Trump vs the Bond Market

Treasury bonds just sent an important message this week.

Well, so much for “4D chess.”

A week ago, I wrote a post unpacking a whacky conspiracy theory that claimed President Trump was crashing the economy on purpose to bring down interest rates so he could refinance the national debt at lower yields.

It was a dumb theory. But I humored it because Trump amplified it on Truth Social and because it helped illustrate some key concepts about interest rates and the Treasury bond market.

Now, after this week’s market mayhem, even the conspiracy theorists have gone quiet. Let’s break down what happened.

Bond Yields Surge Despite Stock Market Panic

Let’s rewind to last weekend. After two brutal days in the stock market on Thursday and Friday, investors hoped President Trump might soften his tariff stance before markets reopened on Monday.

Surely, he’d recognize the damage his “reciprocal tariffs” were doing to business confidence and the broader economy—right?

Nope.

“We have massive Financial Deficits with China, the European Union, and many others. The only way this problem can be cured is with TARIFFS,” Trump posted on Truth Social on Sunday.

By that evening, panic was creeping in. CNBC’s Jim Cramer even floated the possibility of a 1987-style crash (In October of that year, the S&P 500 dropped more than 20% in a single day).

When markets opened on Monday, it wasn’t quite that catastrophic. But it was ugly. The S&P 500 fell nearly 5% at its low, adding to last week’s 5% and 6% drops.

Initially, the bond market behaved as expected: the 10-year Treasury yield fell to 3.87%, its lowest level since October, as investors fled to the safety of government bonds.

But then something flipped. Yields started climbing. Slowly at first, then suddenly. By day’s end, the 10-year had spiked to over 4.2%. On Tuesday it climbed to 4.25%. By Wednesday, it topped 4.5%.

The 30-year Treasury yield followed a similar trajectory, jumping from 4.32% on Monday to more than 5% by midweek, just shy of its highest level since 2007.

Investors were stunned. Why were bond yields rising as recession fears were mounting and stocks were tanking? This wasn’t how things were supposed to work.

Trump Blinks

The speed and scale of the bond market’s moves caught the White House off guard. Treasury Secretary Scott Bessent, a former hedge fund manager, was reportedly rattled and conveyed his concerns directly to the president.

This time, Trump listened.

Hours after Wednesday’s yield spike, he abruptly reversed course—announcing a delay on many of the tariff hikes he had introduced just days earlier (China, notably, was the exception. Levies on Chinese goods were raised even higher, pushing tariff rates on that country into the triple digits).

Trump’s announcement lit a fire under the stock market. The S&P 500 surged 9.5%, while the Nasdaq-100 soared 12%, both notching their biggest single-day gains since 2008. Bond yields dropped in tandem, with the 10-year yield falling from 4.5% to 4.25%.

But the relief didn’t last. By Friday, the yield on the 10-year briefly jumped to 4.59%, even higher than before Trump hit pause.

So What Happened, Why Did Yields Surge?

There’s no single answer; just a growing list of things going wrong at once.

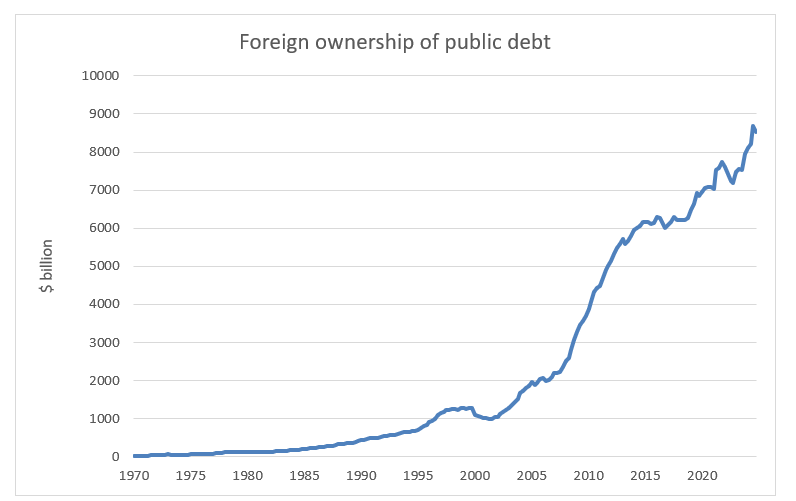

Start with foreign demand. Trump’s on-again, off-again trade war isn’t exactly boosting global confidence in U.S. assets. Foreign investors are a key pillar of demand for Treasuries; they currently hold around $8.5 trillion in U.S. government bonds, nearly 30% of all publicly held federal debt.

There’s been some speculation that China—or another large holder—might have sold Treasuries during this week’s chaos. There’s no hard evidence of that, but it almost doesn’t matter. Even the possibility of foreign buyers backing away is enough to spook the bond market.

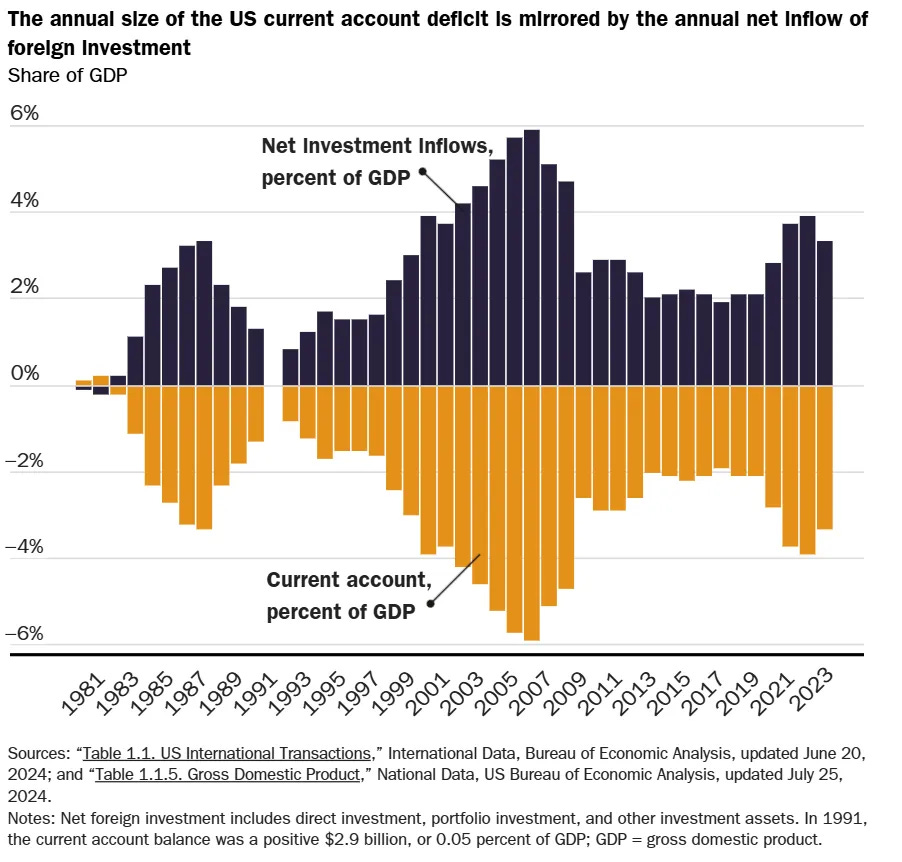

Then there’s Trump’s obsession with shrinking America’s trade deficit. If he somehow succeeds, that could actually reduce the flow of dollars back into U.S. financial markets.

Remember, the flip side of America’s large trade deficit is its massive financial account surplus. Last year, foreigners invested over $2 trillion into U.S. assets. Those capital inflows help finance the government and support bond prices.

If we import fewer goods, we send fewer dollars abroad. And if fewer dollars end up overseas, there’s less foreign money coming back in to buy Treasuries.

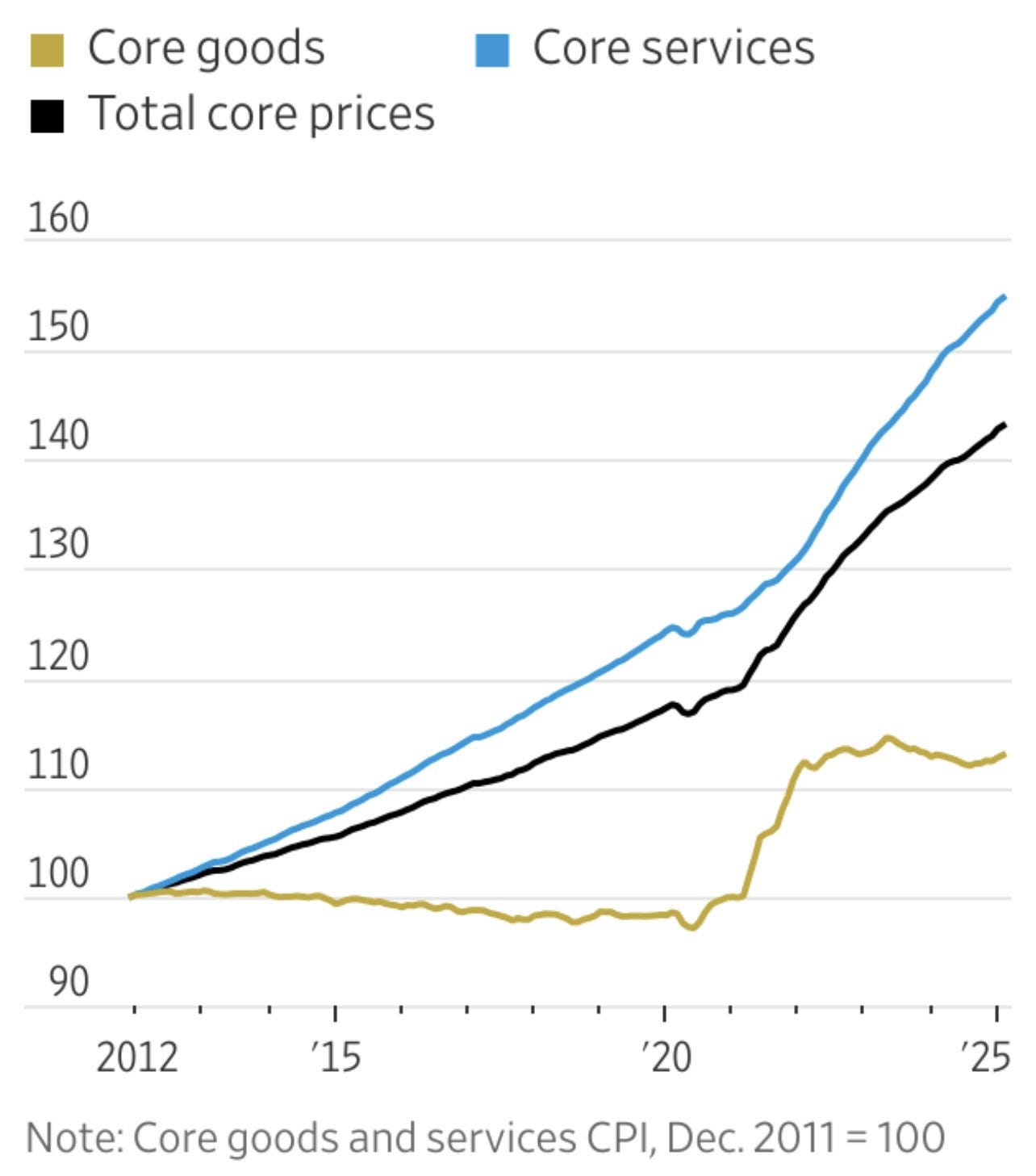

And then we have inflation.

Tariffs will put upward pressure on consumer prices in the coming months. If they stick around, they could lead to longer lasting inflationary pressures by raising the cost of imports or shifting production back to higher-cost U.S. factories.

For decades, cheap goods from abroad kept inflation in check. That era may be ending.

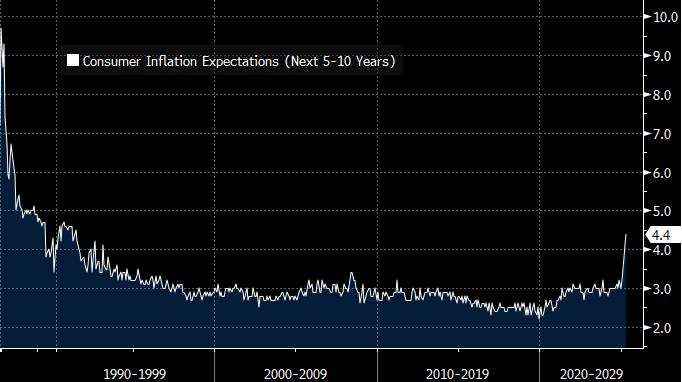

Consumers seem to think so. Inflation expectations, according to the University of Michigan’s latest survey, just hit their highest level since 1991.

That’s a problem. Once inflation expectations start to rise, that can lead to actual inflation, as workers demand higher wages and businesses raise prices in anticipation of more price gains.

All these inflation concerns are causing the Fed to hold its ground. Normally, markets would be pricing in Fed rate cuts with stocks plunging and recession risks rising. But with inflation still a big deal and no clarity on where Trump’s trade war is heading, the Fed doesn’t want to move too quickly.

And here’s another Fed angle to consider. The Supreme Court is reviewing a case that could allow presidents to fire the heads of independent agencies, including the Fed.

If the U.S. central bank’s independence is undermined, it could shake confidence in U.S. monetary policy, and that would almost certainly put more upward pressure on bond yields.

Add to all that some unwinding of leveraged hedge fund trades, investors de-risking by shifting from longer-term to shorter-term Treasuries, and a looming tidal wave of borrowing from Trump’s proposed tax cut extensions, and you’ve got a perfect storm pushing bond yields higher.

What the Markets Are Saying

So yeah, there are a lot of reasons why yields might be rising.

The good news is that this could all reverse quickly if Trump strikes a deal with China or walks back some of his more extreme tariffs. That’s the bet stock investors seemed to be making late in the week. On Friday, the S&P 500 closed more than 7% higher than its low point of the week.

The optimism was fueled by headlines suggesting Trump was open to negotiations with China (as well as hints from the Fed that it was ready to step in if markets got out of control).

Investors were also reassured by the fact that Trump delayed some of his most draconian tariffs. It showed at least some willingness to deal, not just escalate.

Inside the White House, two camps had been battling it out. One favored free trade and deal-making. The other wanted to wall off the U.S. economy and force a return to domestic manufacturing. This week, it looked like the dealmakers won.

That said, bond markets don’t seem to be entirely convinced that everything will just go back to the way they were.

Despite the 90-day pause on some tariffs, levies remain significantly higher than they were before Trump’s “reciprocal tariff” push last week. The 145% tariff on Chinese goods is still in effect. And even with some rollbacks, the average U.S. tariff rate is still at levels not seen in decades.

And what happens three months from now, when the pause ends? No one knows. There’s still a ton of trade policy uncertainty.

Looking Ahead

Hopefully, Trump backtracks further on tariffs and makes some sort of deal with China sooner rather than later.

But even if that happens, at least some damage has already been done. Investors have been shaken, and bond yields are reflecting that.

Unless Trump fully reverses course, we’re probably looking at higher yields going forward than we otherwise would have seen. Weaker foreign demand, stickier inflation, and mounting deficits all point in that direction.

That doesn’t mean Treasuries have lost their role as a safe haven. If the economy truly rolls over, the Fed will cut rates and yields on Treasuries will come down.

Still, it’s a shame that a reckless trade war is undermining faith in what’s supposed to be the world’s safest asset.

For decades, the United States has benefited from something economists call exorbitant privilege, the unique advantages that come from issuing the world’s reserve currency.

It allows the U.S. to borrow cheaply, run persistent trade deficits, and attract massive capital inflows, giving America more financial flexibility than any other country on Earth. That privilege depends on trust in the dollar, and by extension, in Treasuries.

But this week, that trust showed signs of strain.

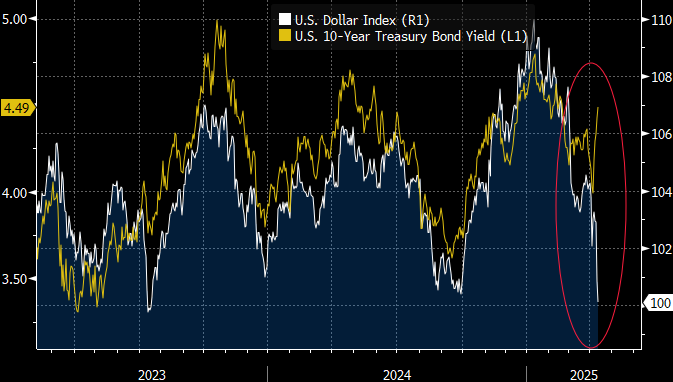

Yields on Treasury bonds rose at the same time that the U.S. dollar plunged. That’s not supposed to happen. Higher yields usually strengthen the dollar, not weaken it.

Some saw the move as a signal that foreign investors may be losing trust and pulling back from dollar-denominated assets.

And when trust in the dollar slips, attention naturally turns elsewhere.

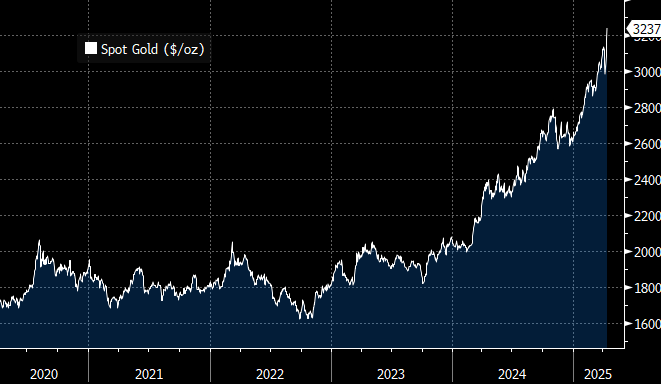

It’s probably no coincidence that gold surged to a new record high this week, just as the Treasury market was flashing red. The yellow metal is up 23% this year, following a 27% gain in 2024.

Gold was already gaining traction as a reserve asset. Central banks, from India to Poland to China, have been quietly accumulating it for years. In 2024 alone, they bought nearly 20% of the world’s total gold supply.

If the dollar’s status as the undisputed global reserve currency begins to wobble, gold becomes an obvious fallback.

It’s neutral. It’s stable. And it has a thousand-year track record.

Excellent work

Presidents have way too much power.