The Junk Food Armageddon

Demand for junk foods could plunge due to GLP-1 drugs.

We could be on the cusp of a junk food Armageddon.

Recently, we’ve seen the stocks of some of the largest food and beverage companies in the world plunge due to concerns about how GLP-1 drugs could impact their businesses.

A month ago, I wrote about GLP-1 drugs and the massive impact they could have on the economy and corporations. But since then, we’ve gotten some new data that sheds more light on the potential economic effects of these drugs.

I’m going to talk about that in a second, but first, here’s a quick recap of GLP-1 drugs for those of you who aren’t familiar with them.

Miraculous Weight Loss

GLP-1 drugs are a new class of medicines that were originally designed to treat diabetes. They mimic GLP-1 (glucagon-like peptide-1), which is a hormone that regulates blood sugar.

These drugs have been used to treat diabetes for almost two decades. But as they’ve gotten more powerful and long lasting, people started to notice something miraculous.

In addition to lowering blood sugar levels, GLP-1 drugs cause people to lose weight. And not just a little bit of weight— a lot of weight.

Taking GLP-1 drugs like Ozempic, Wegovy, and Mounjaro can lead to weight loss of 15%, 20%, or even more.

For the millions of people who struggle with obesity, this is a complete game changer. The potential to lose so much weight by taking a single medication is huge.

So, naturally, as more and more people have learned about the weight losing effects of these drugs, demand has exploded. It’s gotten to the point where the pharmaceutical companies that make these drugs— Novo Nordisk and Eli Lilly— are having trouble keeping up with demand.

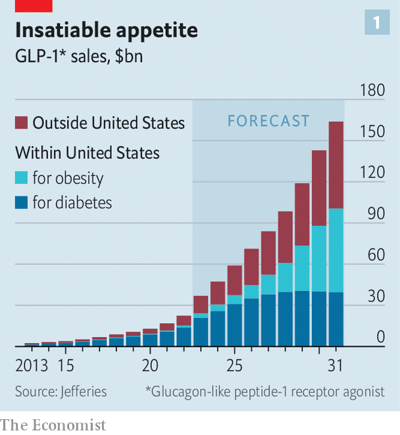

Wall Street analysts expect that the number of patients on these medications could soar into the millions, while sales of the drugs could climb to $100 billion or more by the end of the decade.

But the economic impact of these drugs isn’t limited to just sales of the drugs themselves. If things play out as most people expect, there’s going to be repercussions across the economy.

One area in particular that has been getting a lot of scrutiny is the food industry.

Calorie Reduction

GLP-1 drugs cause people to lose weight by making them feel fuller and less hungry. So, as the demand for GLP-1 drugs really started to take off over the past year, some people began speculating that we would eventually see a noticeable drop in food consumption.

They were right.

We’re now getting some real data on the impact that GLP-1 drugs have on the demand for food, and it’s pretty astonishing.

Morgan Stanley recently surveyed 300 people who are taking these drugs, and according to their survey, people on these medicines reduce their calorie intake by a whopping 20% to 30%.

Today, with only around a couple million people using GLP-1 drugs, that’s not something that’s all that consequential for an industry as large as the food industry.

But over the next several years, as more and more people start to use these drugs, the impact could get much bigger.

By 2035, Morgan Stanley estimates that 24 million Americans, or 7% of the population, could be using anti-obesity drugs. If that 7% of the population reduces their calorie intake by 20% to 30%, we could see a significant decrease in calorie consumption for the nation as a whole.

It’s hard to say how much the decrease would be. If that 7% of Americans ate an average amount of calories, the decrease would be something like one and a half to two percent (1.4% to 2.1%).

But more likely, that 7% consumes a significantly larger number of calories than the average. So, if they cut back, it will probably result in a more substantial national-level decrease— maybe around 3% or 4%.

Now, that might not seem like a lot, but it’s significant when you consider that in recent years, the total amount calories consumed in the U.S. has grown slowly because of healthier eating habits and sluggish population growth.

In that context, a 3% or 4% decline in food consumption is a big shift.

But it’s not just about the overall change in calorie consumption. Some parts of the food industry are going to get hit much harder than others.

That’s because the decline in calorie intake among users of GLP-1 drugs isn’t evenly distributed. Morgan Stanley’s survey shows that users of the drugs cut back on consumption of unhealthy foods dramatically, while increasing their consumption of healthy foods.

For instance, over two-thirds of survey respondents reported consuming fewer salty snacks, baked products and confections.

Over three-quarters of them visited fast food restaurants less frequently.

And over a fifth of respondents gave up alcohol and drinking sugary beverages completely.

On the other hand, consumption of fruits and vegetables; poultry and fish; as well as dairy products stayed the same or even increased.

Research from JPMorgan and Barclays, which looked at actual purchases by GLP-1 drug users by analyzing their purchase receipts, showed similar results—people on these drugs buy a lot less food, and especially junk food.

This is some pretty eye-opening data, and it could spell bad news for companies that sell junk foods—Hershey, McDonald’s, Coca Cola, etc.

What’s especially concerning for these companies is the fact that a lot of the demand for their products comes from a relatively small number of customers, many of whom could be future users of GLP-1 drugs.

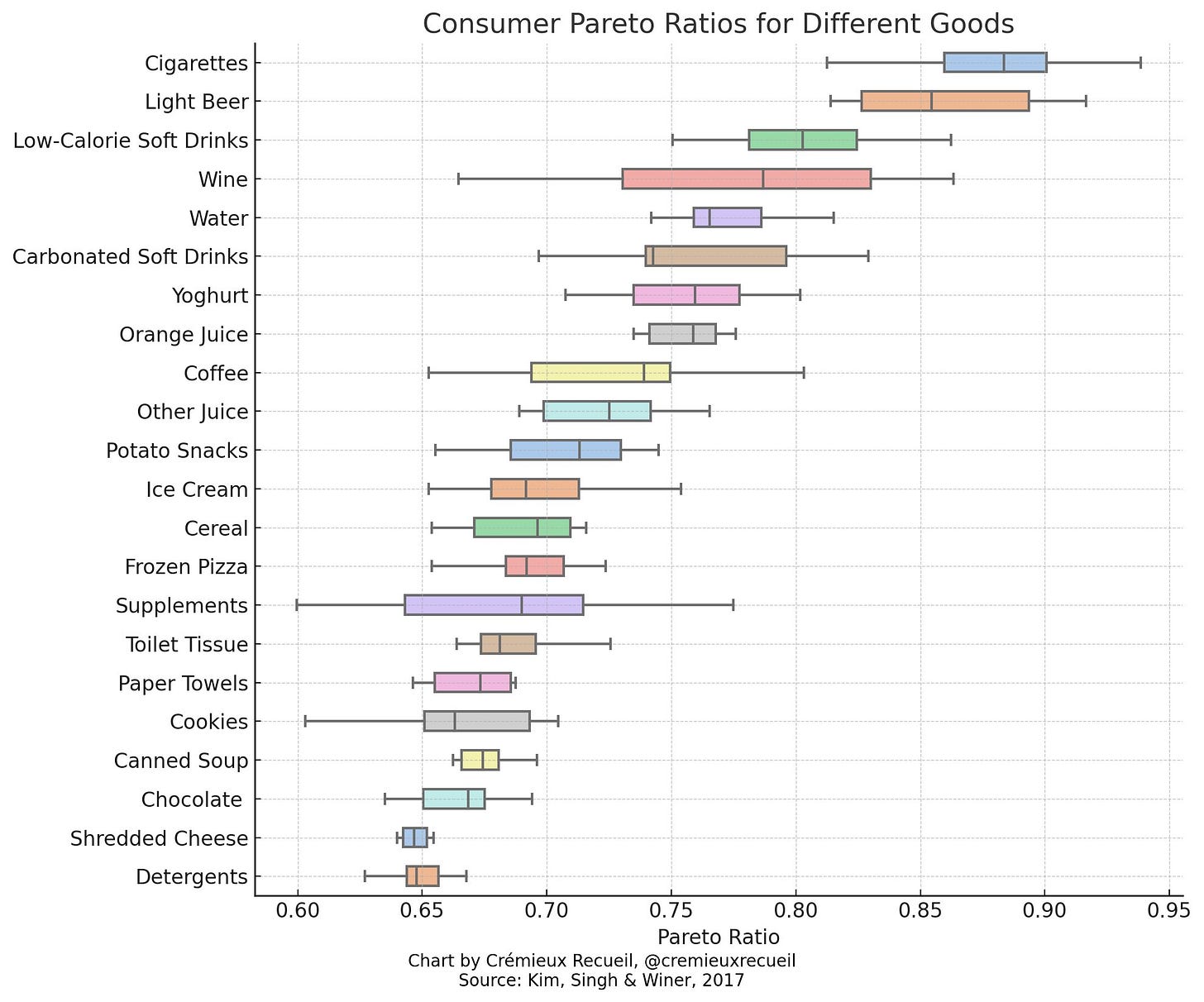

For instance, just 20% of customers at fast food restaurants like Chick-Fil-A, Carl’s Jr and Jack In The Box account for well over half of total spending at those chains.

There’s a similar pattern for other food and beverage categories. The top 20% of consumers account for 70% of ice cream consumption, 75% of coffee consumption, 77% of soda consumption, and 90% of alcohol consumption.

Based on these numbers, you can see how this could be a big problem for the companies that sell those products.

If tens of millions of people start using GLP-1 drugs to lose weight, and many of those GLP-1 users are top consumers of junk food and beverage products, then it’s possible that there could be some pretty nasty declines in the sales of those products.

Uncertainty

Now, the scenario I just described is one way in which things could play out. And the stocks of some of the largest food companies in the world—Nestle, Pepsi, General Mills, McDonald’s, and others—plummeted in recent weeks based on the fear that this is the way that things are going to evolve.

But none of this is a foregone conclusion. There’s a lot of uncertainty about what’s going to happen and events might not unfold in the way I’ve laid out in this post.

The biggest area of uncertainty surrounds what the uptake of GLP-1 drugs is going to be. While Morgan Stanley is forecasting 24 million Americans could be using anti-obesity drugs by 2035, Barclays has a less aggressive estimate of 8 million by 2033.

The high cost of these drugs—which in some cases is over $1,000 per month—could slow their growth. Side effects like nausea and the increased risk of thyroid cancer, could also discourage some people from using GLP-1s.

Then there’s also the possibility that people who are on GLP-1 drugs could stop using them once they reach their target weight. And once that happens, studies have shown that people tend to resume their old eating habits.

So, it could be the case that GLP-1 drugs won’t be as widely-used as many are forecasting.

Personally, I don’t think that’s likely based on what we know today. The potential market for anti-obesity drugs is just so big: over 100 million people in the U.S. and 1 billion people worldwide are obese. A lot of those people are probably going to give these drugs a shot.

But even if that’s the case and GLP-1 drugs take off as expected, we don’t know for sure how the usage of these drugs will affect food consumption.

I’ve talked about some of the early data we have on the consumption trends of GLP-1 users, but that data is based on surveying or measuring the purchases of a small sample of people over a short period of time.

We don’t know whether those trends would apply to a larger population of GLP-1 users over the long term.

Maybe the big declines in junk food consumption by GLP-1 users that we’re seeing so far are a reflection of people being really careful about their diets when they first start taking these drugs, and as time goes on, they loosen up a bit and start to eat more junk food.

Heck, some people even think GLP-1 drugs are going to increase the demand for unhealthy foods.

One Barclays analyst argues that people will cycle on and off of GLP-1 drugs, and when they’re off of the drugs, they’re going to eat a lot more junk food than they normally would because they know that they can lose any weight they gain by using the drugs again.

It’s an interesting theory. I don’t know if I buy into it, but it just goes to show that the debate about what impact GLP-1 drugs will have on food demand is far from settled.

The Bottom Line

For me, the bottom line is this. Based on what we know today, I think it’s safe to say that GLP-1 adoption is going to grow substantially over the coming years. That, in turn, is going to lead to fewer calories being consumed in the U.S., as well as other developed countries that have a high prevalence of obesity.

Demand for some foods— including healthy foods, yogurt and the like— will probably go up, while demand for other foods—especially junk foods—will go down.

Does that mean all companies that sell unhealthy foods are toast? Not necessarily. A lot of companies are already talking about premiumization, or getting consumers to spend more money on higher quality products.

If companies can successfully sell premium products for more money, then they might be able to maintain or even increase their profits despite consumers eating fewer calories.

But not all companies will be able to do this. It’s probably easier for a company like Hershey to sell more expensive, premium chocolates than it is for Jack in the Box to sell more expensive, premium burgers.

So, there’s going to be a wide spectrum of winners and losers in the food industry from the growth of GLP-1 drugs: some companies will be very negatively impacted, others might see little impact, while others could even benefit.

From an investment perspective, I’m going to be keeping a close eye on the stocks of the major food companies. There could be buying opportunities in some names that get whacked too hard on fears about GLP-1 drugs.

On the other hand, stocks of companies that can’t adapt to the new reality could go down further from here.

We’ll see what happens.