What Microsoft’s Selloff Says About the Future of Software

Microsoft’s earnings were fine, yet the stock suffered its worst drop since COVID.

Microsoft shares were hammered on Thursday, down about 10% for their worst drop since COVID.

That’s a huge move for a three trillion dollar company.

At first glance, it looked like an earnings reaction. But the numbers themselves weren’t that bad. Revenue and profits both came in ahead of expectations.

So why the selloff?

The answer has less to do with Microsoft’s quarter and more to do with a much bigger question investors are suddenly grappling with: what happens to business software as AI improves?

What Investors Didn’t Like

Let’s start with Microsoft’s latest earnings report. While the headline numbers were slightly above expectations, investors were turned off by two things.

First, Azure, the company’s cloud computing division, grew 39% instead of the 40% a lot of people were expecting.

Second, capital expenditures jumped 66% year over year to $37.5 billion.

Azure is where Microsoft captures a lot of the benefit from booming AI demand, since it provides the cloud infrastructure companies use to train and run AI models.

So some investors are looking at these two numbers and saying, “Microsoft is spending a lot more on AI investments, but growth in its main AI business is slowing. That’s not great.”

The company pushed back on that narrative. It said that some of the AI computing capacity it’s building is being used internally for products like Copilot, which now has millions of subscribers. As a result, less capacity was available for Azure customers, which held the division’s reported growth down.

That explanation makes sense. And a one-percentage-point difference in Azure’s growth rate, or a surge in capex at a time when nearly every major tech company is spending aggressively on AI, doesn’t really explain a double-digit drop in the stock.

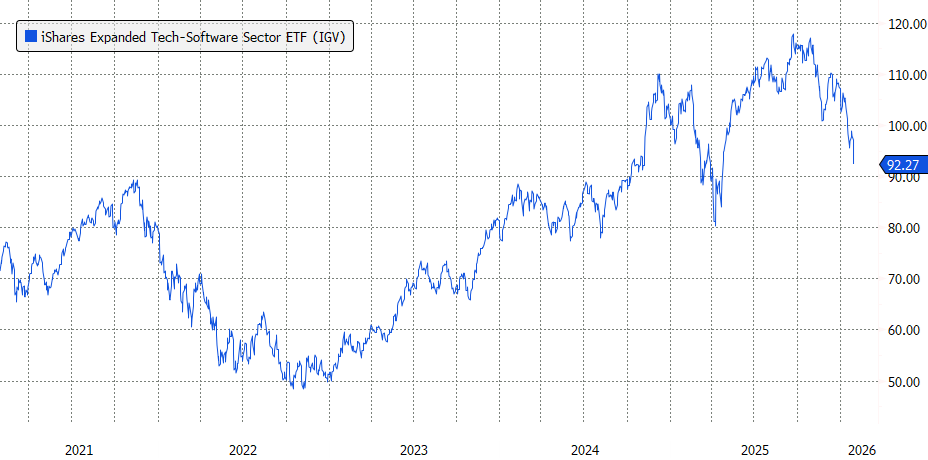

Instead, it’s pretty clear that something bigger is at play. After all, it wasn’t just Microsoft that fell on Wednesday. We’ve seen sizable drops across the industry, from Salesforce to ServiceNow to CrowdStrike. And these stocks have been under pressure for weeks.

The Bigger Question Hanging Over Software

There’s clearly been a shift in how investors are thinking about the entire software industry. And it centers on a deeper question about the role of business software in an AI world.

Right now, that debate is front and center, and the bearish narrative seems to be winning out, at least for now.

The most bearish view is that as AI improves, companies will increasingly be able to build and maintain their own internal tools rather than pay recurring fees to software vendors.

If AI can generate code and create, update, and maintain systems automatically, traditional software products might not be needed anymore. Everyone just builds their own software.

But not everyone agrees with that pessimistic take.

The Bullish Counterargument

Box CEO Aaron Levie argues that AI could actually strengthen enterprise software rather than undermine it.

Even before AI, companies had the ability to write software themselves. They chose not to because it wasn’t core to their business, and specialist software firms could do it better and more reliably.

Why would a company spend valuable resources building HR or payroll software when it can just pay a specialist to handle it?

Levie also argues that AI isn’t well suited to the kinds of tasks traditional software handles.

AI is inherently probabilistic. As we’ve all seen, you can ask ChatGPT the same thing twice and get different answers each time. That makes it great for things like analysis, summarization, and content generation, but not for systems that require precision and predictability.

From this perspective, AI doesn’t replace enterprise software. It works within it.

AI still needs trusted systems where data lives. In fact, Levie argues that as AI-driven activity increases, the importance of those systems could actually grow rather than shrink.

He also says AI could expand software markets by shifting pricing away from simple seat counts toward the value of work performed.

Today, a company might pay for legal software. But if that software starts replacing some of the work lawyers used to do, they might be willing to pay even more.

A More Uneven Future

There are also several middle-ground scenarios.

One is that traditional software doesn’t disappear, but becomes less valuable. Core systems that store data and keep records would still exist, but a growing share of value could shift to AI companies providing agents, automation, and intelligence on top of those platforms.

Another increasingly popular view is that software deeply embedded as systems of record will fare better than thinner, more replaceable software, which may be easier to displace.

Along similar lines, even if most companies don’t actually build their own software, AI could still meaningfully increase competition. If software becomes easier and cheaper to create, barriers to entry fall, opening the door for more AI-native tools, some of which may be better than what today’s incumbents offer.

Regardless of which view proves correct, change seems inevitable. And the impact of AI is unlikely to be evenly distributed.

It could be a boon for some software firms and a serious headwind for others. Some will successfully integrate AI and get stronger. Others, especially those with weaker products or slower adoption, may struggle.

Personally, I think Microsoft ends up on the winning side.

It’s diversified, it’s aggressively incorporating AI into its products, it has a deep partnership with OpenAI, and it benefits through Azure as other companies use AI.

At under 24 times forward earnings, the stock is trading at what’s historically been a pretty reasonable valuation. I added on the pullback.