BOXX: The ETF That Helps You Earn Interest & Dodge Taxes

The innovative fund has caused quite the stir recently. Here’s how it works.

There’s a new money hack that a lot of people are starting to talk about that you should probably know about.

I’m sure you’ve heard about how you can earn over 5% on your money by putting it into high yield savings accounts, CDs, money market funds, and things like that.

Those are all great risk-free savings vehicles, but what kind of sucks is you have to pay taxes on the interest that you earn from them.

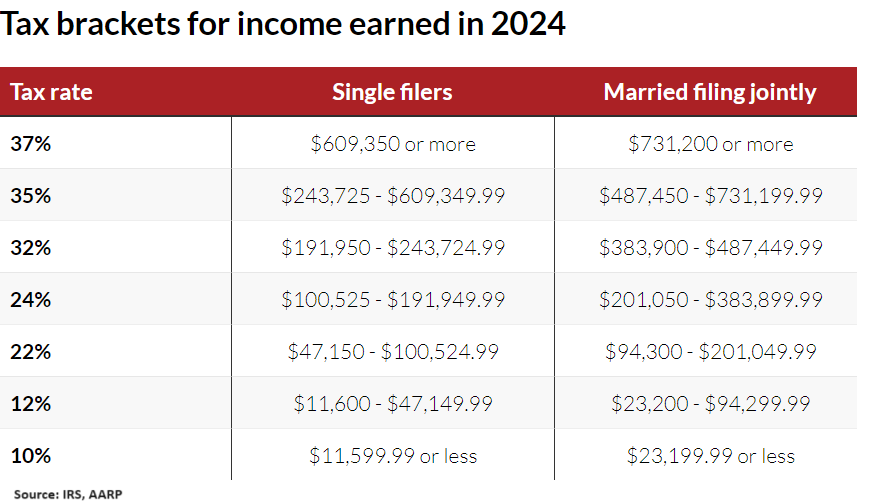

In the U.S., interest income is taxed as ordinary income, which can be a pretty high rate for some people.

But what if you could avoid paying taxes on that income for as long as you wanted to; and when you did pay, you paid a much lower tax rate?

That’s what a new fund called the Alpha Architect 1-3 Month Box ETF (BOXX) helps you do.

BOXX is a fund that uses something called “box spreads” to generate income that’s comparable to the interest paid by other risk-free savings vehicles.

Box spreads can be a little difficult to understand, but they’re essentially a way to either borrow or lend money through the options market.

In the case of BOXX, the ETF lends money in the options market in such a way that it guarantees a return known as the box rate.

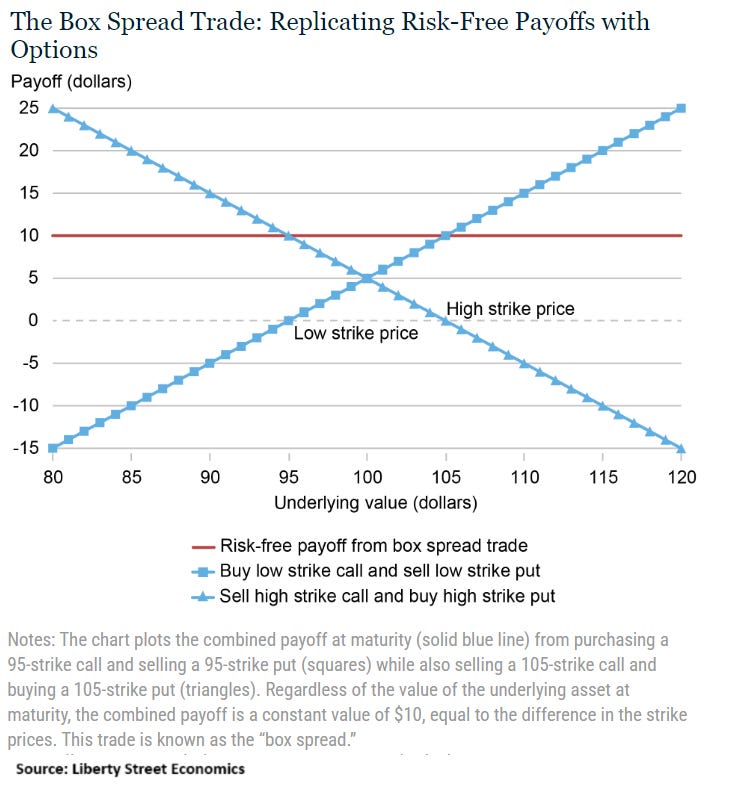

I won’t go too deep into the mechanics of box spreads in this piece (read this if you want to learn more), but a box spread can be thought of as a combination of a “synthetic long” position and a “synthetic short” position (skip to the section below the next chart if you don’t care how box spreads work).

These positions are created by simultaneously:

Buying calls and selling puts of the same strike price and expiration on a stock or index (this is known as a synthetic long position since it has the same payoff as buying the stock or index the traditional way)

Buying puts and selling calls for a higher strike price and the same expiration (this is known as a synthetic short position since it has the same payoff as shorting the stock or index the traditional way)

The combination of these options positions results in a box spread that pays the box rate.

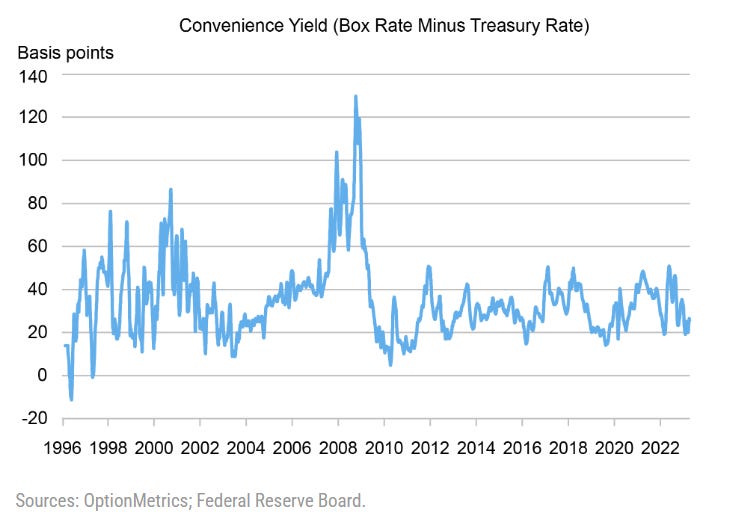

Historically, the box rate has averaged 35 basis points (0.35%) more than the interest rate paid on Treasury bills.

But it’s not just that slightly higher interest rate that makes BOXX so compelling.

The biggest benefit of the ETF is that the income that it earns from box spreads doesn’t have to be distributed to investors in the fund. Instead, the income stays with the fund and is reinvested into more box spreads.

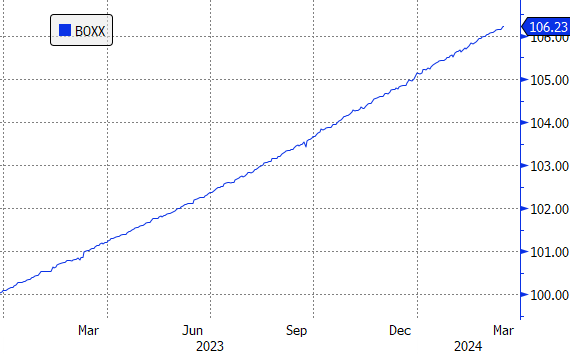

That steadily pushes the price of the ETF higher over time, as you can see from this chart.

That makes BOXX different from, say, a money market fund, which, by law, is required to pass on the interest it earns from holding Treasury bills and other assets to you, so that it can be taxed.

By keeping all of the income it earns inside of the ETF, BOXX makes it so you don’t have to pay taxes—at least until you cash out your gains by selling the fund.

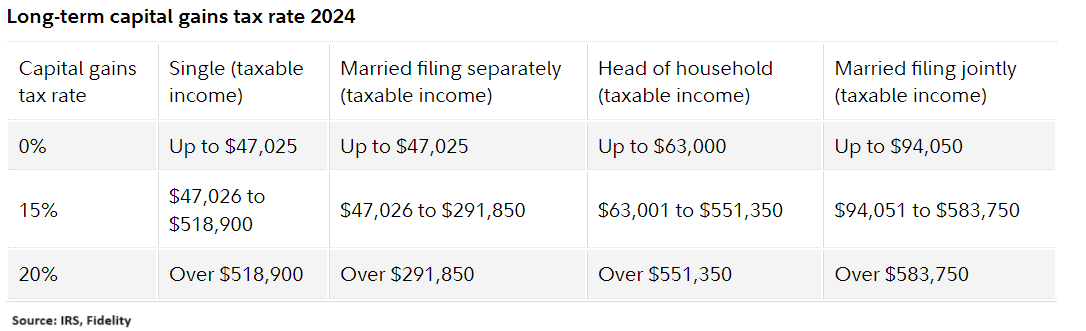

And when you do cash out, assuming you’ve held the fund for longer than a year, you get to pay long-term capital gains taxes rather than ordinary income taxes because your gains are the result of the ETF appreciating in value rather than interest income.

For most people, this is good because long-term capital gains tax rates are lower than ordinary income tax rates.

If you’re in the top tax bracket, for example, you’ll pay 20% on your gains instead of 37%.

Assuming interest rates of 5%, that translates into an 85 basis point (0.85%) higher after-tax rate.

So, those are the two big benefits of BOXX: you get to pay capital gains taxes instead of ordinary income taxes on your profits and you have the ability to defer the taxes on your profits for as long as you want.

What this ETF is essentially doing is tax arbitrage, turning what would normally be interest income into capital gains.

Does that mean you should go sell your money market funds and transfer all your cash into BOXX? Not necessarily.

There are several things you need to know before you potentially buy this ETF.

Credit Risk

Box spreads have credit risk. Treasury bills and FDIC insured savings accounts are explicitly guaranteed by the U.S. federal government, which is why they are widely considered to be risk free.

On the other hand, options trades like box spreads are backed by CBOE—an options exchange— and the Options Clearing Corporation (OCC)—a clearing house.

The OCC is considered a “systemically important financial market utility” by the U.S. government and there are numerous backstops in place to ensure that BOXX receives the money that it is owed.

So, you can consider box spreads (and by extension, BOXX) ultra-low risk, but they aren’t risk free in the traditional sense.

Holding Period

Another thing you have to keep in mind is that you will only benefit from the tax savings I’ve discussed if you hold BOXX for longer than a year. If you sell before that, you will pay short-term capital gains tax rates, which are equivalent to the rates for ordinary income.

Some people have argued that this negates the whole purpose of holding BOXX. They say the purpose of putting your cash into savings vehicles is so you can access your money on demand when you need it; and if you have a longer time horizon, you might as well invest in riskier investments with a higher expected return.

I think there is some truth to that argument. If you need access to your money within a year, BOXX isn’t going to benefit you compared to other savings vehicles (but it won’t necessarily perform worse than those vehicles either).

That said, there are people who are happy to put their money in risk-free (or close to risk free) investments for longer periods of time. They don’t necessarily want to invest in stocks or even longer-term bonds that can move up and down in price significantly.

And with BOXX, their returns can be compounded more efficiently since they don’t need to take money out to pay taxes every year.

High Tax States

It’s also worth mentioning that in some cases, BOXX won’t lower your tax bill substantially compared to alternatives like money market funds, even if you hold the ETF for longer than a year and pay capital gains taxes on your profits.

For high earners in states like California (where the top marginal tax rate is 14.3%) money market funds that hold Treasury bills will offer after-tax returns that are comparable to BOXX because interest income from T-bills is exempt from state taxes, while all capital gains are taxed like ordinary income at the state level.

Management Fee

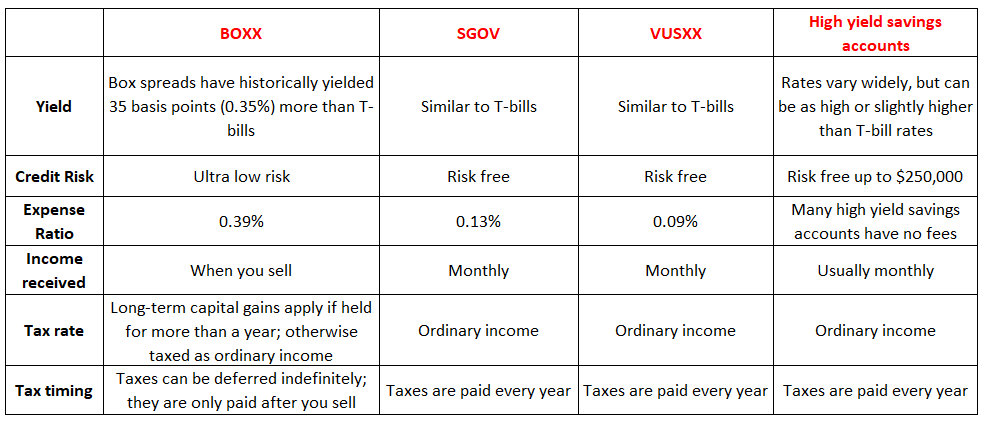

BOXX also has a higher annual management fee than alternatives. It charges 0.39% per year versus 0.13% for the iShares 0-3 Month Treasury Bond ETF (SGOV) and 0.09% for the Vanguard Treasury Money Market Fund (VUSXX).

BOXX’s higher fee is offset by the higher rates that box spreads generate compared to T-bills, but it’s possible that the cost of operating BOXX could grow as the fund gets larger.

This type of strategy has never been implemented in a fund structure, so it’s not clear whether it can scale seamlessly.

BOXX launched around 15 months ago and currently manages $1.7 billion—a number that will likely increase significantly as more people learn about it, potentially making the fund more costly to operate.

Longer Term

While BOXX offers compelling tax savings today, it’s uncertain whether the ETF can continue to offer tax savings to investors over the long term.

Steve Rosenthal, a senior fellow in the Urban-Brookings Tax Policy Center, says that BOXX is exploiting a loophole in which income from box spreads is taxed differently than income from other types of interest.

In his view, that violates the spirit of the tax code’s anti-conversion statute and it’s only a matter of time before regulators close the loophole.

Bottom Line

BOXX is an extremely innovative product that offers investors something truly unique.

A strategy of buying box spreads to generate income is possible to implement on your own, but it’s certainly not easy to do. More importantly, a self-directed box spread strategy would incur taxes every time you closed out one box spread position to roll over into a new one.

Only through the magic of the ETF structure— which allows trading gains to be shielded from taxes until an investor sells (another tax loophole)— is a tax-reducing strategy like the one BOXX offers possible.

If you’re someone who is looking for a place to park your cash and earn close to the risk-free interest rate, then BOXX is a viable option.

Whether it’s better than other options, such as money market funds like VUSXX, ultra-short-term bond ETFs like SGOV, or high yield savings accounts depends on what you’re looking for and your personal circumstances.

I’ve laid out some of the pros and cons of each option below:

Personally, I don’t own BOXX today. I think it’s a super cool ETF, but I’m extremely risk-averse with the money I leave in cash, so I prefer more established funds (like VUSXX and SGOV), even if they end up costing me a little bit more in taxes.

If BOXX sticks around for a while and proves that it can continue to operate effectively at a much larger scale, then I might start to feel more comfortable with it.

That’s not to dissuade you from buying it. If generating close to risk-free yields while minimizing or deferring taxes is a priority for you, then BOXX is worth considering.