The Frozen Housing Market

There’s a great chart going around Twitter showing why the U.S. housing market is frozen.

There’s a great chart going around Twitter showing why the U.S. housing market is frozen.

By frozen I mean that there’s not a whole lot of transactions happening and prices are stuck near all-time highs, even though homes are the most unaffordable they’ve been in decades.

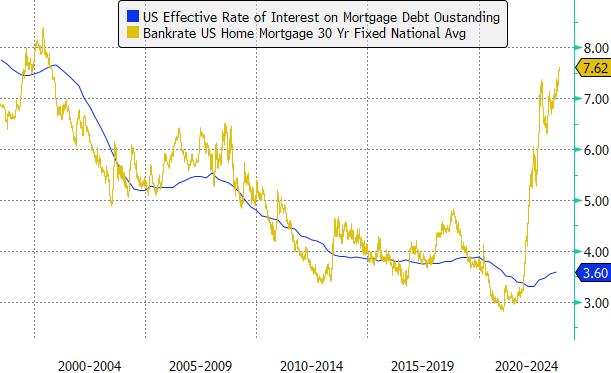

This is the chart.

It shows the average interest rate that borrowers are paying on their mortgage loans. That rate is only 3.6%, which is a heck of a lot lower than the 7.6% that someone who takes out a 30-year fixed rate mortgage today would have to pay.

If you have a mortgage with a 3.6% rate, you aren’t going to be in a rush to sell your house and buy another one—even if you want to. Because you’d be replacing that 3.6% loan with one that has a rate closer to 7.6%, or double what you’re currently paying.

This gap between what homeowners are paying and what they would be paying if they took out a new loan is discouraging them from putting their homes on the market.

That’s depressing the number of homes for sale.

Which in turn is keeping home prices high.

At the same time, those high home values, combined with high rates on new mortgage loans are pricing many potential home buyers out of the market.

So, it’s a double whammy: you have a dearth of supply and a dearth of demand, which is why we see so few housing transactions getting done.

It’s really weird because neither potential home buyers or potential home sellers are happy. No one is getting quite what they want and so the market is at a standstill.

Of course, eventually, this is going to correct itself. That gap between what existing borrowers are paying on their mortgages and what new borrowers have to pay will get narrower over time, which should make it less painful for people to sell their homes and buy new ones.

But that could take time and it’ll be influenced in large part by what the Fed does with interest rates (which in turn depends on what happens with inflation and economic growth).

In the meantime, a lot of the homes for sale will be new homes. Homebuilders don’t care about the mortgage rate gap I just talked about; they just want to sell houses. Today, new homes make up nearly 30% of all homes for sale, the highest level in at least two decades.

So, we’ll see what happens. Remember, the housing market is in this predicament because interest rates went from a really low level to a much higher level in such a short amount of time.

Anytime you have such a rapid adjustment—especially in something as important as interest rates—there’s going to be unexpected consequences from that.

“Unexpected” being the key word. Think about it: if someone told you a year and a half ago that mortgage rates would go from around 3% to almost 8% over the next 12 to 18 months, what would you have thought would happen to the housing market?

You’d probably have expected home prices to crash and for buyers to have a lot of bargaining power.

Instead, prices are still sky-high and it’s the worst time to be a home buyer since at least the 1980s.

Who could have predicted that?