The FTX Collapse

Here's what we know about the collapse of the $32 billion crypto exchange.

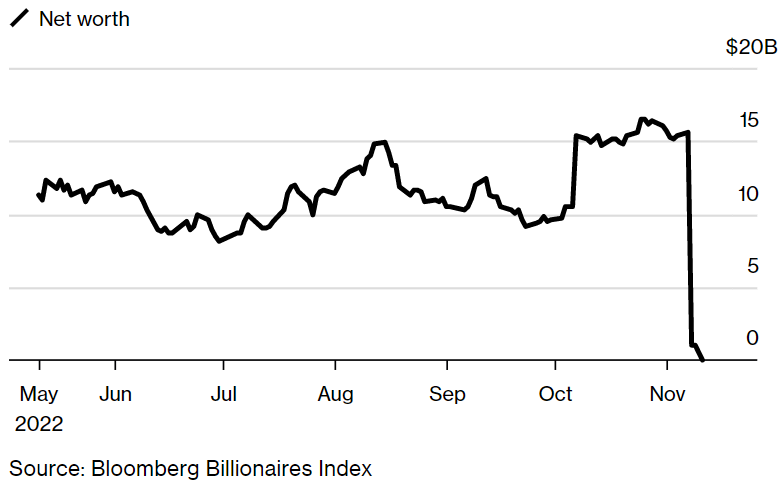

How did this guy lose his $16 billion fortune in a single day last week?

The man you’re looking at is Sam “SBF” Bankman-Fried, the 30-year old founder of FTX—one of the largest firms in the crypto industry….or at least it was until this week.

FTX was founded by SBF in 2019.

What the company does is simple: it matches buyers and sellers of crypto assets like bitcoin, ether, and NFTs—and it holds those assets on behalf of users. It’s like an exchange and a brokerage rolled into one.

Since it was founded over three years ago, FTX’s popularity has exploded. It’s slick marketing campaigns and easy-to-navigate user interface attracted over a million users.

People saw the FTX name splattered across ads during the Super Bowl, on the stadium for the Miami Heat basketball team and on Mercedes formula one race cars.

The company’s founder and CEO, SBF, also had a growing public image. He appeared before the U.S. Congress to testify on crypto regulation and was chummy with NFL superstar Tom Brady.

To the average person, FTX seemed like a cool, trustworthy place to get involved with crypto. By 2022, the company had become one of the three largest crypto exchanges in the world and as a result, Sam Bankman-Fried was one of the richest people in the world.

In January, FTX raised $400 million at a $32 billion valuation. The firm was backed by big-name investors, like the venture capital firms Softbank and Sequoia, as well as Binance—a competitor and the world’s largest crypto exchange.

Source: Crunchbase, Pitchbook, The Information

These investors saw FTX as great way to invest in the crypto boom, which had pushed prices for digital assets like bitcoin and ether to record highs in late 2021.

The great thing about a crypto exchange like FTX is: it can make a lot of money regardless of where prices for crypto assets go. Crypto exchanges primarily generate revenues through trading fees, so as long as users are trading, they’re making money.

It’s a relatively straight-forward business model, and also a lucrative one.

FTX’s revenues jumped more than 10-fold from $89 million in 2020 to $1 billion in 2021 amid a frenzy of trading in crypto markets.

Behind The Scenes

This is essentially how the world saw FTX up until this week—they saw it as a large, fast-growing crypto exchange headed by a talented founder.

People thought: sure, the crypto markets had plunged in 2022, but FTX was in prime position to navigate the headwinds and maybe even come out stronger on the other side of the bear market.

In fact, earlier this year, when a number of high-profile crypto firms were blowing up, FTX swooped in and bought them out at distressed prices.

So, on the surface, it looked like FTX was doing just fine.

But it turns out, behind the scenes, some shady things were going on.

You see, FTX wasn’t Sam Bankman-Fried’s only company. In 2017, he founded Alameda Research, a firm that profited from sophisticated trading strategies like arbitrage, market making and yield farming.

In contrast to FTX’s low-risk exchange business, Alameda made its money through risky trades and investments. It’s there that SBF made his name as a brilliant trader and crypto authority. He leveraged that reputation into launching FTX, which became the bigger, household name.

But SBF was still very much involved with Alameda, where he was a majority owner. And even though it was more under the radar, at its peak, Alameda was reportedly even more profitable than FTX

Now, most people knew that both of Sam’s companies had a connection. Alameda was a market maker on FTX— which means that it provided liquidity to other users so they could more easily buy and sell crypto assets on the exchange.

But the two companies’ relationship was much deeper than that. We now know that FTX secretly lent upwards of $10 billion to Alameda—money that came from FTX customer funds.

In exchange for the money, Alameda gave FTX something called an FTX Token (FTT) as collateral. FTT is a crypto token created by FTX that entitles its holders to discounts on FTX trading fees and other benefits.

The token has value to the extent that people like and use FTX to make trades, but the value of the token is highly subjective and tied to the reputation and strength of FTX as a company. You can think of it like the unit of value for a rewards program, similar to airline points or Starbucks stars.

It’s not entirely clear when or how Alameda got these FTT tokens, but it’s likely that it received them when they were first created in 2019.

The Collapse

So, what you essentially have is a situation where FTX creates a bunch of tokens out of thin air, gives them to Alameda. And then a couple years later, Alameda turns around and uses those same tokens as collateral for $10 billion of worth loans from FTX.

This was all going on in secret. Then earlier this month, Coindesk published details of a private financial document that included a look at Alameda’s balance sheet.

People saw that a huge percentage of the company’s assets were made up of this FTT token and that it also owed FTX a bunch of money.

This was extremely worrying.

A few days later, Changpeng Zhao, the CEO of the world’s number one crypto exchange Binance, tweeted that, because of what he learned in the Coindesk report, his firm would be selling all of the FTT tokens it received as part of a business transaction in 2021.

The price of FTT immediately tanked and the rumors began to swirl.

If FTX had lent billions of dollars to Alameda, and most of Alameda’s assets were made up of the FTT token, then there was no way that Alameda could pay FTX back now that the price of that token was plummeting.

From a price of around $25 last week, the token fell to less than $2.00 this week, decimating the value of Alameda’s assets. With Alameda unable to pay back FTX, FTX had no way to pay back all of its customers, who were now racing to withdraw their money from the exchange.

On Sunday, November 11th alone, FTX received $5 billion of customer withdrawal requests. Shortly thereafter, it stopped allowing customers to take money out of their accounts.

The company is now considered to be insolvent and it’s estimated to be $6-8 billion short of what it needs to pay its customers back.

FTX, along with Alameda Research, filed for bankruptcy on Friday, November 11, pushing Sam Bankman-Fried’s net worth from $16 billion to zero overnight.

Unanswered Questions

This is a quickly evolving story and there are a lot of open questions. Why did Sam Bankman-Fried and FTX lend their customers’ funds to Alameda and was what they did illegal?

The prevailing theory is that Alameda Research took heavy losses on its investments earlier this year as the crypto market tanked. FTX transferred customer funds to Alameda to help it survive.

But that shouldn’t have happened.

In FTX’s terms of service, it clearly states that assets in customer accounts won’t be loaned to anyone else.

And while FTX was collapsing, SBF tweeted that the company doesn’t invest customer assets and that it had enough money to pay back all of its customers. This was egregiously wrong.

There’s also the question of exactly how Alameda lost so much money and what it did with the money that FTX lent to it? Records show that the company invested at least some of it into risky crypto startups. A lot of those investments are likely worth a fraction of what they were valued at on Alameda’s balance sheet.

This isn’t a great sign for FTX users, many of whom had put a lot of their money onto the platform and are hoping to get some or all of it back.

To make matters worse, there’s evidence that FTX was hacked the night after it filed for bankruptcy, with hackers running off with as much as $662 million. That means there’s even less money to pay back customers of the exchange.

Another question is: what type of contagion might we see as a consequence of FTX’s downfall? The blowup in several major crypto protocols and companies earlier this year may have led to losses for Alameda. Now the blowup of Alameda and FTX may lead to further losses in other big entities that exposed to those companies.

This is all going to take a long time to play out and it doesn’t seem like sentiment in crypto markets will recover anytime soon.

This whole FTX saga is very reminiscent of what happened to Mt. Gox, which was the world’s largest crypto exchange several years ago. It filed for bankruptcy in 2014 and lost billions of dollars worth of its customer’s bitcoin.

So, FTX’s downfall isn’t necessarily something we haven’t seen before nor is it an indictment of crypto itself. True crypto believers urge people to manage their own crypto assets and not trust quote “centralized” platforms like FTX to store them (“not your keys, not your coins”).

But the fact of the matter is: the average person doesn’t want to deal with messy things like storing their own private keys and using a hardware wallet. If crypto is going to become mainstream, easy to use platforms like FTX are necessary. But they have to be held to a much higher standard than they have been.

Frauds and scams aren’t exclusive to crypto, but they are much too commonplace and give the industry a bad name, while hurting ordinary people.

Crypto will never reach its full potential unless this changes.