Mega Corporations Are Taking Over the Stock Market. Should You Be Worried?

A measure of U.S. stock market concentration just hit a 50-year high.

This sounds too crazy to be true, but it is true: one U.S. company is worth more than the entire stock market of almost every single country in the world.

That’s right. If you take the market value of every publicly traded company in the United Kingdom, for example, and add them all up, you get $2.9 trillion. That’s less than the market value of Microsoft, which on its own is worth $3.1 trillion.

It’s the same for Apple; with a $2.9 trillion market value, Apple is worth more than every publicly traded company in Germany combined ($2.3 trillion).

In fact, there are several massive U.S. companies—including Nvidia, Alphabet, Meta, and others—that are worth more than the stock markets of entire countries.

But the interesting thing is that it’s not just international stock markets that look small compared to these U.S. companies.

The U.S. stock market itself is being taken over by these mega corporations. Microsoft makes up over 7% of the S&P 500, the most widely followed index of U.S. stocks. Apple makes up 6%; Nvidia, makes up 5%; and so on.

In fact, if you take the ten largest U.S. companies, they make up over a third of the S&P 500—the largest weighting for the top ten in 50 years.

That raises the question that many on Wall Street are grappling with: has the U.S. stock market become too top heavy?

The concern is that because just a handful of stocks make up such a big part of the market, if they fall, that could bring down the entire stock market.

Should we be worried about that?

Well, the short answer is: probably not. But if you are worried, there is something you can do, which I’ll talk about at the end of this post.

But first: why shouldn’t we panic about the concentration of the U.S. stock market?

Fundamental Underpinnings

We probably shouldn’t panic because there are fundamental reasons why America’s top companies are so big. For instance, globalization has created a world that is the most interconnected that it’s ever been.

A company isn’t just limited to its domestic market; it can sell its products to the entire world. And if that’s the case, then companies today are generally going to be bigger than they were in the past, when there was less international trade.

Additionally, a lot of these top U.S. companies benefit from network effects, which means that the more customers they have, the stronger they become. Think of Meta, parent company of Facebook and Instagram. The more users that those apps have, the more appealing they become for other people to use them.

Both of these factors—globalization and network effects—were brought together and turbocharged by the internet and mobile phones. Thanks to these technologies, we have companies that are benefiting from network effects at a global scale.

Amazon, for instance, offers consumers a marketplace to purchase goods from sellers from all around the world.

As I’m sure you’re well aware, few companies can compete with the breadth of products that Amazon offers.

These advantages that companies like Amazon have don’t seem to be weakening either.

We’re entering a new technological era driven by artificial intelligence, and while it’s still early and things can change, what we’re seeing is that the mega corporations of the internet and mobile phone era are continuing to dominate in the A.I. era.

Companies like Microsoft, Meta, Amazon, and Alphabet are spending tens of billions of dollars on A.I. investments that could further entrench their leadership positions in the industries in which they operate.

Yes, there are a few smaller companies, like OpenAI and Anthropic, who have shown that they can compete with the big boys in A.I— and maybe the competitive landscape for A.I. will shift even more in the future.

But at least right now, A.I. is proving to be a costly technology to develop, benefiting the mega corporations who have the money to invest in it.

And boy do they have a lot of money. The ten largest companies in the S&P 500 are on track to make $581 billion in profits this year, or 27% of all profits for companies in the index.

So, as you can see, there are fundamental reasons for why America’s top companies have grown to be so large and so dominant.

And that means that even though the stock market is the most concentrated it’s been in decades, that alone isn’t a reason for the market to tumble.

As a matter of fact, in 2020 and 2021, the market was nearly as concentrated as it is today, with the top 10 stocks making up over 30% of the S&P 500. Yet, the stock market has gone up from where it was back then.

It’s also worth noting that today’s market isn’t the most concentrated it’s ever been. If you go back to the 1950s and 60s, just one stock—AT&T— made up 13% of the U.S. stock market, while the top three stocks made up 28%.

Nothing Lasts Forever

Those are the reasons why maybe we shouldn’t be so worried about today’s stock market concentration.

But, there is a flip side to the story. Some people believe that competition will eventually lead to the downfall of today’s top companies.

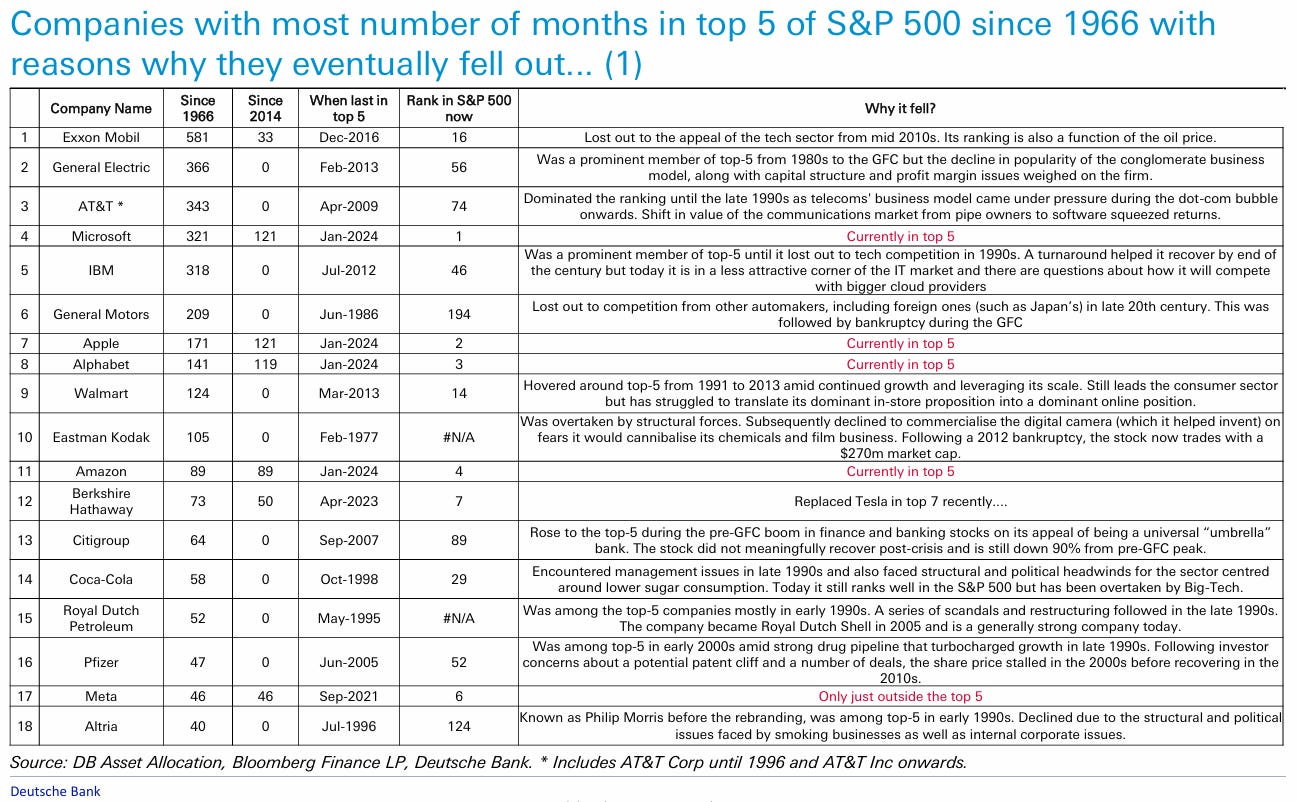

They point to former American giants like AT&T, IBM, and General Electric as examples of seemingly invincible companies that eventually fell from prominence.

AT&T, for example, was the largest company in America for years. According to data from Deutsche Bank, in the period since 1966, AT&T was one of the top five most valuable U.S. companies for 343 months, or nearly 29 years.

Meanwhile, GE was a top five company for over 30 years.

That’s significantly longer than the 14 years that Apple has been in the top five and even the 27 years that Microsoft has been in the top five.

But, of course, even though AT&T and GE are still around today, they are shadows of their former selves.

Could the same thing happen to Apple, Microsoft and the other top company’s of today? Maybe.

Another thing that supports the idea that today’s biggest companies won’t always be so dominant is the concept of reversion to the mean. If we look back through history, previous periods of stock market concentration have eventually given way to periods of less concentration.

In other words, stock market concentration could be like a pendulum. We have periods of high stock market concentration where a few companies dominate. And then it swings the other way and there is less concentration in the market.

Market Impact

I’ve laid out a couple of arguments for why today’s largest companies might not stay big forever.

But even if those arguments are right, that still doesn’t mean that the stock market is going to plunge.

If the stocks of today’s biggest companies start to decline, other companies could rise, offsetting those declines.

In fact, we’ve seen this take place to a certain extent already. A couple of years ago, Tesla was the fourth-largest stock in the S&P 500, with a market cap of more than $1.2 trillion.

But since then, as the electric vehicle market has cooled off, the stock fallen by 60%, equal to a market value decline of almost $700 billion.

Yet, the impact on the S&P 500 from Tesla’s decline hasn’t been noticeable because other big stocks have more than made up for it.

For instance, in the same time that Tesla has fallen, shares of Nvidia have soared, adding $1.2 trillion of market value, thanks to a massive increase in the demand for the company’s A.I. chips.

In other words, the demise of one or two big stocks probably won’t be enough of a headwind to bring the entire stock market down.

But if we see a broader decline in the share prices of the America’s top companies, that could have more of an impact.

If we see something like, say, the dot-com bust of the early 2000s, which led to significant share price declines for all of America’s top companies at the same time, then that could bring the market down.

That’s not something that keeps me up at night, but if you’re someone who’s worried about that, then you might want to consider investing in in equal-weighted index funds, like the Invesco S&P 500 Equal Weight ETF (RSP).

Whereas a traditional S&P 500 index fund like the Vanguard S&P 500 ETF (VOO) weights its holdings by market cap, giving bigger companies a bigger weight, RSP invests equally across all of the stocks in the S&P 500.

The ETF reduces your exposure to America’s largest companies, which is beneficial if you think that the stocks of those companies are going to underperform going forward.

If you don’t think that’s the case or you don’t have a strong opinion the matter, then you might want to stick with the traditional S&P 500.