How The Government Helps Americans Acquire Their Most Valuable Asset

A quick explainer on the U.S. mortgage market.

For most Americans, a house either is or will be the most important asset that they ever own. It will account for the lion's share of their net worth, exceeding the value of their stocks, bonds, and retirement accounts.

According to the latest edition of the Federal Reserve’s Survey of Consumer Finances, the median value of a primary residence was $225,000 in 2019, compared to a median value of $65,000 for a retirement account.

Meanwhile, the median net worth of a homeowner in the U.S. was $255,000, forty times the $6,300 median net worth of a renter. This is a major reason why the U.S. government has been actively promoting home ownership for over a century—though America’s infatuation with owning a home began much earlier than that.

“The desire for a home of one's own is hard-wired into the American psyche, reaching back to Thomas Jefferson's notion that the independent yeoman farmer would be the backbone of the new republic.”- Vincent J. Cannato, associate professor of history at the University of Massachusetts

The U.S. government’s promotion of home ownership was largely limited to words in the early part of the country’s history, but starting in the 1930’s, the Franklin Delano Roosevelt administration opened the door to much more significant action. Subsequent administrations added to the government’s involvement, building up to the system we now have.

Today, it’s fair to say that if it weren’t for the government, home ownership would be much less accessible and widespread than it is. To understand why that’s the case, let’s go over how the mortgage market works.

The Mortgage Market

Mortgages are loans in which real estate is used as collateral. They are important because most people can’t afford to pay the high price of a house in cash.

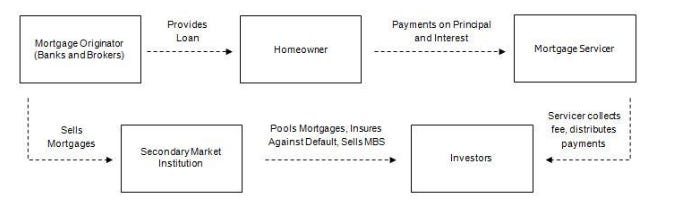

Instead, most people go to a mortgage lender who originates a mortgage loan. That loan allows them to buy the house they want and the originator gets a fee in return.

Some originators hold mortgages on their books, making money off the interest that homeowners pay. But most originators quickly sell off their loans onto what’s called the secondary market*.

This is where the government comes in. The secondary market is dominated by Fannie Mae and Freddie Mac, two companies that are backed by the federal government.

They buy mortgages, bundle them together, and re-sell them to investors. The packages of mortgages are called mortgage-backed securities, or MBS, and they come with a guarantee from Fannie and Freddie that even if a home owner misses a payment, investors will get all of the money that they are owed.

Here's the important part: because Fannie and Freddie are backed by the U.S. government, MBS are backed by the U.S. government too. That’s made these securities highly sought after by investors and a close alternative to the safest investments in the world—Treasuries.

But without the government guarantee that underpins the mortgage-backed securities market, this system wouldn’t exist. Interest rates would be much higher; the number of mortgages that are originated would be much lower; and far fewer people would be able to afford a home.

The bottom line is this: the majority of Americans are able to acquire their most valuable and important asset thanks to the government’s involvement in the mortgage market.

*Even when they sell off mortgages, originators sometimes keep the servicing rights to the loans for themselves.