Inflation Cools Some More

U.S. inflation came in below expectations for a second-straight month.

Are the days of high inflation in the U.S. over? That’s the hope after we got a second-straight CPI report which showed consumer prices growing more slowly than expected.

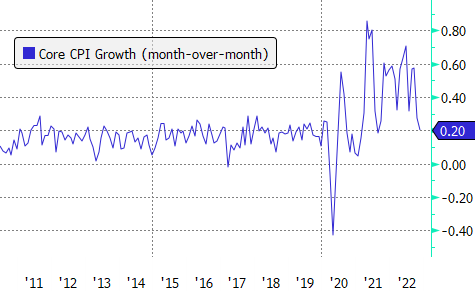

The core consumer price index grew by only 0.2% from October to November—the slowest pace of growth in 15 months.

If you annualize that figure, it comes out to an inflation rate of only 2.4%, well below the 7-8% rates we saw for much of this year.

The great thing about today’s number is that it’s the second straight month in which we’ve seen inflation come in below expectations. So, this isn’t just an isolated data point—a trend is starting to emerge.

Additionally, this slowdown in inflation isn’t being driven by just one or two categories. Prices for nearly everything are rising more slowly or outright falling—medical care, vehicles, shelter—as well as food and energy.

In fact, if you look at the headline CPI, which includes food and energy prices, it grew even more slowly than the core CPI—only 0.1% from October to November.

This is fantastic news and inflation seems to be slowing down even more quickly than some optimists had envisioned.

That’s going to give the Federal Reserve the confidence it needs to hike rates by a smaller amount when it makes its interest rate decision tomorrow. A 50 basis point hike is basically a lock at this point.

After that, the market currently expects that the Fed will make two more 25 basis point hikes before it ends its rate hiking cycle early next year.

But since this is a great day for consumers and investors, let me end this with an even more optimistic thought: if we keep getting inflation readings like today, could tomorrow be the Fed’s last rate hike of the cycle?

It’s a long shot, but it’s a possibility.