Investors Stick With Cathie Wood & ARKK

Cathie Wood's funds may be down, but investors aren't giving up on her.

(You’ll find the text version of “Investors Stick With Cathie Wood & ARKK” below this embedded video)

Cathie Wood was the hottest stock picker of 2020 and 2021.

Her focus on “disruptive technologies” like electric vehicles and cloud computing was handsomely rewarded in the post-Covid market environment that valued growth over profits.

From the start of 2020 to the start of 2021, investors poured billions of dollars into her flagship Ark Innovation ETF (ARKK) as prices for the fund tripled.

Assets under management in ARKK exploded from from $2 billion to $28 billion in less than a year.

Including ARK’s seven other ETFs, Cathie was managing nearly $60 billion at her peak.

But the good fortune didn’t last.

When the Covid bubble began popping in late 2021, Cathie Wood’s stocks were the hardest to fall. All of her top holdings, from Tesla to Teladoc to Zoom crumbled, and the ARKK Innovation ETF fell a whopping 67% in 2022. From its highs, the ETF was down as much as 80%.

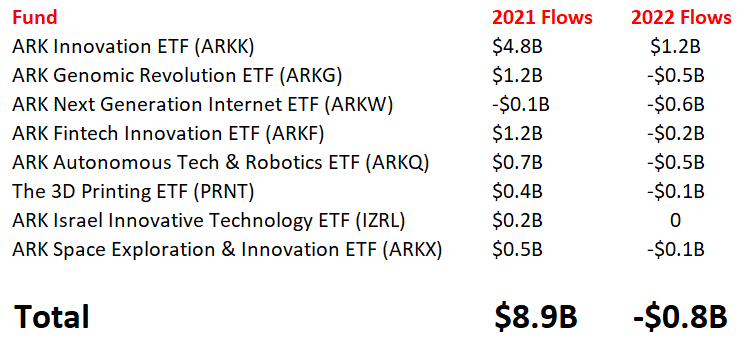

But here’s something shocking. Even as ARKK tumbled, investors never gave up on Cathie. In 2021, they added $4.8 billion to the ETF and in 2022, they added $1.2 billion.

That tells you how committed some investors are to Cathie Wood and her story about disruptive innovation.

But I don’t think that’s the only reason that money is staying in these ETFs.

I think some of the money in those funds also comes from short-term traders who use them as liquid vehicles for quickly and easily getting high beta exposure to the markets.

If you think the market is going to go up over the next month, then maybe you buy ARKK to get a bigger bang for your buck.

Or maybe you have a strong feeling that TSLA is going to underperform, but you want to make it a market-neutral trade, so you pair your TSLA short with with a long position in ARKK.

I wouldn’t be surprised if some of that is going on as well.

But still, you have to give credit to Cathie. Even though the performance of her funds has been lousy, she’s been such a good marketer and storyteller that investors have—at least so far—stuck with her through thick and thin.