Is Twitter Worthless?

Twitter's business is in worse shape than we thought.

Twitter might actually be worthless.

Check out this tweet Elon Musk made a few days ago:

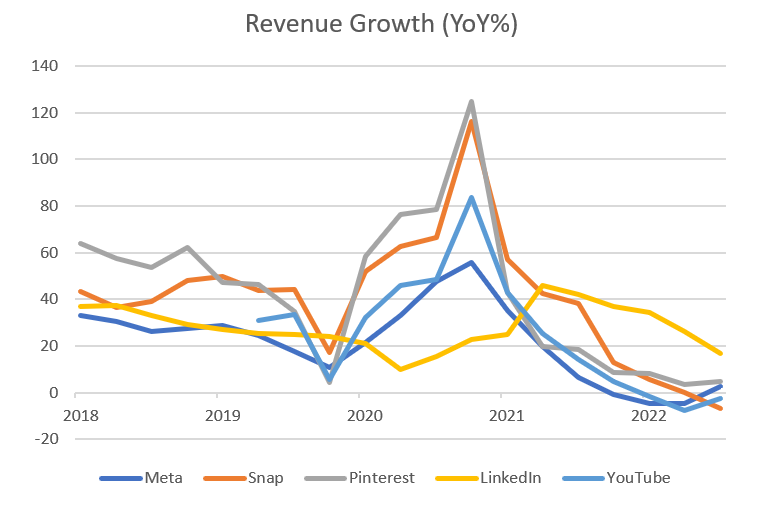

Wow—a 50% drop in revenues—that is an ugly number. Just to put that in perspective, here are the year-over-year revenue growth rates for some other big social media companies.

You can see that all of them have seen a deceleration in revenue growth following the post-pandemic surge of 2021.

But a decrease in growth is a very different thing than an outright decline.

Revenues for Meta, LinkedIn and Pinterest are still going up, just at a slower pace. While revenues for YouTube and Snap are down, but only around 2% to 7%.

Compare that to the 50% drop in Twitter’s revenues and you get a sense of how poorly Twitter is performing as a business today.

Now here is the crazy part.

Twitter has been a private company since Elon bought it a little less than nine months ago. So, it hasn’t been required to disclose its finances publicly since then.

We don’t know exactly how much money it’s bringing in, how much money it’s spending, or what assets/liabilities are on its balance sheet.

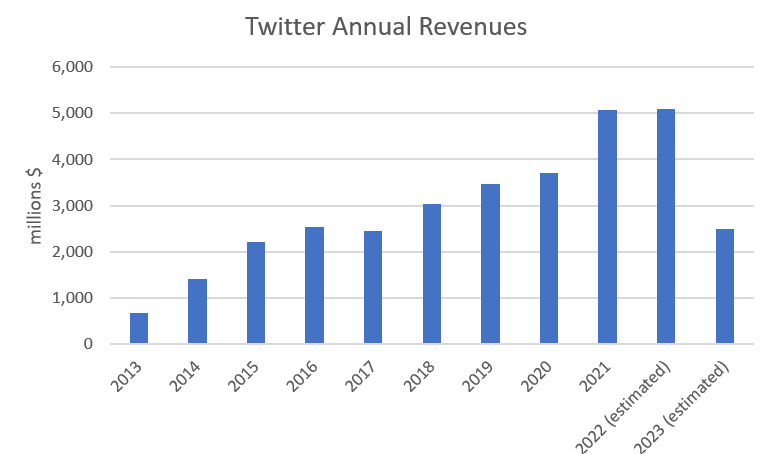

But we have an idea. If what Elon said about the 50% drop in revenues is true, then Twitter is on track to make around $2.5 billion in revenues this year, compared to just over $5 billion last year.

We also know that Twitter has been cutting costs aggressively. It’s laid off most of its workers—upwards of 80% of them—and it’s not paying rent on its office buildings.

So, using this information, we can try to come up with a back-of-the-envelope valuation for Twitter.

The Valuation

Now, as Elon alluded to in his tweet, Twitter is not a profitable company today. Even though the company has cut costs by billions of dollars, it’s still burning cash.

So, we can’t value it based on profits like we would most publicly traded companies.

Instead, what usually happens when you have an unprofitable company is that it’s valued based on revenues, with the assumption (or hope) that eventually the company will become profitable.

Here you can see what revenue multiples Twitter’s social media peers are trading at.

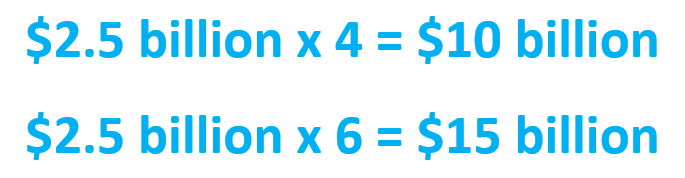

You have Meta and Pinterest trading at around 5 to 6 times revenues, while Snap is trading closer to 4 times revenues.

You could make the case that because Twitter’s business prospects and financial position are so poor, it deserves a lower multiple than its peers. But let’s be generous and give it the same type of multiple as these other companies.

If we put a 4x multiple on Twitter’s $2.5 billion of revenues, we get a valuation of $10 billion. And if we use a 6x multiple, we get $15 billion.

These numbers already look really bad when you compare them to the $44 billion price that Elon paid to buy Twitter.

But it gets worse.

That $10-15 billion valuation that we just came up with is for the entire Twitter business—what’s sometimes called the “enterprise value” of the company.

But shareholders of Twitter—like Elon Musk, who owns more than three-quarters of the company’s stock—don’t have claim to all of that value.

Some of the value is claimed by the company’s creditors.

When Elon purchased Twitter last year, he financed some of the acquisition with debt—debt that the company is now on the hook to pay back.

That debt amounts to $13 billion, which means that of the $10-15 billion valuation for Twitter, creditors have claim to nearly all of it—and Twitter’s stock is worthless.

Obviously, this is just a quick and dirty calculation. You could make some other assumptions and come up with a completely different valuation for Twitter.

But I think it’s fair to say that no matter what your assumptions are, Twitter is worth far less today than it was nine months ago before Elon purchased the company.

And honestly, it’s pretty shocking to see this magnitude of value destruction in such a short amount of time.

The combination of advertisers abandoning Twitter and the heavy debt load that Twitter took on to finance Elon’s acquisition have been devastating for the company.

The Road Ahead

Now, I should add that if Twitter were a public company today and its stock was trading on the New York Stock Exchange, the price of that stock probably wouldn’t be zero.

As long as the company was still in business and it was still making its debt payments, there would be some value to the stock simply because there is always the possibility that things could turn around.

Advertisers could come back, or the company could generate revenues in some other way. The business could improve, and that possibility is worth something—maybe a few billion dollars.

But still, the price of the stock would almost certainly be far less than what Elon paid for it. And unless there’s some miraculous turnaround, Elon’s acquisition of Twitter will probably go down as one of the worst investments of all time.

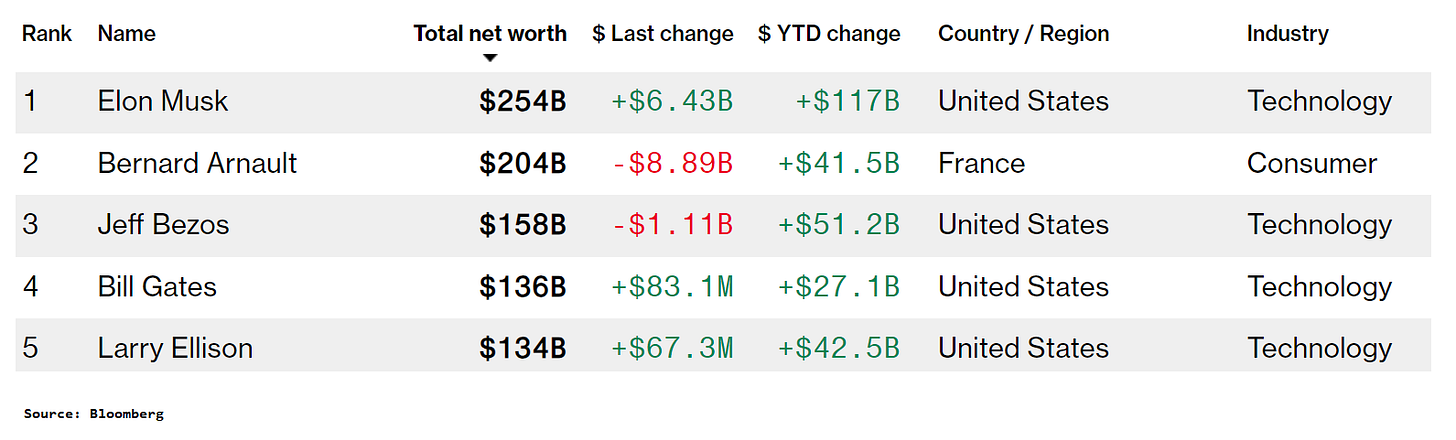

Granted, for Elon, it’s not a huge deal (at least financially). This is a guy whose net worth is around $250 billion today, largely thanks to his stakes in Tesla and SpaceX.

He can finance Twitter for a long time to come, even if it continues to lose money.

It’s more a question of: will he want to? He’s already put around $24 billion into the company.

If Twitter keeps losing money, it’s conceivable that at some point, he won’t want to throw good money after bad.

If that happens and if it gets to the point where Twitter can’t make payments on its debt any longer, the company will go bankrupt and its creditors—the big banks that Twitter owes money to—will become the new owners of the company.

That’s the worst-case scenario and I’m sure Elon is trying hard to avoid it. Getting Twitter to a more sustainable financial position where it’s no longer losing money (and ideally, doesn’t have such a hefty debt load) will go a long way towards taking that worst-case scenario off the table.