Is Nvidia In A Bubble?

We’ve never seen anything like this before in the history of capitalism.

We’ve never seen anything like this before in the history of capitalism.

This is a chart of the market value of Nvidia. And what you can see is that the value of this company has been going absolutely vertical recently.

Just a year ago, the company was worth around $500 billion. A few months later, it was worth $1 trillion.

Eight months later: $2 trillion.

And it’s still going up. Today, Nvidia has a market cap of $2.3 trillion, making it more valuable than every company in the world— except two.

This has everyone on Wall Street wondering: is this a bubble? Well, it’s actually not that easy to answer that question because what’s going on with Nvidia is unprecedented.

You see, Nvidia is at the heart of a monumental investment boom.

As you might be aware, Nvidia designs computer chips known as graphics processing unit (GPUs). These GPUs are good at what’s known as parallel processing, or the ability to do a lot of calculations at once.

They were initially used to improve the quality of computer graphics, especially in video games. But over time, GPUs began to be used for a wide variety of other tasks, including scientific simulations, cryptocurrency mining, and artificial intelligence.

Now, A.I. has been around for a while, but it wasn’t something that was used all that extensively, and it certainly wasn’t something that most people thought much about.

That all changed on November 30, 2022: the day that OpenAI released ChatGPT.

All of a sudden, everyone was talking about A.I. It wasn’t just a buzzword anymore; it was a real technology that could do incredible things.

ChatGPT pushed A.I. into the mainstream and it made people wake up and realize that the world was about to radically change because of artificial intelligence.

Businesses, in particular, now had to scramble to figure out how they could use this technology to their benefit because if they didn’t, they could very well be overtaken by competitors who did.

That set off an A.I. arms race in which companies rushed to incorporate A.I. into their products and operations to stay ahead of the competition.

And if this was an arms race, well, then Nvidia was the arms dealer.

Companies that wanted to use A.I. had to use Nvidia’s GPUs to power their A.I. applications.

This led to an explosion of demand for Nvidia’s products, causing the company’s revenues and profits to skyrocket. From $8 billion in 2022, Nvidia’s earnings quadrupled to $32 billion in 2023, and they’re expected to nearly double again to $60 billion this year.

We’ve never seen growth this strong at this scale.

That’s why it’s not so easy to brush off the surge in Nvidia’s stock as a bubble. There are real profits backing the stock’s rise.

At its current price of $927 per share, Nvidia is trading at around 37 times its expected earnings over the next 12 months, which isn’t that different than the valuation for a company like Microsoft, which is trading at 32 times expected earnings.

When people normally talk about bubbles, they’re referring to a situation when the price of a stock is wildly overvalued based on fundamental factors like profits.

On the surface, that doesn’t seem to be the case for Nvidia.

But, there’s more to the story.

The thing is, Nvidia’s revenues and profits have grown so fast that it’s hard to tell whether they’re sustainable or not.

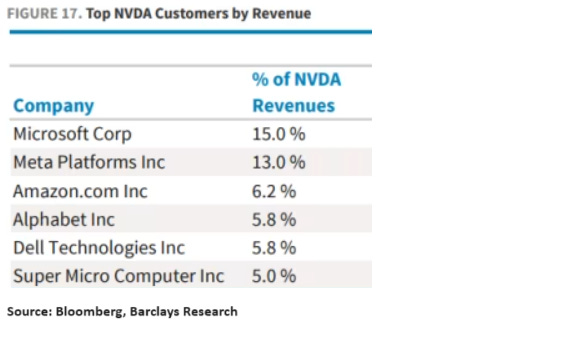

If you look at the biggest customers of Nvidia, it’s companies like Microsoft and Amazon, who are buying up GPUs to put into their data centers, so that they can rent them out to other companies through their cloud computing services.

You also have companies like Meta (as well as Microsoft and Amazon) who are using GPUs to build A.I.-powered applications of their own.

So, you essentially have a handful of giant tech companies that are spending tens of billions of dollars to buy up as many GPUs as they can get their hands on.

But once they’ve had their fill, will they keep on buying them at such a rapid pace?

That is the big question and it’s here that some people are making the bubble case for Nvidia.

Nvidia bears argue that it’s not that the stock is overvalued relative to its profits today. Rather, it’s overvalued compared to what its profits are going to be a year or two from now, once the handful of mega tech companies that are scooping up GPUs at such a frenetic pace eventually slow down their purchases.

These Nvidia bears sometimes point to the difference between A.I. training and inference to make their case. Training is when an A.I. model learns complex patterns by analyzing massive amounts of data— it’s extremely computationally intensive and requires a lot of GPUs.

On the other hand, inference is when a trained model is used— like when we type something into ChatGPT and it gives us a response. Inference is less computationally intensive and requires fewer GPUs.

So, bears argue that demand for Nvidia GPUs is rocketing higher because companies are training all these new A.I. models, but once they’ve finished doing that, demand is going to drop.

Competition

Another risk for Nvidia that some people point out is competition. When you have so much money being made, that’s going to attract rivals who want a piece of that for themselves.

So naturally, you have other big semiconductor companies like AMD, as well as startups like Groq and Cerebras, who are making chips for A.I. that compete with the ones Nvidia makes.

Even Nvidia’s own customers, like Microsoft, Amazon, and Google, are working on creating A.I. chips that they can use in place of GPUs.

In fact, Google has created a chip called the Tensor Processing Unit (TPU), which some say rivals Nvidia’s GPUs in performance.

Google is currently using these chips to power Gemini, which is its competitor to ChatGPT.

So, as you can see, a lot of companies are gunning for Nvidia, hoping to take a slice of its profits for themselves. And if they’re successful, that could dent Nvidia’s A.I. chip market share, which is estimated to be around 90%.

Short-term vs Long-term

By now you might have the sense that Nvidia is doing spectacularly well, but that there are also risks to the outlook for the company.

And I think that’s the right way to think about Nvidia and its stock.

I’m looking at it like this: demand for GPUs has gone up by an enormous amount extremely quickly; that makes for a much shakier foundation than if demand had climbed steadily over a longer period of time.

I wouldn’t be surprised to see a slowdown in GPU demand once this surge is over. When that happens, Nvidia’s stock could take a big dive.

That said, longer-term, Nvidia’s story is strong. I think this idea that companies are going to stop training A.I. models once they reach some kind of end point is flawed.

There is no finish line. New models are continuously going to come out, and they’re going to be bigger and more powerful than previous generations.

We haven’t even begun to scratch the surface on what A.I. is capable of. We’re going to see ever-improving models focused on not just text, images or even video—but also robotics; health care; finance and more.

At the same time, competition from other chipmakers will probably bring Nvidia’s market share down from its current monopoly-like levels, but the company has proven that it’s extremely innovative, and that means it’s probably going to be able to maintain its leadership role in the market for A.I. chips for a long time to come.

Nvidia’s competitive advantages in software and networking, which make its chips easy to use, also gives it a leg up on the competition.

So, the bottom line is this: I wouldn’t be chasing Nvidia at these levels. But if we see a downturn in the market for A.I. chips and a sizable pullback in shares of the company, then it could start to look attractive again.

It’s anyone’s guess exactly how big the market for A.I. chips will grow to be over the long-term, but all indications are that it’s going to be massive.

And if Nvidia remains a dominant player in that market, then it’s going to continue to be one of the largest companies in the world.

I hope you bought that dip to around 800…

I’m worried. I mean, it’s just TOO good.