up in Icahn Enterprises stock, but he can’t easily sell the stock because it would be very difficult to do so without negatively impacting the price and he wants to keep the price high.

Borrowing money using the stock as collateral gives him the ability to raise cash without selling the stock— and that’s exactly what he’s done. Carl Icahn borrowed billions of dollars over the past several years.

Guess what he did with it? He put it into his activist fund.

You see, despite Carl Icahn’s reputation as a brilliant investor, his activist fund has performed horribly over the past decade largely because of bearish bets on the market.

Carl Icahn expected the market to go down, but it’s gone up, and his bad bets have resulted in a 53% loss for the fund since 2014.

By borrowing money, Carl Icahn was able to replenish the investment fund’s coffers, giving it more firepower to launch its activist campaigns. After all, no company is going to take an activist investor seriously unless that investor has enough money to buy up a lot of stock and throw their weight around.

So this scheme that Carl Icahn was orchestrating—selling stock and then turning around and paying out cash in dividends— was a way for him to keep Icahn Enterprises stock high so he could use that stock as collateral to borrow money, which he could then put into his activist fund to make up for bad investments that the fund had made.

It was a pretty convoluted process, but it was working for years until Hindenburg uncovered it and released their report.

Now the scheme is at risk of falling apart because it depends on the price of Icahn Enterprises stock staying high.

If the stock drops, well, then Carl Icahn could have some big problems. And unfortunately for him, that’s exactly what’s been happening.

Ever since the Hindenburg report came out, Icahn Enterprises stock has fallen by over 50%.

But even after the decline, the stock is trading at a premium of more than 40% compared to its net asset value, suggesting that there could be more downside to come.

Making matters worse, if Icahn Enterprises stock falls enough, it could trigger margin calls for Carl Icahn. Remember how I said that Carl Icahn had borrowed money using his shares of Icahn Enterprises as collateral?

That’s known as a margin loan. And the way margin loans work is the borrower needs to keep the value of the collateral above a certain threshold. If they don’t, they could get a margin call.

So as the price of Icahn Enterprises stock has fallen, Carl Icahn’s collateral has decreased in value, and he’s had to post more and more of his shares as collateral for his loans.

A couple of weeks ago, the company came out and said that Icahn had pledged 65% of his Icahn Enterprises stock as collateral for loans.

The concern is that if the stock keeps dropping, at some point, his lenders will force him to sell his stock to repay the loans. That could cause an even sharper drop in the stock, leading to more forced selling in a vicious cycle.

So, this could be really bad for Carl Icahn, but it’s not his only problem.

A day after the Hindenburg report came out, federal prosecutors opened an investigation into Icahn Enterprises.

As of today, they haven’t charged the company with any wrongdoing, but prosecutors may be looking into certain allegations in the Hindenburg report that I haven’t discussed yet.

The report points to several suspicious instances where Icahn Enterprises marked its assets at prices well above what they should have reasonably been valued at.

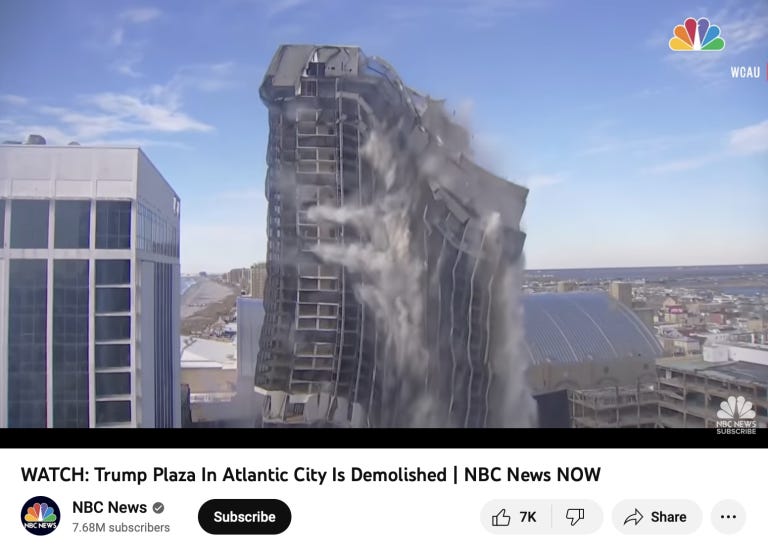

In one example, Hindenburg said that Icahn Enterprise kept the value of its real estate portfolio unchanged over the past several years, even though one of its biggest properties— the Trump Plaza Hotel and Casino in Atlantic City— was demolished in 2021.

In another example, Icahn Enterprises marked its 90% stake in a publicly-traded meat packing company called Viskase at a $243 valuation, even though it was worth only $89 million based on where the stock was trading at in the stock market—something that everyone could clearly see.

So, these are all concerning things and when you combine them with that whole margin loan scheme I talked about earlier, it’s not surprising that shares of Icahn Enterprises have been plunging ever since the Hindenburg report came out.

Of course, Carl Icahn hasn’t been sitting idly by as this has happened. A week after the Hindenburg report was released, Carl came out and blasted the research organization and its founder, Nate Anderson.

"Hindenburg Research, founded by Nathan Anderson, would be more aptly named Blitzkrieg Research given its tactics of wantonly destroying property and harming innocent civilians,” Carl said, while adding that he “intend[s] to take all appropriate steps to protect…unitholders and fight back.”

Wantonly destroying property and harming innocent civilians? That sounds a bit hyperbolic if you ask me!

Of course, we’ve heard things like these before. In January, after Hindenburg released a report accusing India’s richest man, Guatam Adani, of fraud, he and his company fired back saying that Hindenburg Research was the “Madoffs of Manhattan” and that its report was a “calculated attack on India” itself.

As of today, Adani’s net worth is still down $60 billion, or 50%, since that Hindenburg report came out.

So, Hindenburg is used to taking on some of the richest people in the world.

This time it just so happens to be Carl Icahn, a man who made his name and fortune by holding corporate insiders accountable for mismanagement and questionable behavior.

Now the tables have turned and he’s the one being held accountable for his own questionable behavior, which is kind of ironic.

With all that said, is Carl Icahn going to go broke? Probably not. In the worst case, he’ll be forced to sell his stock, maybe at very depressed prices.

But unless there’s some hidden landmines we don’t know about, he’ll still probably come out of this a billionaire.

He just won’t be nearly as wealthy as he once was, and he’ll probably be embarrassed that his reputation as a brilliant investor took a hit because of Hindenburg’s findings.