Pricing In The End of Obesity

The world is about to radically change and Wall Street is frantically trying to figure out who the winners and losers will be.

The world is about to radically change and Wall Street is frantically trying to figure out who the winners and losers will be.

Everyone from Walmart to Nestle and countless other major companies are weighing in on how GLP-1 drugs are going to impact their businesses.

If you haven’t heard, GLP-1 drugs are a new class of medicines that some people are calling “miracle drugs.” They were originally designed to treat diabetes, but they are being found to have a ton of additional health benefits.

These drugs mimic GLP-1 (glucagon-like peptide-1), which is a hormone that regulates blood sugar.

“When blood sugar levels start to rise after someone eats, these drugs stimulate the body to produce more insulin. The extra insulin helps lower blood sugar levels,” according to the Mayo Clinic.

In 2010, the Danish pharmaceutical company Novo Nordisk began selling a GLP-1 drug called liraglutide, which was marketed under the name Victoza. Users of Victoza injected it daily to treat diabetes, and one of the side effects that came with the drug is slight weight loss.

Curious about the weight loss, researchers at Novo Nordisk dug a bit deeper. They found that injecting GLP-1 into rats caused them to eat significantly less.

They also found that in humans, GLP-1 sends signals to many different parts of the body— including the gut, the brain, and other organs. In combination, these signals make it so someone feels much fuller and less hungry.

Novo Nordisk saw this as an opportunity. In 2014, it released another higher-dose version of liraglutide specifically for weight loss. It was called Saxenda and it resulted in weight loss of around 6%.

Now, liraglutide was a pretty effective drug, both for diabetes and weight loss. But one issue with it is it had to be injected every day. That’s obviously a hassle. So, over the next few years, Novo continued to do research in an effort to find a longer lasting version of the drug— which it eventually did.

That drug, called semaglutide, was approved for diabetes in 2017. Sold under the brand name of Ozempic, it only had to be injected once a week since it lasted longer in the body.

But it turns out that convenience isn’t the only benefit of the longer lasting GLP-1 drug. It also leads to much more weight loss—15% of the user’s body weight, or two-and-a-half times as much as liraglutide.

No one knows why semaglutide has so much more of a potent effect on weight loss than liraglutide, but it does. And by taking the weight loss potential up to 15%, the drug set off a frenzy.

Once it became known that Ozempic leads to such significant weight loss, demand for the drug exploded as doctors began prescribing the medication to treat obesity, even though it wasn’t approved for that use.

Finally, in 2021, Novo got FDA approval to sell a higher dose version semaglutide specifically for weight loss called Wegovy. That drug is now a bigger seller than Ozempic is.

Dominating A Massive Market

Novo Nordisk is sitting pretty. It dominates the fast-growing category of GLP-1 drugs for obesity.

Right now, its only real competitor is Eli Lilly, whose drug tirzepatide has been shown to lead to even bigger weight loss than Novo’s semaglutide—20% of body weight or more.

That drug, which combines GLP-1 with the hormone GIP (gastric inhibitory polypeptide), has been sold for diabetes under the brand name of Mounjaro since 2022, and could be approved for obesity as soon as this year.

Once approved, Mounjaro for obesity will almost certainly be a smashing success. Demand for these weight loss drugs is insatiable, even though they can cost over $1,000 per month.

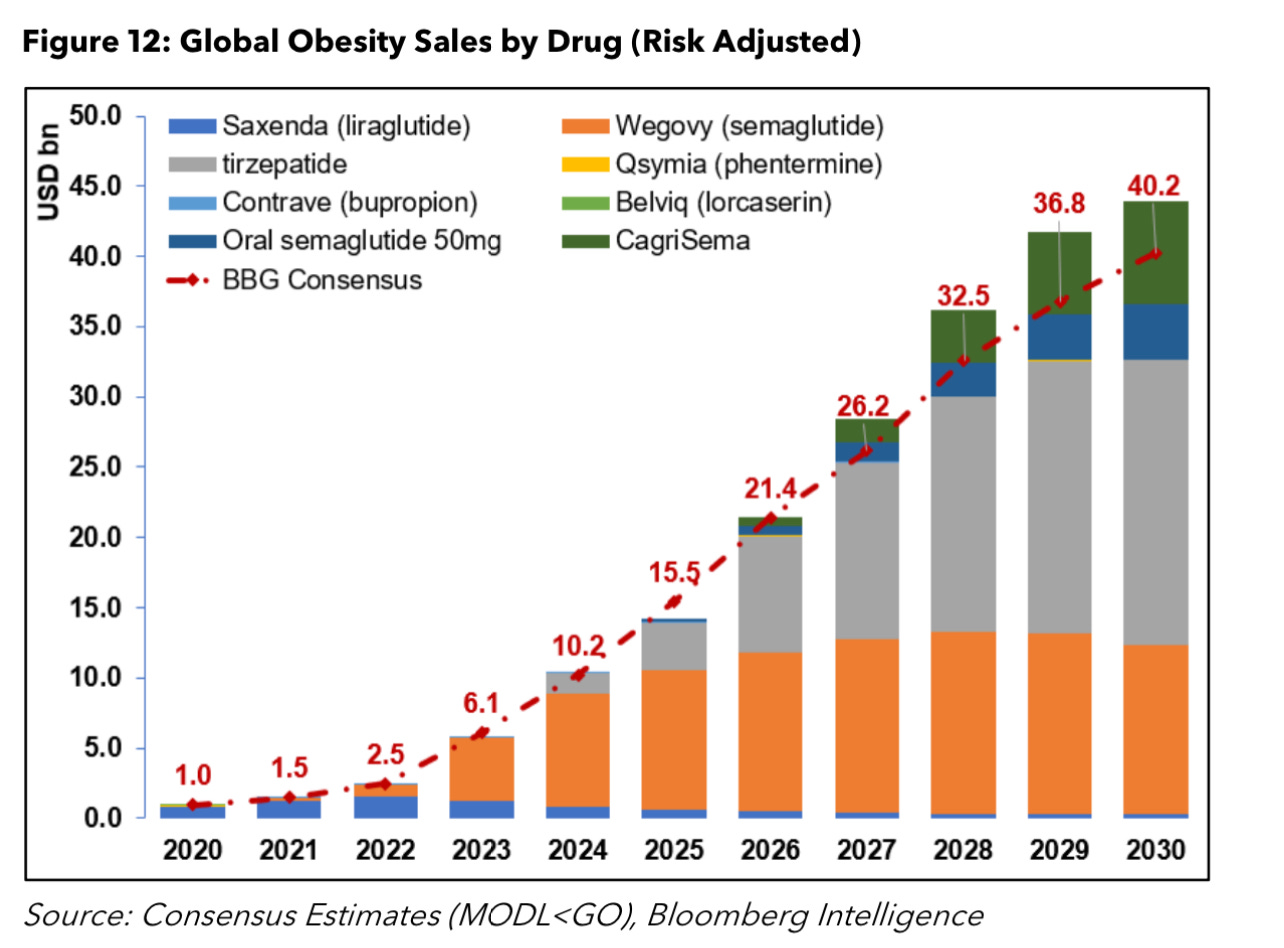

Wall Street analysts expect that sales for anti-obesity drugs could increase from $2.5 billion in 2022 to more than $40 billion by 2030 (some even believe that sales could top $100 billion by the end of the decade).

Initially, almost all of those sales will be for the anti-obesity drugs created by the two companies I’ve been talking about, Novo Nordisk and Eli Lilly.

Each of those companies is expected to control roughly half of the market for anti-obesity drugs for the next few years at least.

That dominance is reflected in the market values of the two companies. Today, Novo is worth just under $400 billion. It’s so big that the government of Denmark—a tiny nation with a population of only 6 million— has started to publish economic statistics that exclude the impact of the pharmaceutical company.

Meanwhile, Eli Lilly has become a giant as well. It’s currently valued at around $550 billion, making it the 10th-most-valuable company in the world by market cap.

That said, even though Novo Nordisk and Eli Lilly will dominate the market for anti-obesity drugs for much of this decade, competitors are working on drugs of their own.

Pharma companies like Pfizer, Amgen, Altimmune and others are testing GLP-1 drugs that show a lot of promise. Some of these might be oral medications, some of them you might have to take only once per month, and some of them might result in extremely significant weight loss approaching 30%.

But none of these drugs is likely to hit the market before 2026 at the earliest.

Massive Repercussions

You can probably tell by now that anti-obesity drugs are going to be huge and that the pharmaceutical companies that sell them are going to make a lot of money.

But that isn’t the most interesting consequence of the emergence of this new, revolutionary class of medicines.

If these drugs see widespread use and rates of obesity start to decline, the repercussions could be massive.

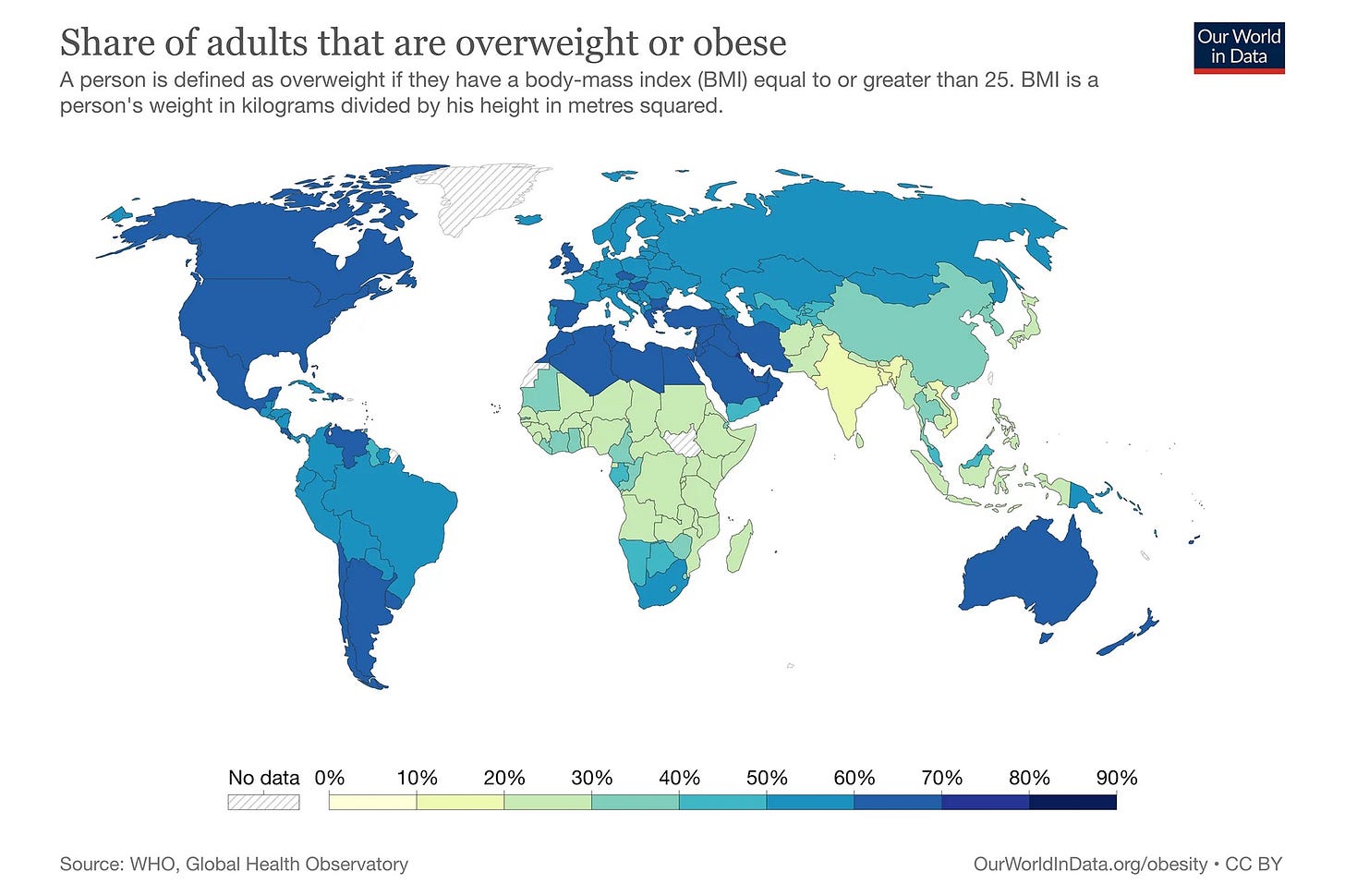

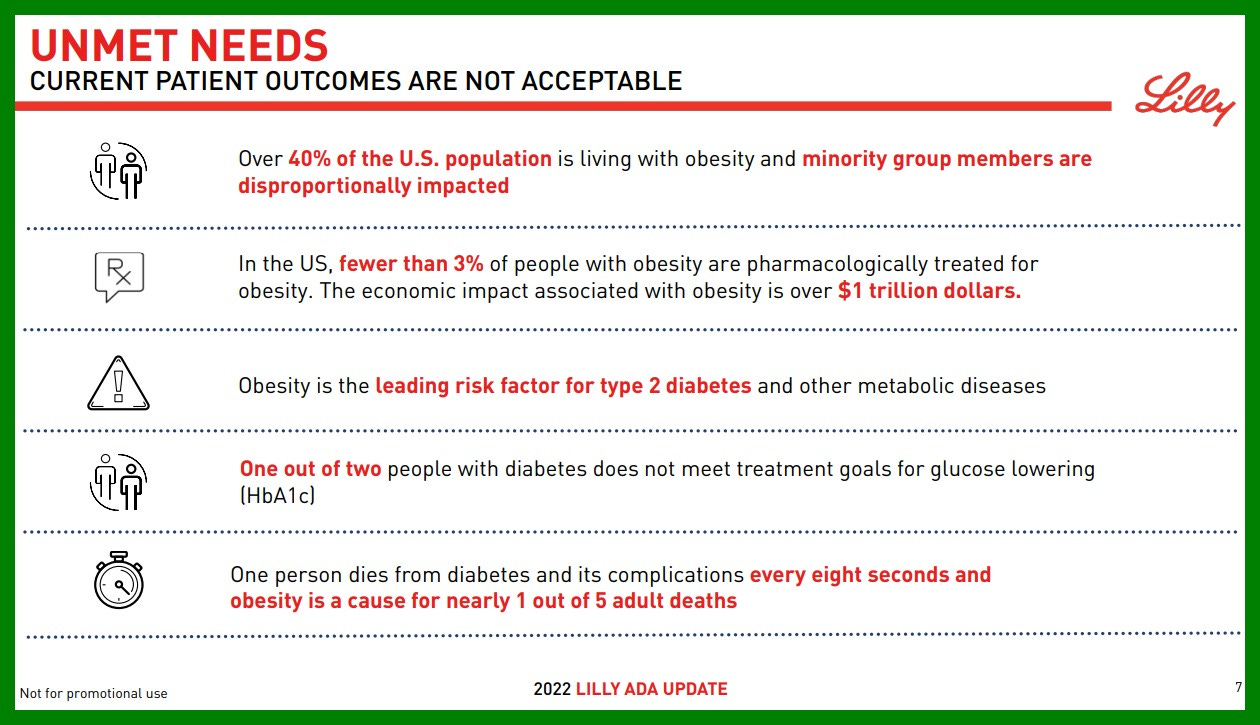

Obesity today is an enormous, global health care issue. The World Health Organization estimates that more than 1 billion people globally are obese— or one in eight people.

The risk of heart disease, strokes, type 2 diabetes, osteoarthritis, sleep apnea, fatty liver disease, and certain cancers are much higher when you’re obese. Not to mention, nearly one out of five adult deaths is caused by obesity.

The cost in terms of human health is extremely high. And so too is the economic cost. Treating the complications that arise from obesity costs hundreds of billions—if not trillions of dollars.

Any drugs that can alleviate obesity would be revolutionary, both in terms of the benefits to human health and the benefits to the economy.

A recent study showed that Novo Nordisk’s Wegovy (semaglutide) reduced the risk of major adverse cardiovascular events by 20% in adults who are overweight or obese. That is a big, big deal.

There’s also evidence that GLP-1 drugs might be able to help with conditions like alcoholism, fatty liver disease, Parkinson’s and even Alzheimer’s.

The Losers

The data seems to suggest that there are potentially some massive health benefits from GLP-1 drugs, which is great for individuals and for society.

That said, it’s not great for everybody. There are many companies that benefit from the status quo—a world in which rates of obesity are high and rising.

These companies profit either directly or indirectly from obesity, and anything that makes obesity less prevalent is going to hurt them.

Case in point is Medifast, which sells traditional weight loss products— meal plans, coaching sessions, and things like that. Medifast recently said that GLP-1 drugs are hurting its business.

Meanwhile, the stock of Resmed— which sells devices to treat sleep apnea— has plunged in recent weeks as investors speculate that fewer obese people will translate into fewer people with sleep apnea.

The stocks of Dexcom— which sells continuous glucose monitoring systems— and Insulet— which sells insulin pumps— have similarly been punished as investors reason that the incidence of type-2 diabetes could go down in the future if obesity rates decline.

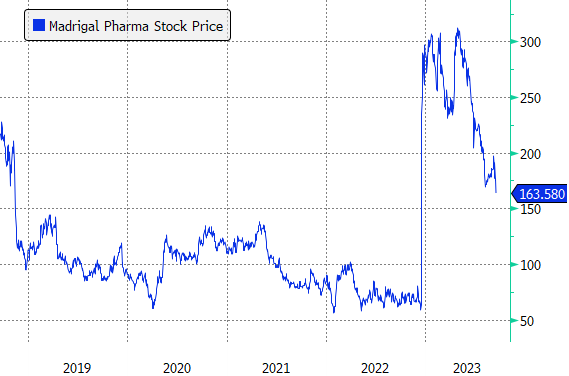

Even stocks of some pharma companies have been hit, like those working on treatments for fatty liver disease, a condition that is common for those with obesity.

Because obesity is such a widespread issue that causes so many health problems, a reduction in obesity rates has the potential to reverberate far and wide across the health care industry.

We could see fewer knee placements, fewer heart surgeries, fewer statins being prescribed—the list goes on and on.

Not to mention, there could be an impact outside of health care, as well. We’re starting to see people speculate about the effect that GLP-1 drugs could have on the food industry.

Executives at Walmart and Nestle were asked about this recently and they suggested that yes, people are probably going to eat less due to these drugs.

That said, neither Walmart nor Nestle were too concerned about these drugs having an impact on their businesses.

Nestle said that it might see fewer sales of sweets, but that it might also see an increase in sales for its healthier food brands like Lean Cuisine. At the same time, its coffee, water and pet care brands shouldn’t be affected.

Walmart said that it might see fewer sales of grocery items, but that it might also see an offsetting increase in apparel sales as people buy more clothes as they lose weight.

In other words, diversified businesses like Nestle and Walmart are probably going to be okay. But it’ll be interesting to see the impact on companies like McDonalds, Wendy’s, and Coca Cola, who are in the business of selling cheap calories.

It’ll also be interesting to see the more indirect consequences of GLP-1 drugs. One analyst thinks that they will benefit dating app companies like Match.com and Bumble because if people lose a lot of weight and feel better about themselves, they might be more inclined to use these apps.

So, this is all fascinating stuff to think about. Could these drugs really bring about an end to obesity? And if so, what impact will that have on businesses, the economy, health care, etc.?

Of course, as with any new promising innovation, it’s probably a good idea to temper our expectations. I’m certainly not claiming that these are miracle drugs or that people should rush out and use them.

That’s for each individual and their doctor to decide.

Over time, we’ll also get a better sense of whether there are downsides to these drugs. Historically, weight loss drugs have come with major side effects.

GLP-1 drugs don’t seem to have those same crippling side effects, but it’s still early (there is evidence that they can cause gastrointestinal issues for some people in the short-term and they might increase the risk of thyroid cancer in the long-term).

We’ll see what happens.

no, this will not end obesity. Headline was just to get clicks.

What would be the effect(s) of the use of these GLP-1 drugs be on world population?