One Company Owns Nearly All Of America's Stocks

Its name is Cede & Co. and if you’ve never heard of it, you’re not alone—most people haven’t.

Did you know that one company owns almost all of the stocks in the U.S.?

Its name is Cede & Co. and if you’ve never heard of it, you’re not alone—most people haven’t—but this company owns tens of trillions of dollars worth of U.S. stocks.

So how did Cede & Co. come to own so much stock?

Well, it all started in the 1960s and the 1970s, during what some people call the Paperwork Crisis.

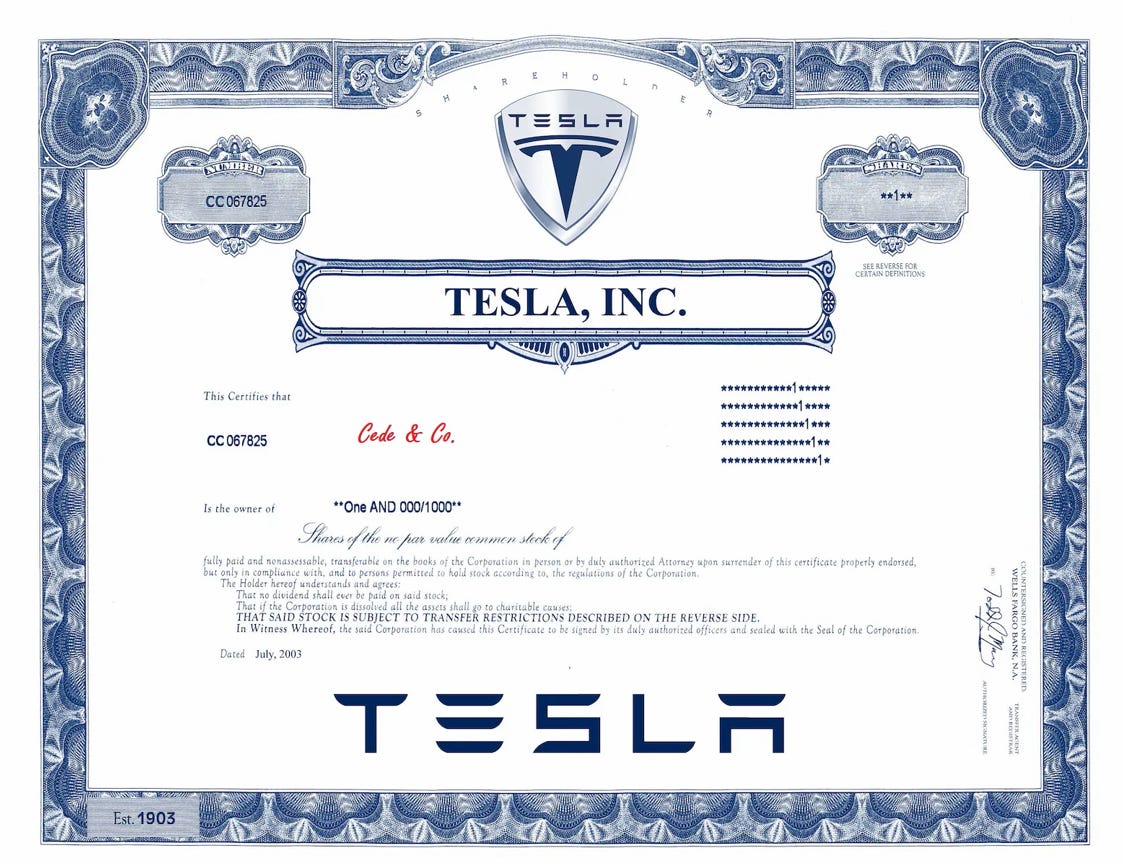

Back in those days, processing stock transactions was a nightmare. Every time stocks were transferred from one party to another, stock certificates like this one had to physically change hands.

So, at the end of each day, hundreds of Wall Street messengers went out on foot throughout New York City’s financial district to hand deliver stock certificates to brokers who had bought stocks on behalf of their customers and to return with paper checks for those who had sold stocks.

But that wasn’t the only headache. Stock brokers had to fill out dozens of different forms to finalize these stock transactions, with a single stock transfer requiring the completion of as many as 33 forms.

There was so much paperwork that the New York Stock Exchange started to shut down every Wednesday just so people had enough time to get through it all. And with the number of stock trades growing every year, the problem was only getting worse.

By 1975, it got so bad that Congress stepped in. That year, it passed the Securities Acts Amendments of 1975, a law designed to make the United States’ securities markets more efficient, transparent, and competitive.

The law instructed the SEC to “bring about the discontinuation of the physical movement of the negotiable stock certificate as a means of settlement among brokers or dealers of transactions in securities.”

For the New York Stock Exchange, that was confirmation that it was on the right track.

Two years before Congress had passed its law, the NYSE along with the American Stock Exchange and the National Association of Securities Dealers, had created the Depository Trust Company (DTC) with a goal of reducing the cost of completing stock trades.

The DTC centralized the process of changing stock ownership. A stock seller could sign and deliver their stock certificate to their broker, who could then deliver that certificate to the DTC.

The DTC would then send that certificate to the company that issued that stock, and the company would exchange it for a fresh stock certificate in the new owner’s name. The DTC would then pass that certificate to the new owner’s broker who would then pass it along to the new owner themselves.

Exchanging stock certificates at one central location was already a big improvement over the fragmented system that existed before, but with Congress’s backing, the DTC did something even more significant.

It immobilized the stock certificates. That means that instead of passing them back and forth every time someone bought or sold a stock, all the stock certificates were always kept in one central location. And changes of ownership were recorded electronically using a computerized system.

This was a game changer.

From then on, when someone bought or sold a stock, that ownership change was reflected on the books of the DTC; no physical stock certificates had to change hands.

Today, the DTC is the record keeper for nearly all the stocks in the United States.

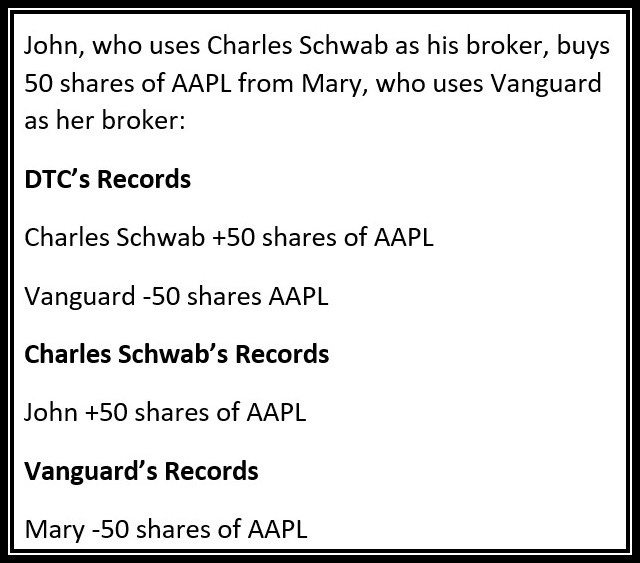

So, what essentially happens when you buy a stock is: the DTC updates its records to show that your broker now owns the stock, and your broker updates its records to show that you own the stock.

It’s a much simpler process.

No stock certificates ever leave the DTC and the registered owner of the stock certificates (the name written on the physical certificates and in the records of the company that issued the stock) doesn’t change either.

That name always remains Cede & Co.—which is a legal entity that’s affiliated with DTC (Cede is short for certificate depository).

So, Cede & Co. is the registered owner of the stock, but you’re the true owner, also known as the beneficial owner.

Today, Cede & Co is the registered owner of nearly all the stocks in the U.S., but there are still a small number of people who choose to register their stocks in their own name.

There’s really no major benefit to doing this, but some people do it— maybe because they like collecting physical stock certificates or they like having a more direct relationship with the companies they invest in.

But for the most part, stock certificates are becoming obsolete. A lot of companies don’t even issue them anymore and they’re essentially a relic of the past.

Critical Components

That’s the story of how Cede & Co came to “own” most of the stocks in the U.S.

It’s a name you’re probably not going to hear much about. Similarly, you’re probably not going to hear much about the DTC or its parent company, the Depository Trust & Clearing Corporation (DTCC), which also owns several other subsidiaries focused on what’s known as post-trade processing—or what happens after a stock transaction is executed.

But these companies are critical components of America’s financial market infrastructure. Behind the scenes, they’re responsible for ensuring the smooth and efficient processing of not just trading in stocks— but in bonds, mutual funds and derivatives as well.

*The DTCC is a monopoly. When evidence began to emerge that it may have been abusing its monopoly power to benefit its parent exchanges (the NYSE and the Amex), the SEC forced the exchanges to divest their stakes. Today, the DTCC is owned by its users—which includes “brokers/dealers, banks, investment managers, and other third parties who market financial markets and services.” It’s highly regulated and “operates on an at-cost basis, returning excess revenue from transaction fees to its member firms.”