Oil Prices Surprise To The Downside In 2022

Here's why oil prices have performed so poorly in the face of seemingly bullish news.

(You’ll find the text version below this embedded video)

What if I told you a year ago that in 2022, Russia would invade Ukraine; Europe and the U.S. would ban Russian oil imports; and geopolitical tensions around the world would be sky high; what do you think would have happened to oil prices?

You probably would have expected them to go up.

Yet, here we sit, with only a couple of weeks left in the year and oil prices are actually down in 2022.

The U.S. oil benchmark, West Texas Intermediate, is down by 6% this year, while the European benchmark, Brent, is down by 2%.

At their highest levels of the year in March and June, both oil benchmarks were up close to 60%. But they’ve since fallen 40% from those levels, erasing all of their gains.

Why have prices fallen? Well, as is always the case when it comes to commodities—it’s all about supply and demand.

Oil prices have fallen as demand has come in below expectations this year. Lockdowns and weak economic growth in China have reduced demand from the world’s second-largest oil consumer, while economic weakness in Europe and elsewhere have also sapped demand.

Then on the supply side, Russia’s oil exports have proven to be much more resilient than expected. Even though Russian exports of crude to the U.S., Europe, Japan and Korea have slowed down to a trickle because of restrictions put on by those countries, Russia has rerouted its oil to willing buyers in China, India and Turkey.

The result is only a very small net decrease in Russian oil supplies this year. At the same time, oil supplies from other countries have surged in 2022 by 4.6 million barrels per day, according to the International Energy Agency (IEA), well above the 2.1 million barrel per day increase in demand.

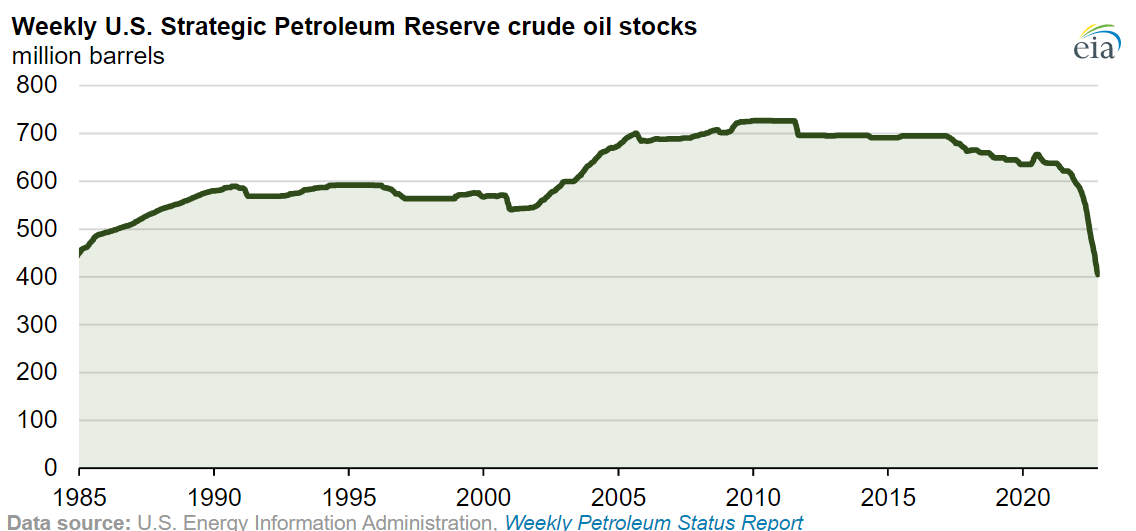

A drawdown of emergency oil reserves in the U.S. and other countries has further added supplies onto the market.

That’s why oil prices are now down on the year.

But remember that this is just a moment in time. We’re simply comparing oil prices today to where they were at the start of the year. But for much of 2022, consumers have faced lofty prices, especially for the end products that they use.

Even though oil prices never reached an all-time high this year, gasoline and diesel prices did.

A shortage of refining capacity pushed prices for those products to record premiums compared to oil itself.

As a reminder: oil prices make up roughly half the price of the price you pay at the pump. The rest comes from costs related to refining and distribution, as well as taxes.

Today, gasoline prices are back down to where they started the year, but diesel prices are still holding onto a 20% gain.

So what might happen next year? Well, if there’s anything we learned from this year, it’s that predicting energy prices is foolish because you’re more likely than not going to end up wrong.

But I think we can safely say that if we get a global economic recession in 2023, then all bets are off and oil prices will probably keep heading lower.

On the other hand if the economic outlook improves, then demand might pick up and put upward pressure on prices.

That doesn’t necessarily mean we’re going to see a surge in prices at the pump though. Just like diesel prices are up significantly from where they started the year at the same time that oil prices are down, if more refining capacity comes online next year, then we could see the opposite.

Fortunately, there’s good news on that front. According to the IEA, three large refinery projects in Kuwait, Nigeria and Mexico are coming online by the end of 2023, which could significantly boost refining capacity.