Jack Dorsey Spent $300 Million To Hang Out With Jay-Z

A Delaware court says that Jack used corporate coffers to bolster his relationship with Jay-Z.

Jack Dorsey spent $300 million of his company’s money to hang out with Jay-Z. That was the accusation that was thrown at the founder of Block by a shareholder of the company.

This week, a court in Delaware basically agreed with the shareholder.

This is a pretty funny story:

Back in 2021, Block—which was known as Square at the time—purchased the music streaming service TIDAL for $306 million.

TIDAL, if you’re not familiar with it, is a streaming music service similar to Spotify.

It offers a nearly identical catalogue of songs to stream, but it claims to offer a few advantages over Spotify, like higher quality audio and access to some exclusive songs from top artists.

But despite that, it’s a really small player, with only 2 million subscribers compared to nearly 200 million for Spotify.

So when Block agreed to buy TIDAL for around $300 million in 2021, it came as a big surprise—not only because TIDAL was a tiny player in the streaming music space—but because streaming music had nothing to do with Block’s existing business.

Block was and is a fintech company. It provides hardware, software and payment processing capabilities to merchants. You might have seen or used a Square tablet at your local restaurant— that comes from Block.

Block also offers financial services to individuals through its Cash App, which is a popular app that competes with Venmo.

So given Block’s focus on fintech, why the heck was it buying a music streaming service?

Well, it turns out that Jack likes to hang out with the rapper and record producer known as Jay-Z, and Jay-Z was the public face and driving force behind TIDAL, which he along with a group of other artists purchased in 2015.

You can already kind of see where I’m going with this.

In the summer of 2020, Jack was hanging out with Jay-Z in the Hamptons. That’s when he came up with a plan to buy TIDAL.

He called up Block’s board of directors— from the Hamptons— and told them his idea.

That set off a whole formal process where the board of directors formed a committee to analyze the deal and see whether it was a good idea.

But this was just kind of a façade. Jack is the man at Block; he’s the founder, he’s the CEO, and he owns about half of the total stockholder voting power at the company.

So the board met a few times over the course of several months and they asked Jack and other members of Block’s management team questions. Questions like, “why are we doing this?” “Is TIDAL a good company?” and “does anyone other than Jack think this is a good idea?”

The management team didn’t really have a whole lot of positive things to say in response to those questions.

They told the board that TIDAL was losing a ton of money; it was under investigation by Norwegian authorities for inflating subscriber numbers; it was accused of withholding royalty payments to artists; it had lost an arrangement it had with Kanye West to provide exclusive music to the service; and it had received a $50 million loan from Jay-Z to help it through financial difficulties.

Additionally, most senior executives at Block were opposed to the acquisition of TIDAL.

But Jack didn’t care; he still wanted to buy it.

And as you would expect, the board of directors went along with his plan and approved the acquisition. Block officially acquired TIDAL in March of 2021.

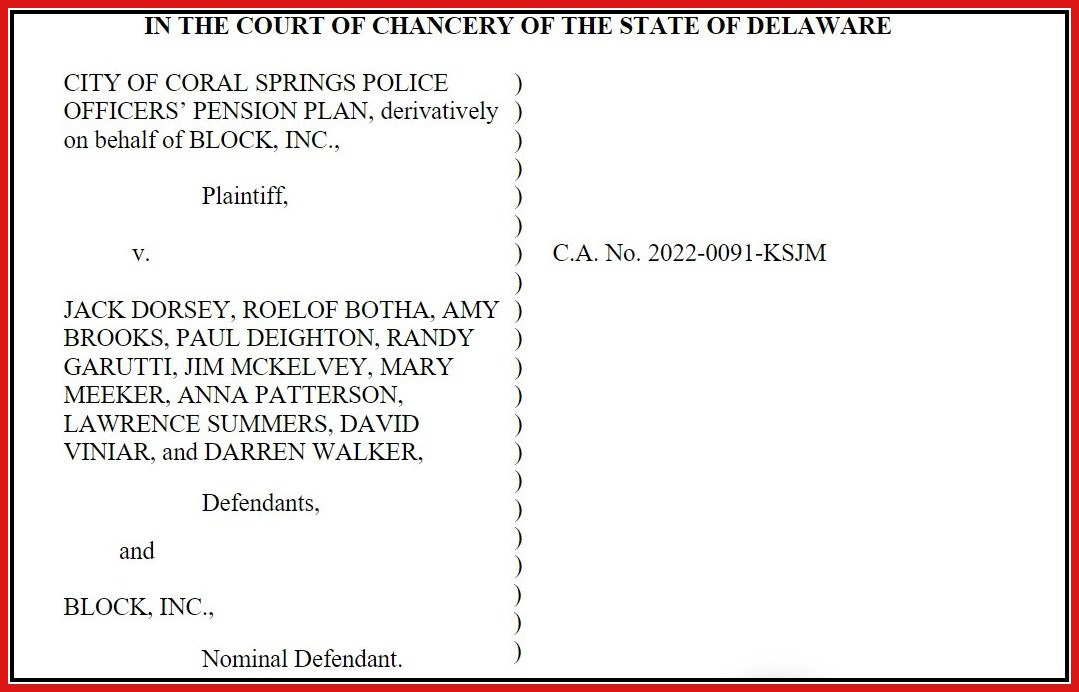

Less than a year later, a pension fund that owned shares of Block filed a lawsuit against Jack and Block’s board of directors for breaching their fiduciary duty.

The lawsuit accuses Jack of “pushing through the unfair TIDAL Acquisition, motivated transparently by interests other than the best interests of [Block] and its stockholders” and it accuses the board of “consciously disregarding their duty to exercise appropriate oversight of [Jack].”

The lawsuit uses some pretty colorful quotes to make its point. The technology reporter Peter Kafka was quoted as saying that the acquisition was “a way for Jack Dorsey to move money from his publicly traded company to a company owned by a guy he likes to hang out with.”

Meanwhile, NYU professor Scott Galloway said that the acquisition “was a $300 million bar tab to hang out with Jay-Z.”

The lawsuit goes to great lengths to prove that by buying TIDAL, Jack was disregarding his fiduciary duties to Block shareholders in order to help Jay-Z unload his stake in a failing streaming music company.

The lawsuit says that Jay-Z cashed out $63 million when he sold most of his TIDAL stake to Block, a massive premium to what he paid for the stake just five years prior.

So, this all sounds really bad, but did Jack and his board breach their fiduciary responsibility as the lawsuit claims?

Well, the Delaware court that decided the case doesn’t think so.

In its ruling, the court admitted that it’s “reasonably conceivable that [Jack] used corporate coffers to bolster his relationship with [Jay-Z].”

It also acknowledged that Block’s acquisition of TIDAL was a “terrible business decision.”

But it also said that the board is “free to make a terrible business decision without any meaningful threat of liability, so long as the directors approve the action in good faith.”

The court pointed to the fact that Block’s board of directors asked a lot of questions about the acquisition and the fact that Block’s management team thoroughly answered those questions as evidence that they acted in good faith.

The acquisition being a terrible business decision wasn’t enough for the court to get involved.

This is what the court said was a manifestation of Delaware’s business judgment rule, which exists to “free fiduciaries making risky business decisions in good faith from the worry that if those decisions do not pan out in the manner they had hoped, they will put their personal net worths at risk.”

In other words, the court is saying that the state of Delaware doesn’t want to do anything to discourage the people who manage businesses from taking risks and making what they believe are the best decisions for their businesses. Only when those decisions are made in bad faith will there be legal consequences.

This and other business-friendly policies are the reason why more than 65% of Fortune 500 companies are incorporated in Delaware, a tiny state with a population of only 1 million people.

So this was a pretty interesting story. Block overpaid for TIDAL because Jack wanted to help out Jay-Z and Block’s board of directors let him.

It’s not a great look, but in the grand scheme of things $300 million is a pretty small amount of money for a company like Block that is worth $35 billion today and was worth over $100 billion when it made the acquisition.