Why Cocoa (and Chocolate) Prices Are Surging

If you see the price of chocolate going up at your local grocery store, this is why.

A standard-sized Hershey’s bar, like this one, weighs 43 grams and contains around 10% cocoa.

Which means that the nearly five-fold surge in cocoa prices over the past year and a half has increased the cost of the chocolate in this bar by around three-and-a-half cents.

For a larger 100-gram dark chocolate bar, like this one with 70% cocoa, the impact is greater: a 56 cent increase in the cost of the chocolate.

So, if you see the price of chocolate going up at your local grocery store, this is why.

Now, the good news is that the actual price increases you’ll see probably won’t be as dramatic as I just described—at least not right away.

Companies like Hershey’s and Lindt have hedged, or pre-purchased, a lot of their cocoa at lower prices, which means that they’re partially insulated from this year’s cocoa surge.

But still, what we’re seeing in the cocoa market is pretty insane. Just over the past two months, the price has doubled to $10,000 per ton.

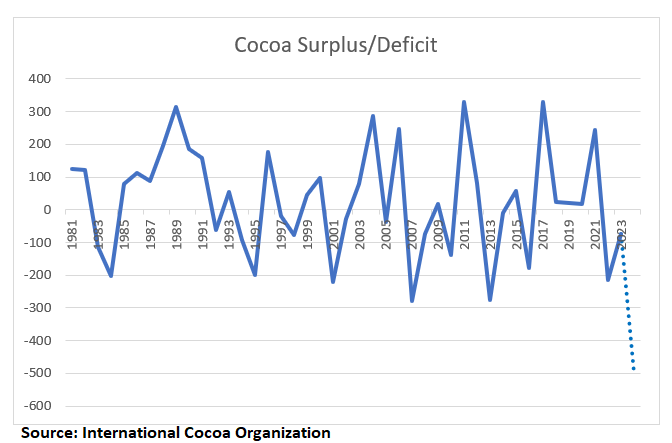

That has a lot of people wondering: how much of this has to do with speculation in the futures market and how much of it has to do with the actual supply and demand for cocoa.

What seems to be the case is that while speculation might be adding some fuel to this run up in prices, everyone agrees that cocoa supplies are tight right now.

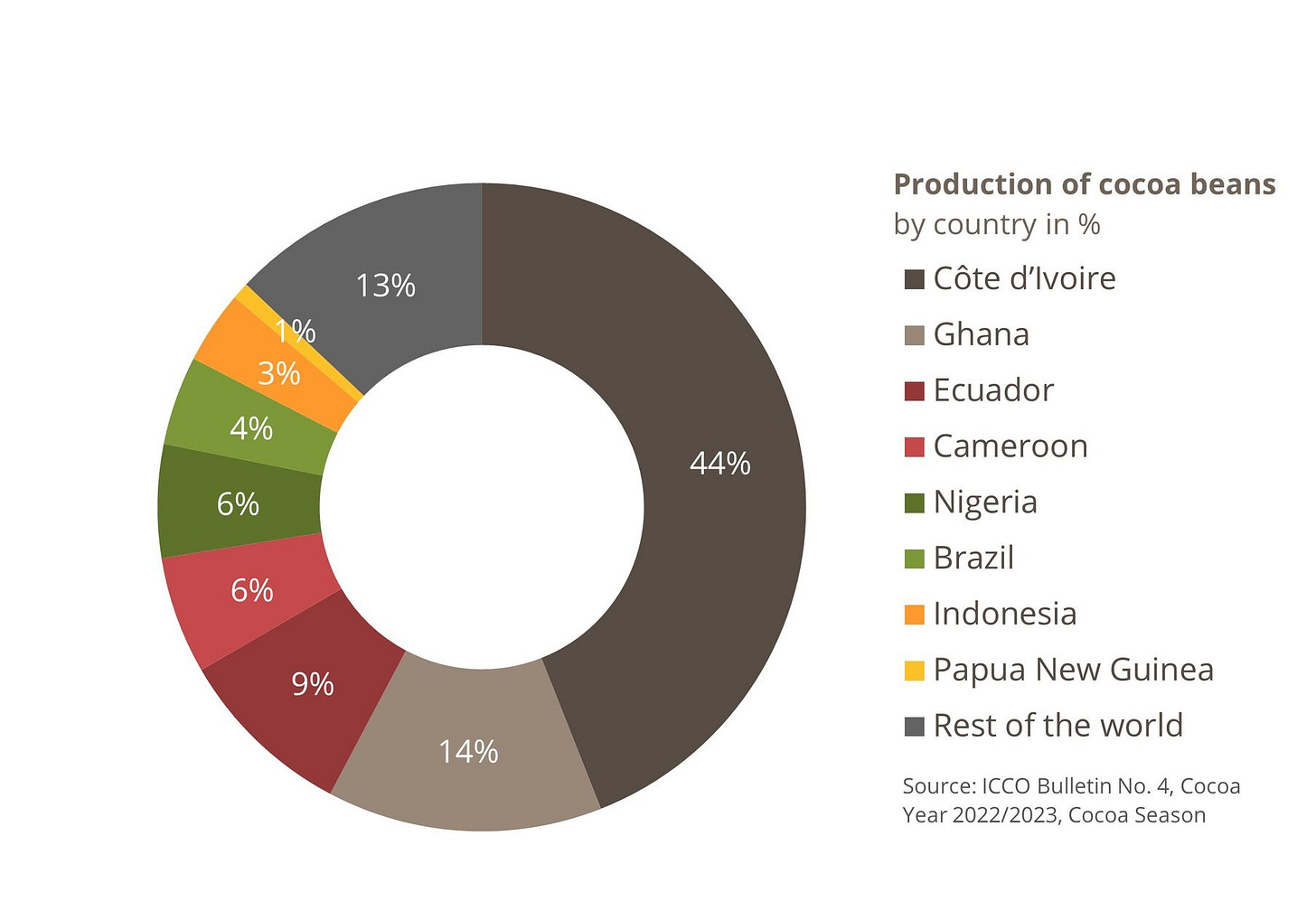

Bad weather and crop diseases have led to poor cocoa harvests in West Africa, a region of the world that accounts for three-quarters of global cocoa supply.

Some people believe that cocoa demand could outstrip cocoa supply by upwards of 500,000 tons this year—the largest deficit on record.

So, yeah, cocoa is in short supply right now and we’re going to be paying higher prices for chocolate products for a while.

But, like with all commodity markets, things will eventually rebalance. High prices will encourage more supply and they’ll discourage demand.

What’s unclear, though, is how long it’ll take for the market to become balanced again and where cocoa prices will eventually stabilize.

Factors that could keep cocoa prices higher than their historical levels going forward include the aging of West Africa’s cocoa tree population and European Union regulations that require cocoa imported into the continent to come from sources that don’t contribute to deforestation.

If you look at the futures market, today it’s currently pricing cocoa for delivery at the end of 2025 at just under $6,000 per ton, significantly lower than current prices, but still historically high.

The cocoa harvest that begins this coming October will play a big role in determining where prices go next.