The ESG War

This is going to be a major political issue over the next year and a half, but you’re not going to get the full story from politicians.

(You’ll find the text version of “The ESG War” below this embedded video)

Right wing politicians absolutely hate these three letters: E-S-G.

This is going to be a major political issue over the next year and a half, but you’re not going to get the full story from politicians.

So here it is.

Essentially what we have is a new front opening up in the culture wars and it’s in a very unexpected place: the stock market.

The battle surrounds a concept called ESG.

If you’ve never heard of ESG, it stands for environmental, social and governance, and it’s a movement where people base their investment decisions in part on non-financial factors.

Rather than just focusing on things like revenues and profits, investing through an ESG lens entails looking at a company’s impact on the environment; its impact on society based on how it treats workers and customers; and its governance practices, which includes things like how much a company pays its executives and how responsive the company is to shareholders’ concerns.

ESG investing has been all the rage over the past several years.

Fund managers have been rushing to offer ESG themed investment products and investors have been eating them up. As of 2022, there was $8.4 trillion invested in ESG-related strategies in the U.S. and tens of trillions of dollars invested in them globally, according to The Forum for Sustainable and Responsible Investment.

Investing through an ESG lens essentially means looking at how companies score based on ESG criteria and then buying more of the ones that score well and buying less of the ones that score poorly.

For several years now, ESG has been a growing theme within the investment industry as both fund managers and investors have embraced it.

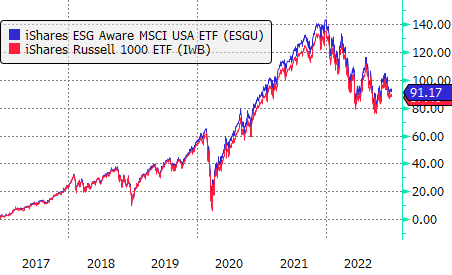

And lucky for them, they’ve been rewarded for doing so. ESG investment strategies have outperformed regular, “vanilla” investment strategies in recent years because they’ve been overweight stocks in strong-performing industries like technology and underweight stocks in weak-performing industries, like oil and gas.

But the honeymoon period seems to be coming to an end.

Angry that these investment strategies encourage companies to support left-leaning causes while hurting red-state industries like fossil fuels, Republicans have begun viciously attacking ESG.

Florida governor and potential 2024 presidential candidate Ron DeSantis has called ESG a form of “woke capitalism” that’s being used to impose an ideological agenda.

Former Vice President Mike Pence said that ESG was “[allowing] left-wing radicals to destroy American energy producers from within.”

DeSantis, Pence and other Republicans have pushed money managers who invest funds on behalf of red states—like state pension funds— to refrain from using ESG criteria when investing, and in some cases, they’ve introduced laws to prevent them from doing so.

A lot of Republican politicians don’t like ESG because they see it as something that encourages companies to support “left leaning” environmental and social causes.

But I think there’s a few points that need to be made about this.

One is that sure, companies are influenced to some extent by investors. If there’s a lot of money that’s invested with ESG criteria in mind, then it makes sense that companies will want to improve their ESG scores so that they can benefit from those investments.

But that raises the question of why there is so much money in ESG investment strategies to begin with. Is it just something that liberals came up with to push their agenda?

ESG Means Different Things To Different People

Well, one way to think about ESG is that it’s a form of activism. You invest in an ESG fund because you want to get companies to change their behavior and practices in order to align with your values. By investing in ESG funds, you can use your financial power to push companies to prioritize environmental and social issues.

This is how Republican politicians and even many Democratic politicians think about ESG.

But there’s another way to think about ESG investing—and that’s as a way to reduce the risk and potentially increase the returns of your investment portfolio.

If you think that climate change is a major risk, then maybe you want to avoid investing in companies that own coastal hotels and restaurants, ski resorts and things like that—not for political reasons but for financial reasons.

Or maybe you’re like most investors and you own many stocks across many industries and believe that climate change will drag the economy down, hurting all of them. If that’s the case, you want companies to collectively reduce their carbon emissions so that doesn’t happen.

And then on the social side, maybe you believe that companies that treat their employees well and have a positive impact on their communities are more likely to be successful in the long term.

Good For Business?

In fact, it’s for these reasons that some companies might be implementing ESG policies on their own. There’s been a lot of talk about companies becoming more “woke”—some of that pressure might be coming from investors, but some of it might be companies doing it on their own because they think it’s good for their businesses.

That’s the view of BlackRock, the largest investment management company in the world, which has become a punching bag of Republicans who don’t like ESG.

BlackRock has said that “climate risk is investment risk.” Because of that, they encourage companies to tell investors how much exposure they have to climate and other ESG-related factors.

BlackRock doesn’t tell companies what to do; they just want more transparency on these issues which could materially impact the companies that they invest in.

And the irony is that at the same time that Republicans are bashing BlackRock, Democrats are saying that the firm is not going far enough and should divest from fossil fuel companies altogether.

We’ve even seen some left-leaning states like Maine go as far as to order their state pension funds to get out of all of their fossil fuel investments—which is essentially the opposite of what red states are telling their pension funds.

A Blurring Line

The ESG battle isn’t going away anytime soon. Like I said, it’s been pulled into the broader culture wars and you’re going to continue to see pressure from politicians on money managers and the companies they invest in to either support ESG-related initiatives or go against them.

But outside of the sway politicians have on money managed on behalf of state governments, their influence is limited. Most of the money in ESG strategies is private money. The decision to adhere to ESG principals are being made by private companies.

That’s the free market.

Personally, I don’t invest in ESG funds or employ any type of ESG strategies, but I have no issues with those who do.

And the reality is, the line between what’s ESG and what’s not ESG is kind of blurring. Most publicly traded companies are increasingly doing things that align with ESG principals—things like cutting carbon emissions and prompting diversity in their workforce.

So whether you like it or not, if you invest in a standard broad market index fund or even if you just hold individual stocks, you’re probably exposed to companies that are becoming more ESG-focused.

From an investment product perspective, I do think ESG can be improved. Why lump the E, the S and the G together? Even Republican politicians probably agree that good corporate governance—things like fair executive compensation and more transparent financial reporting— leads to better stock market returns.

I’d love to see more funds that separate out these components and then investors can pick and choose for themselves which issues are most important to them. It’d also be great to get more transparency about how ESG scoring is calculated and which specific actions a company is taking to address these issues.