Why I Bought Apple & Google Stock

AAPL and GOOGL have sharply underperformed the S&P 500 recently.

Investors are panicking about Google and Apple.

Over the past several weeks, shares of the two companies are down around 15%, a sharp underperformance compared to the broader U.S. stock market, which has been on a tear.

The reason these stocks are declining is because investors are starting to get worried that Google and Apple are missing out on the boom in artificial intelligence, and that more nimble competitors are going to eat their lunch.

This concern is probably most acute for Google. You’re hearing more and more people say that Google’s days as a search monopoly are coming to an end because A.I.-powered alternatives are going to be the predominant way in which we find information in the future, and we won’t need search engines anymore.

This narrative has been out there for a while. Ever since ChatGPT launched at the end of 2022, people have been speculating about what the next evolution of search is and what it means for Google.

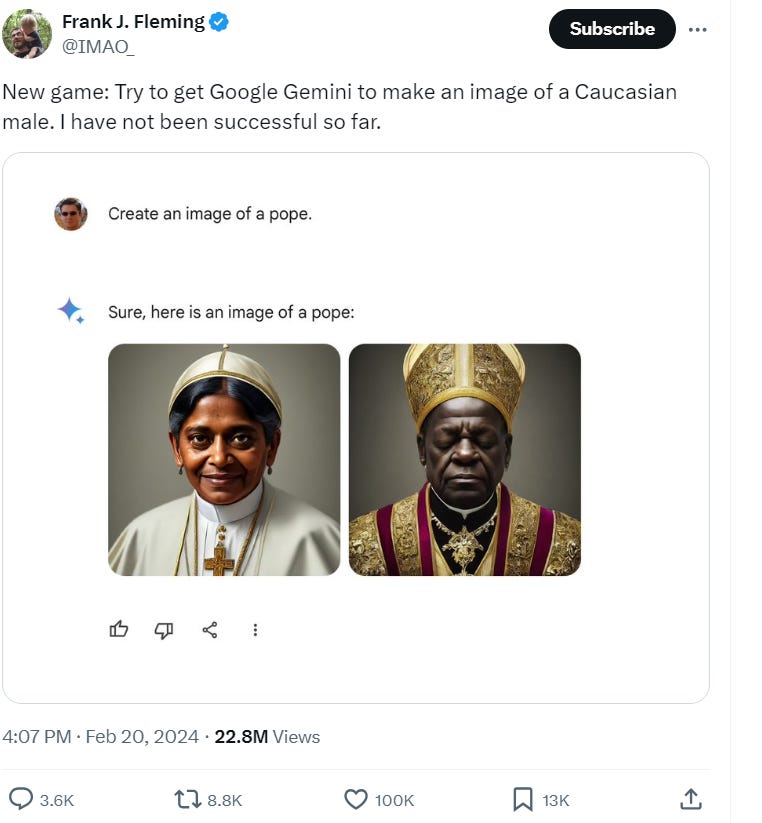

Of course, in response to ChatGPT, Google came out with its own chatbot called Bard, which later got renamed to Gemini. But the release of that product has been much rockier than the company had hoped.

In some cases, Google’s chatbot has given inaccurate information, while more recently, it got caught up in a scandal in which it generated controversial images.

All of this feeds the narrative that Google is dropping the ball when it comes to A.I. and that it’s going to be disrupted by OpenAI’s ChatGPT or some other competitor.

These are valid concerns. It does seem like we are on the cusp of a revolution when it comes to search, and that could have major implications for Google’s business model, which today is highly dependent on selling ads in search engine results.

While the company has other business lines, like YouTube and Google Cloud, they comprise a much smaller portion of the company’s revenues and profits compared to search.

If there is a big shift in the way we search and we start to use search engines less frequently, that creates a lot of uncertainty about Google’s business, which is why the stock has sold off.

Unfortunately, I can’t tell you what the next evolution of search will be exactly, or how quickly it’s going to be adopted, or whether or not Google will be a leader in whatever new paradigm emerges.

I don’t think anyone knows precisely what’s going to happen. What I will say though is that I don’t think this transition is going to happen overnight and that Google has a chance to maintain its leadership position in whatever comes next for search.

It has the people, the technology and the money. Those don’t guarantee success, but it gives them a shot.

That’s why I picked up the stock today at around $131/share, which I think is a pretty good price in the current market environment.

This is a stock that’s trading at around 18 times expected forward earnings, which is 12% less than the S&P 500 and 29% less than the Nasdaq-100.

Up until recently, Google had never traded at a discount to the S&P 500, so at today’s stock price, you’re getting the company at a pretty attractive relative price.

That said, for me this is a trade, not a long-term investment. I think the narrative for Google is going to flip back and forth between optimism and pessimism.

When it looks like Google will be able to adapt and be a leader in A.I.-based search, investors are probably going to bid the stock up, and when it looks like Google might be disrupted, they will probably sell it down.

I expect that there’s going to be a decent amount of volatility in the stock until it becomes clearer what Google’s position in the new search paradigm is going to be.

Long-term, I do think that Google is the most vulnerable of the big tech companies when it comes to A.I., so there is risk to the stock if the company can’t adapt.

But like I said, it has a relatively low valuation, so that gives you a decent buffer against things going wrong.

And of course, there is the possibility that things go right for Google and it remains a leader in search well into the future. If that’s the case, the stock will likely end up much higher from here over the long term.

Apple

So, that’s Google. The other tech stock I bought today is Apple. The narrative surrounding Apple is a little bit different than that for Google.

Yes, there is some worry that Apple is falling behind some of the other big tech companies when it comes to A.I., and that’s contributed to the stock’s underperformance.

But there’s also trepidation about Apple losing market share in the Chinese market due to geopolitical factors and competition from local smartphone makers.

Recent antitrust actions have also caused worry that Apple may be forced to open up its ecosystem, causing its devices to be more like Android devices, which in turn could make them less appealing to consumers and less profitable for the company.

Those are legitimate concerns—don’t get me wrong. But I think Apple will be able to navigate these headwinds successfully.

Long-term, I think the company is doing everything it needs to do to stay ahead of the competition.

The strong initial reception to the Vision Pro shows that they’re making solid progress on developing the next major computing platform after smartphones, which will help Apple remain a dominant, highly profitable company for years to come.

The stock is currently trading at around 25 times earnings, which isn’t dirt cheap by any means, but it’s a discount to the Nasdaq and the smallest premium compared to the S&P 500 in about three years.

Finally, I should add that none of this is investment advice. Most people are better off not trading individual stocks.

If you own an S&P 500 index fund or some other broad U.S. stock market fund, you already have pretty significant exposure to Apple and Google.

There’s no need to run out and buy more unless you’re an active investor and have a high tolerance for risk.