The Final Results Are In: Stocks & Bonds In 2022

And what to expect in 2023.

(You’ll find the text version of “The Final Results Are In: Stocks & Bonds In 2022” below this embedded video)

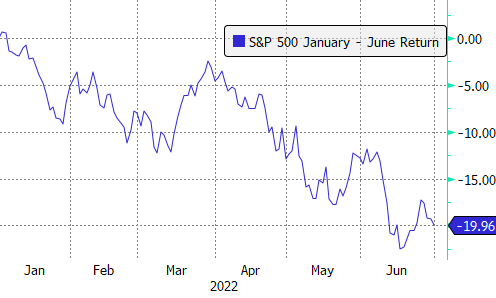

On June 30, I posted a video discussing how U.S. stocks had just notched their worst first-half return since 1962.

At the time, the S&P 500 was down 20% on the year and I noted that as bad as stocks had done in the first half of 2022, it didn’t necessarily indicate anything about what was going to happen in the second half of the year.

A negative return in first half of the year is followed by a negative return in the second half of the year 50% of the time. It’s a coin flip.

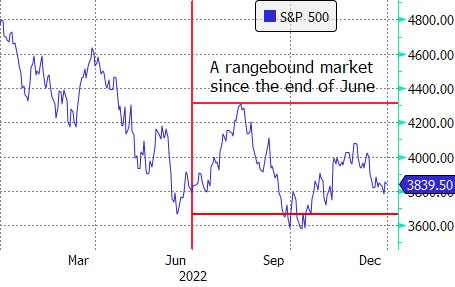

Now the final results are in and stocks actually went up during the second half. It’s not much, but from the end of June to the end of December, the S&P 500 delivered a positive return of 2.3%.

You could say that U.S. stocks have essentially been treading water for the past six months.

That doesn’t mean 2022 was a good year. On the contrary. The market still ended the year with an 18% loss, which is its first negative year since 2018 and its largest annual decline since 2008, when it fell by 37%.

But I think a lot of people will look at 2022’s 18% decline and be kind of relieved. Because for everything that 2022 threw at investors, it could have been a heck of a lot worse.

Inflation hit a 40-year high.

Interest rates went from zero up to 4.5%.

We saw Russia invade Ukraine, which send commodity prices spiraling upwards.

There was an energy crisis in Europe; Zero-Covid lockdowns in China; the list goes on and on.

2022 felt a lot worse than it ended up being, at least when it comes to the most popular measure of the broad U.S. stock market—the S&P 500.

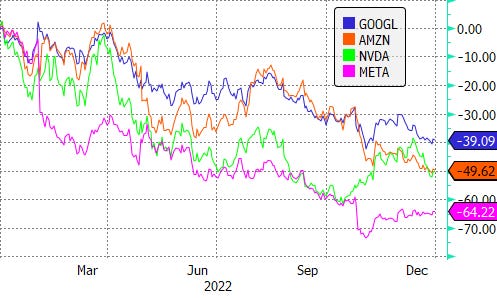

There were areas of the financial markets which were hit much harder than that index.

For instance, the tech-heavy Nasdaq 100 fell by 32% no thanks to massive declines in stocks like Alphabet, Amazon, Nvidia, Meta and others.

If you look at former high flyers like the ARK Innovation ETF (ARKK), cloud computing stocks, SPACs, meme stocks, and cryptocurrencies— they were down 50, 60, 70% or more. A total bloodbath.

While you wouldn’t know it by looking at the S&P 500, an enormous asset price bubble was bursting behind the scenes, bringing all of the frothy parts of the market back down to earth.

That bubble would have popped regardless of the macroeconomic situation, but I think it’s fair to say that the bursting was accelerated by the huge spike in interest rates we saw in 2022.

I talked about the fed funds rate going from zero to 4.5%. We also saw the 10-year Treasury yield go from 1.5% at the start of 2022 to 3.87% by the end of the year.

The spike in bond yields led to a 13% decline in the Bloomberg US Aggregate Bond Index, its worst decline on record.

Yes, believe it or not, this was the worst year for bonds in modern history. Prior to 2022, we hadn’t seen a decline larger than 2.9%.

Turning the Page

This is the story of markets in 2022 in a nutshell: we got a shallow bear market in the broad U.S. stock market; the Covid Bubble popped, leading to huge losses in the frothy parts of the market; and we saw the worst decline in history in the U.S. bond market.

Many investors will be happy to turn the page to 2023. But whether or not we see better returns in the new year is going to depend on the answers to some big open questions, like:

Will the Fed be successful in bringing down inflation?

Is the Fed close to the end of its rate hiking cycle or will it end up pushing rates well above 5%?

Can the U.S. economy avoid a recession and a large increase in the unemployment rate?

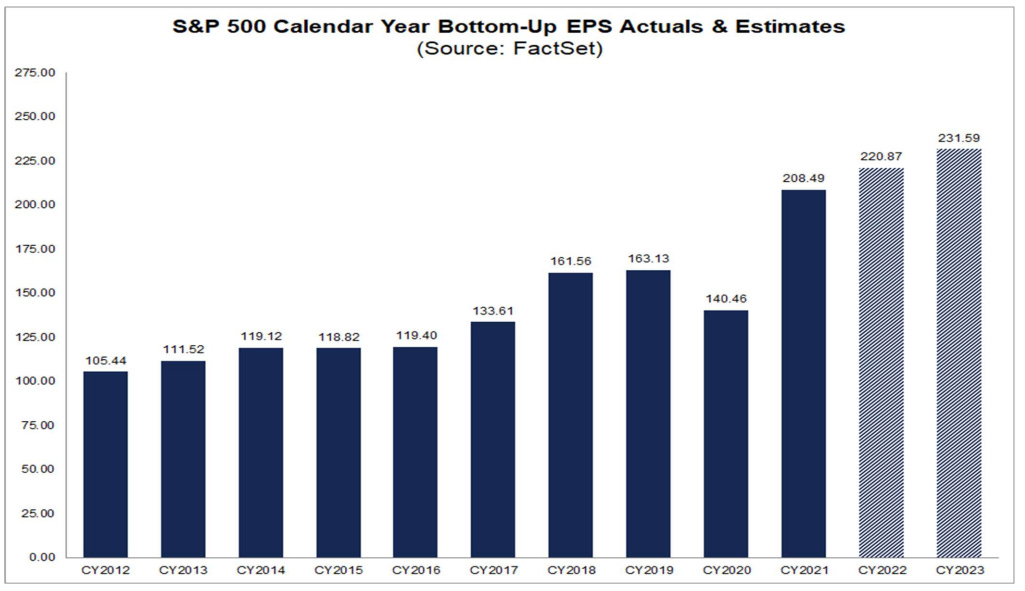

Can corporations continue to grow earnings in 2023?

And what happens with major economies outside of the U.S., like in Europe and China?

Fortunately, history is on the side of bulls. Since 1950, a negative year for the S&P 500 has been followed by a positive year 80% of the time, according to Carson Group.

That’s not a guarantee that stocks will rise in 2023—there have been periods where stocks fell in back-to-back years—but it’s a comforting statistic.

I’m keeping my fingers crossed that 2023 ends up being a better year than 2022.