MicroStrategy: Infinite Money Glitch or Ponzi Scheme?

Michael Saylor says his company is making $500 million per day by selling dollar bills for $3. Is his claim legit?

Did this guy figure out how to print free money? This is Michael Saylor, the founder of a company called MicroStrategy.

Saylor’s net worth has soared to more than $10 billion this year, making him one of the 250 richest people on the planet.

But Saylor’s rise into the upper echelons of wealth has come with a lot of controversy.

Recently, he’s claimed that his company, MicroStrategy, is the most profitable company in the world— that it’s making $500 million per day— more than Apple, Amazon, Microsoft or any of the mega companies that we’re all familiar with.

Not only that, Saylor claims that he and MicroStrategy are just getting started, and that every company— and every person in the world— needs to copy his strategy or risk being left behind.

Is there any truth to this or is it all just a scam?

Judging by what’s going on in the stock market, investors seem to believe what Saylor is saying.

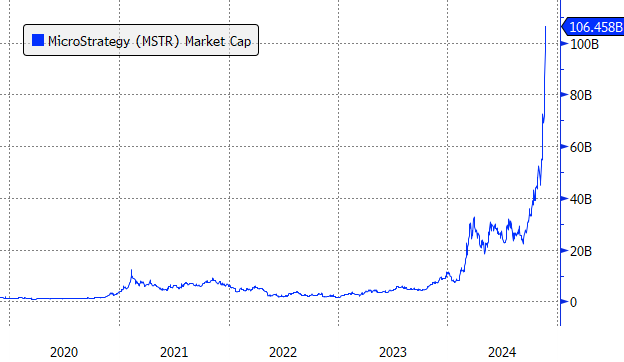

MicroStrategy’s stock has been going through the roof. It’s now valued at around $100 billion, up from just $10 billion at the start of the year.

So, what’s going on here? Has Saylor really created a perpetual money machine?

That’s what I’m going to talk about today. First, let’s lay out what MicroStrategy actually is.

Software Origins

Founded in 1989, MicroStrategy originally developed software for business intelligence. Interestingly, the company was a big winner during the internet bubble of the late 1990’s.

When that bubble peaked in the year 2000, MicroStrategy’s stock soared to astronomical heights, catapulting Saylor’s net worth to $7 billion.

But the bursting of the internet bubble and an accounting scandal at MicroStrategy caused the stock to plummet, and with it went Saylor’s net worth.

That’s ancient history now, but it gives you a little bit of context about the types of ups and downs that Saylor has seen during his career.

A Dramatic Transformation

In the 20 years after the internet bubble burst, MicroStrategy continued to trudge along and sell software.

In those years, it was a relatively small company by the standards of publicly-traded companies, with a market value of around $1.5 billion.

But that changed in 2020 when MicroStrategy began a dramatic transformation. In August of that year, it became the first publicly-traded company to purchase bitcoin.

Using cash that it had in the bank, the company bought $250 million worth of the cryptocurrency at an average price of around $11,650.

That, it turns out, would be the first of many large bitcoin purchases by MicroStrategy.

At the time of the first purchase, Saylor said that his company was buying bitcoin because it was digital gold— a new form of money that would protect against inflation and provide upside for early investors.

Very quickly, he seemed to be proven right. Inflation accelerated and bitcoin prices rocketed higher in 2021.

And all throughout that period, MicroStrategy continued to purchase bitcoin aggressively— not just with the cash that the company made from its software business, but with additional funds that it raised from investors as well.

These funds enabled MicroStrategy to buy much more bitcoin than it would otherwise be able to buy.

The first of these capital raises came in December of 2020, when MicroStrategy raised $650 million by selling convertible bonds.

To put that in perspective, the $650 million was more than the total cash the company had generated in the previous decade from its software business.

So, by raising money from investors, MicroStrategy was able to amplify its firepower to an enormous degree.

This continued for a while— MicroStrategy would raise money through stock and bond sales and use the proceeds to buy bitcoin. And as this went on, MicroStrategy’s name recognition grew and its stock price surged.

Between August of 2020, when MicroStrategy made its first bitcoin purchase, and November of 2021, when the price of bitcoin reached a multiyear peak, the company had bought 114,000 bitcoins at an average purchase price of $27,713.

When bitcoin reached its high, it was trading at around $68,000, meaning MicroStrategy had more than doubled its investment.

Its 114,000 bitcoins were worth just short of $8 billion— a gain of $5 billion for the company.

Things were looking incredible for MicroStrategy and Michael Saylor at the time. The stock had increased 10-fold from where it traded before the company began buying bitcoin and nothing could seemingly go wrong.

But a few months later, everything changed.

Crypto Winter

In 2022, financial markets plunged as the U.S. Federal Reserve hiked interest rates dramatically to combat inflation.

In turn, the price of bitcoin crashed. The implosion of the crypto exchange FTX compounded the problems for the crypto industry and by late 2022, bitcoin had dropped 77% from its highs, reaching a low of $15,600.

All of a sudden MicroStrategy’s big bet on bitcoin was looking downright foolish. The company was now losing money on the bitcoins that it bought and the stock price reflected that, with shares down nearly 90% from their highs.

At the time, there were legitimate concerns about not only MicroStrategy’s ability to continue executing its strategy of investing in bitcoin, but its ability to survive at all.

Remember the $650 million worth of convertible bonds that MicroStrategy sold in December of 2020? If crypto markets remained depressed, MicroStrategy would be on the hook to pay those back.

I’m going to talk more about convertible bonds in a bit, but essentially, they are what are known as hybrid securities because they have characteristics of both stocks and bonds.

If MicroStrategy’s stock price is high enough, the bonds get converted into stocks and the money the company raises by selling them doesn’t need to be paid back.

But if the stock price is low, then the bonds need to be paid back like any other form of debt.

When bitcoin crashed in 2022 and MicroStrategy’s stock was in the gutter, the convertibles were acting more like debt. There was the expectation that they’d probably have to be paid back at some point.

Fortunately for MicroStrategy, the maturity date for the bonds was December of 2025, so the company had plenty of time before it had to come up with the money.

Bitcoin bottomed out in late 2022, so there was almost three years before these bonds would mature.

That gave Saylor and his team some much needed breathing room. So rather than panic when bitcoin prices plunged, they were able to hunker down and stick it out.

They didn’t buy much bitcoin in 2022, but as cryptocurrency prices started to recover in 2023, they started to buy it again.

MicroStrategy bought $1.9 billion worth of bitcoin in 2023 and another $4 billion worth of bitcoin during the first nine months of 2024.

Turbocharged

That brings us to the present day, when things are getting really insane. Over the past few weeks, MicroStrategy has absolutely turbocharged its bitcoin purchases.

On November 11, it announced that it bought $2 billion worth of bitcoin; a week later on November 18, it announced a $4.6 billion purchase; and a week after that on November 25, it revealed a $5.4 billion buy.

In other words, in just the span of two weeks, MicroStrategy bought $12 billion worth of bitcoin. In terms of dollar value, that’s more bitcoin than the company had bought in the previous four years combined!

The crazy part about all this is last month, MicroStrategy unveiled this bold plan to raise money from investors to purchase $42 billion worth of bitcoin over the next three years.

That was already a huge, almost unbelievable amount of money to raise in just three years, but now we see that the company has raised almost a third of that in just two weeks.

These massive numbers have really excited investors, and it’s the reason why MicroStrategy’s shares have skyrocketed in recent days, pushing the company’s market cap to $100 billion.

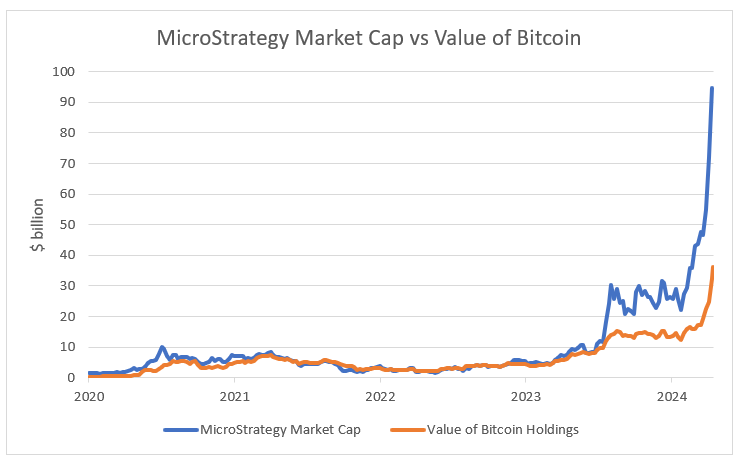

In fact, the excitement has grown to such a level that MicroStrategy is now valued at around 3x the value of its bitcoin.

You heard that right. While MicroStrategy’s market cap is around $100 billion, its bitcoin holdings are worth only $36 billion.

This big gap is the reason why MicroStrategy is such a controversial stock. Bears argue that the stock is way overvalued, while bulls say that it deserves its premium valuation.

Let’s look at both sides of this issue to see who is right. I want to start with the claims made by Michael Saylor that I mentioned at the beginning of this post— all that talk about how MicroStrategy is the most profitable company in the world making $500 million per day.

I’m going to be honest with you: that claim is extremely misleading. It’s based on the fact that MicroStrategy bought a bunch of bitcoins over the past few weeks and the price of bitcoin went up since the company bought them.

Anyone can go out and buy an asset— whether it be a stock or a cryptocurrency— and make some quick money.

Those are investment gains and they’re not in any way the equivalent of operating profits generated by companies like Apple or Amazon. For Saylor to characterize them in the way that he did is hyperbolic nonsense.

So, that claim is ridiculous. But there are other claims that we should look at as well.

BTC Yield

We know that MicroStrategy’s aim is to buy bitcoin and profit from the appreciation in bitcoin’s price.

I admit: it’s a strategy that’s worked well for the company (at the current bitcoin price of $98,000, MicroStrategy has made $16 billion on its bitcoin investments).

But Saylor often uses a bunch of jargon to make it seem like MicroStrategy is doing much more than just buying and holding bitcoin— that it’s doing something really special to create value for stockholders.

He’s talked about how MicroStrategy is powered by a “bitcoin reactor” that makes money by “stripping the volatility” off of fixed income securities and transferring it to MicroStrategy shareholders.

Jargon aside, the crux of his thesis centers on a metric he calls the BTC Yield, which measures the increase in bitcoin per share over time.

Let me put it more simply. When you go out and buy MicroStrategy stock, you own a certain number of shares. At the same time, MicroStrategy has this big pot of bitcoin that they’ve purchased over the years.

Each of your shares represents a portion of this pot. For instance, today, each share of MicroStrategy represents 0.001451 bitcoins in MicroStrategy’s bitcoin pot.

Saylor says that over time, he can increase the number of bitcoins that each share represents. And because of that, MicroStrategy’s stock is a good investment and deserves to trade at high levels.

The problem is— yes, bitcoin per share has been increasing and could potentially continue to increase—but that’s only because new investors are buying shares at such a high premium.

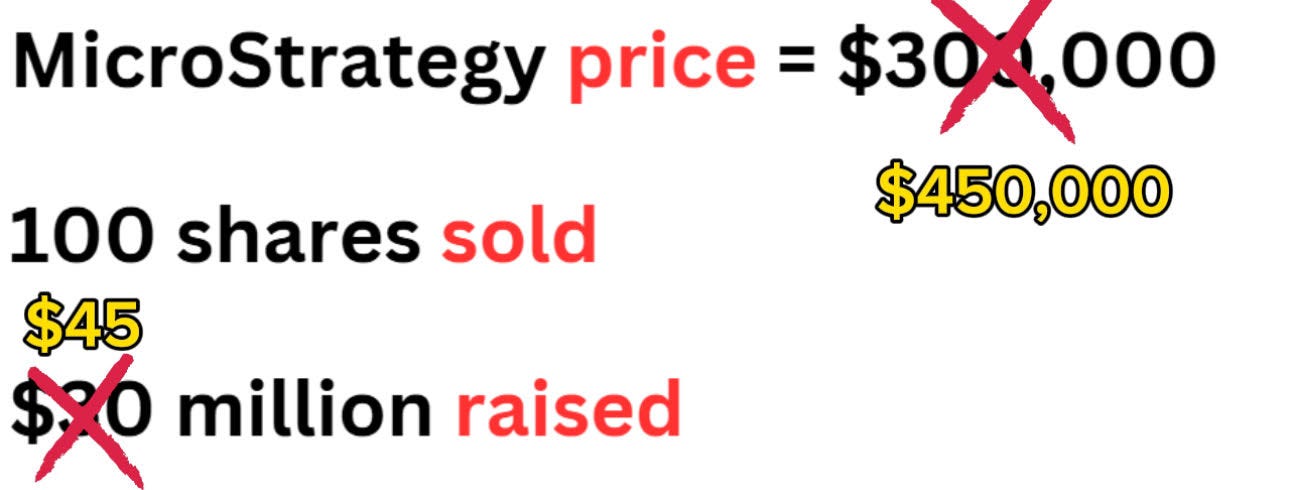

Let me give you an example with nice round numbers to make this clearer.

If there are 100 shares of MicroStrategy outstanding and MicroStrategy owns 100 bitcoins, then each share represents ownership of 1 bitcoin.

Let’s say the stock price of MicroStrategy reflects this with no premium in the shares.

If bitcoin is trading at $100,000, MicroStrategy’s stock in this scenario also trades at $100,000 because one share represents ownership of one bitcoin.

But now let’s say that investors in MicroStrategy go crazy and bid up the stock so that it has a 200% premium.

In this case, MicroStrategy stock trades for $300,000. If the company goes out and sells 100 shares, it can raise $30 million dollars at that price.

With that $30 million, it can turn around and buy 300 bitcoins at a price of $100,000.

Now let’s look at the situation: MicroStrategy owns 400 bitcoins and there are 200 share outstanding. That means that each share represents ownership of 2 bitcoins, up from 1 bitcoin before.

What’s changed? Each share represents twice the number of bitcoins as it did before. But is this magic?

No— the investors who bought MicroStrategy at a premium price boosted the value of all of the existing shares.

It was a transfer of value from new buyers of MicroStrategy stock to earlier buyers of MicroStrategy stock.

So, this is essentially what’s going on here. There is no free money; there is no free lunch— just a transfer of wealth.

Selling Volatility

There is another aspect of MicroStrategy’s scheme that I should also cover because Saylor talks about it a lot, and it’s this concept of selling volatility.

You see, MicroStrategy has historically raised money from investors in two ways. One is through the sale of common stock, like I outlined in my example.

The other is through the sale of convertible bonds— like those convertible bonds I mentioned earlier in this post.

As I discussed, convertible bonds are hybrid securities. You can think of them like a bond— which is a type of debt— combined with a call option.

If you’re unfamiliar with call options, they are a type of security that entitles you to buy a stock at a particular price (the strike price) at or before a particular time (the expiration date).

A call option has value because the price of the stock in question could rise above the strike price before the option expires. It’s great if you have a call option that grants you the right to buy a stock at $100 if that stock is trading at $120, for example.

Anyway, the more volatile a stock is, the more valuable a call option is because there is a higher chance that the stock will rise above the strike price.

So, in the case of MicroStrategy, the stock is extremely volatile— it moves up and down huge amounts every day— which makes its call options extremely pricey.

MicroStrategy has taken advantage of this by selling convertible bonds, which, like I said, have call options embedded inside of them.

They’re usually structured in a way like this: the holder of the bond gets a small amount of interest— or maybe even no interest.

In exchange for the low interest rate, the convertible bond holder gets the option to purchase MicroStrategy’s stock at a price that’s 50% above the current share price of the company.

So, if MicroStrategy’s stock goes through the roof, that’s great— the bonds get converted into stocks and the holder profits that way.

But if the stock goes down or fails to reach the conversion price by the time the convertible bonds mature, then they’re never converted into stocks and the money is paid back just like any other bond.

With convertible bonds, the upside is unlimited, while the downside is limited— as long as MicroStrategy has the money to pay back the bonds*.

The main thing to understand is that convertible bonds are hybrid securities that MicroStrategy is selling to raise money in order to buy bitcoin.

And just like when it sells regular common stocks, there is no free lunch. After all, in the case where MicroStrategy’s stock rises significantly, convertible bonds turn into stocks.

Granted, MicroStrategy can sell shares at a higher price using convertible bonds than it can with common stocks.

If you sell common stocks, you usually sell them at the current market price of the stock. With convertible bonds, the conversion price is usually much higher than the current stock price (55% higher in the case of MicroStrategy’s latest convertible bond offering).

So, in my earlier example, it would be like MicroStrategy selling shares at $450,000 instead of $300,000.

Anyway, yes, that’s all true; there are some advantages of selling convertible bonds, but there are downsides as well.

By selling convertible bonds, MicroStrategy is making a trade-off— the company is able to potentially sell stocks at a higher price, but at the risk of not being able to sell any stocks if the stock price goes down.

If the stock price doesn’t exceed the conversion price by the time the bonds mature, then the convertible bonds must be repaid.

That is a risk! There is no free lunch.

Worst Case Scenario

Earlier, I talked about how back when bitcoin crashed in 2022, there was all this concern about MicroStrategy not being able to pay back its convertible bonds.

This is what I was talking about. Fortunately for MicroStrategy, bitcoin prices didn’t stay down that long and so the company didn’t have to worry about those convertible bonds that were set to mature in 2025.

Obviously, since then, MicroStrategy’s stock has gone way up and those bonds have long been converted into stock, so they won’t ever have to be paid back.

But that same situation could arise in the future if bitcoin crashes again— and there’s no guarantee that things work out as favorably for the company the next time around.

MicroStrategy has been smart about spacing out the maturities of its bonds so that it doesn’t have to pay them all back at once during a very inopportune time, but if it’s luck is bad, it could still get caught in a storm.

The next bond maturity that the company faces is in February of 2027, so over two years from now.

The worst-case scenario is for bitcoin and MicroStrategy’s stock to crash around that time. If that happens, the company might quickly have to come up with a billion dollars to pay the bonds back, either by selling some of its bitcoin holdings or by selling stock at depressed prices.

But the worst-case scenario isn’t the only downside scenario investors in MicroStrategy have to be wary of.

Two Main Risks

The stock is tied extremely closely to bitcoin. This is for obvious reasons: the vast majority of the company’s value comes from its pot of bitcoins. The software business is probably worth around $1-2 billion, a tiny sliver of the company’s $100 billion market cap.

So, if bitcoin goes down, MicroStrategy will almost certainly go down with it.

In addition to the risk of bitcoin going down, investors have to worry about MicroStrategy’s premium coming down as well.

Today, there is a 3-to-1 ratio between the value of MicroStrategy’s stock and the value of MicroStrategy’s bitcoin holdings. But in 2022, the ratio fell all the way down to 1-to-1.

In fact, it was trading around 1-to-1 at the start of this year.

So, those are the two big risks of holding MicroStrategy stock— a drop in bitcoin and a drop in MicroStrategy’s premium.

The Bullish Case

But, of course, there’s a flip side to all of this also. After all, the stock has performed extremely well this year, rising almost sixfold.

Maybe instead of going down, the stock’s premium continues to expand.

Like I said, today MicroStrategy trades at a value that’s 3x that of its underlying bitcoin holdings. But who is to say that it couldn’t trade at 4x, 5x, or even more?

Now, that would obviously be a speculative bet to make, but judging from the many investors buying MicroStrategy today, a lot of people are willing to make that bet.

It’s interesting: with bitcoin, investors are guessing what the price of bitcoin will be. With MicroStrategy, they’re guessing what the price of bitcoin will be and what the premium of the stock will be compared to the value of MicroStrategy’s bitcoin holdings.

Anyway, you could certainly imagine a scenario where the rally keeps going: bitcoin surges past $100,000, fueling another leg higher in MicroStrategy’s stock.

Michael Saylor and his team seize the moment to raise another $10 billion— or even $20 billion— to buy more bitcoin, which pushes prices even higher, creating a self-reinforcing cycle.

In fact, this scenario that I just described is what makes MicroStrategy’s role in this bitcoin cycle different than it was during the last cycle a few years ago.

MicroStrategy has gotten so large and it buys so much bitcoin now that it can actually impact the underlying bitcoin market in a notable way.

That wasn’t the case during the last cycle back in 2020 and 2021. Now with the company potentially buying $20 billion worth of bitcoin in one shot, that is not negligible, even for an asset like bitcoin, which has a market capitalization of $1.8 trillion.

The Short Term

So, this is how I’m thinking about MicroStrategy over the short and long term.

Right now, we are in a bitcoin bull market. No one knows how long that’s going to last— maybe bitcoin goes to $120,000, $150,000, or even $200,000 (or maybe it’s already topped out; I have no idea).

But to the extent bitcoin goes up, MicroStrategy is probably going to go up as well.

How much it goes up depends on both the price of bitcoin and the premium that investors are willing to pay for MicroStrategy’s stock.

The Long Term

At some point, though, there will be the inevitable crypto winter. Bitcoin will drop 50% or more and MicroStrategy will fall even harder than that.

The crypto bear market will be the riskiest moment for MicroStrategy. If you’re Michael Saylor, you do not want to see the bear market take place right before a big batch of your convertible bonds is about to mature.

That would be bad because you’d have to make distressed sales of either bitcoin or stocks to pay back the bonds.

But assuming MicroStrategy survives the bear market, what happens then?

After the crash, I think there are two ways this can play out. The bearish scenario is for MicroStrategy’s premium to turn into a discount. If investors start to feel less enthusiastic about MicroStrategy and Saylor, then they might not want to pay a premium for the stock anymore.

You can imagine a scenario where people say “hey, I can buy bitcoin through a bitcoin ETF and get 1-for-1 exposure to the cryptocurrency; why should I pay extra for MicroStrategy’s stock?”

In that case, maybe MicroStrategy’s market value drops below the value of its bitcoin holdings— maybe even sharply below.

We saw a similar dynamic with the Grayscale Bitcoin Trust (GBTC), which, before becoming an ETF in 2024, operated as a quasi-closed-end fund.

GBTC traded at a large premium for many years, but eventually, that premium turned into a massive discount of as much as 50%.

So, that’s the bearish long-term scenario.

There is a more optimistic scenario as well though, and it’s a repeat of what we saw during the last crypto winter.

Bitcoin drops, MicroStrategy stock crashes, and the premium shrinks temporarily— but eventually starts to rise again as the price of bitcoin recovers.

You could even make a fundamental investment case for buying MicroStrategy at the bottom when the premium is gone.

If you buy the stock at a value equal to the value of MicroStrategy’s bitcoin, you might feel good about paying fair value for that exposure.

And at the same time, you have the potential to capture additional upside if there’s another mania that sends the premium higher again.

Remember, every time MicroStrategy raises money by selling stock at a premium, there is a wealth transfer from investors who bought at a high premium to investors who bought at a low premium (or no premium).

So, you might want to be one of those investors who is benefiting from the wealth transfer.

The Saylor Wildcard

Speaking of which, you want to know which investor is really benefiting from that wealth transfer? Michael Saylor.

He is the original MicroStrategy shareholder, and his share of MicroStrategy’s bitcoin pot grows every time he’s able to sell stock to someone else at a premium.

So, it’s kind of funny. I said there’s no “free money” in this situation, but for Michael Saylor, it feels like there is because he’s turning the big mania in his company’s stock into a windfall for himself and other early investors.

If I was a MicroStrategy shareholder, I might even worry that Saylor is seeing too much success.

With him making so much money so easily, he might start to feel invincible— and that’s a very dangerous feeling to have when you’re dealing with financial markets.

It’s quite possible that he could take on too much risk— borrow too much money— and put MicroStrategy in a very vulnerable position when the next downturn in bitcoin begins.

He is raising a lot of money with convertible bonds right now. That could come back to bite him and the company down the line.

I’m not saying that it’s going to happen, but it’s something to watch out for, especially when you consider Saylor’s personal views about bitcoin. He has this almost religious fervor for the coin that could cause him to make risky decisions that backfire in the future.

We’ll see what happens. MicroStrategy is a fascinating company that’s closely connected to bitcoin, but one that also has elements of being a meme stock and cult stock as well.

It’s going to be fun watching how this all plays out over the next few years.

Thanks for reading!

*In reality, many of the buyers of convertible bonds are hedge funds who use a strategy called “convertible arbitrage,” where they combine a position in MicroStrategy’s convertible bonds with a short position in MicroStrategy’s stock. They’re not necessarily betting on the stock going up (or down)

What a fun read! I find your writing and explanations very easy to understand as a novice in the BTC/stocks/bonds arena. This is like watching a movie of intrigue! I hope you follow up in the future of where this leads MS and BTC. The feedback loop with MS purchasing of BTC could reach unbelievable highs if the timing works out for them. I wonder what the current oligarchs think of Saylor's rise into their financial world? Hopefully he is more of a humanitarian than lets say... Soros.

I agree it’s a ponzie scheme