TikTok’s Money Machine: On the Brink of Collapse

Few people truly grasp just how lucrative TikTok has become—or the staggering amount of money its U.S. operations generate for the company.

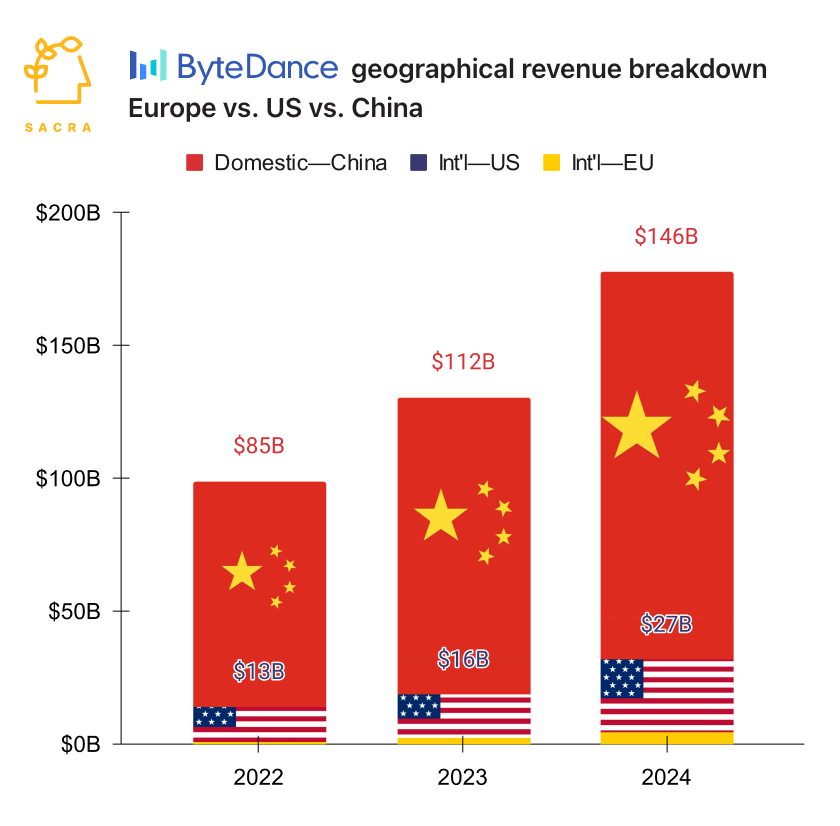

According to recently released data from Sacra, TikTok’s U.S. operations generated a massive $27 billion in revenue in 2024. That’s double what it made just two years ago.

For context, this $27 billion represents nearly 80% of the revenue ByteDance—TikTok’s parent company—generated outside of China last year.

To make this even more striking, TikTok’s U.S. revenue isn’t far behind the $36 billion that YouTube brought in globally for Alphabet in 20241. In fact, if TikTok were to continue operating unimpeded, it has a great shot at surpassing YouTube in revenue this year.

But that’s a big if.

TikTok is hurtling towards a ban in the U.S., and even if it somehow avoids that fate, the app’s American operations may be sold off—potentially without its prized recommendation algorithm.

Losing the algorithm, which powers TikTok’s addictive content discovery, would fundamentally alter how the app functions.

For ByteDance, the stakes couldn’t be higher. The potential loss of TikTok in the U.S. would be a devastating blow to the company. After all, we’re talking about a business that could have generated $100 billion or more in annual revenue in the not-too-distant future.

If TikTok’s U.S. operations are sold, maybe it still hits those numbers, but ByteDance wouldn’t benefit from any of that growth. And if the sale happens under duress and without the algorithm, ByteDance would be forced to accept a fraction of TikTok’s true value.

On the flip side, any buyer of TikTok’s U.S. operations could land an incredible bargain—especially if the rumored $50 billion price tag is accurate. At that price, TikTok’s U.S. business would sell for less than 2x its 2024 revenue.

That sounds like a steal, but there’s a catch. Any buyer would need to replicate TikTok’s magic—its algorithm—for the app to maintain its dominance. If they can pull that off (or even come close), TikTok’s U.S. business could eventually be worth $1 trillion.

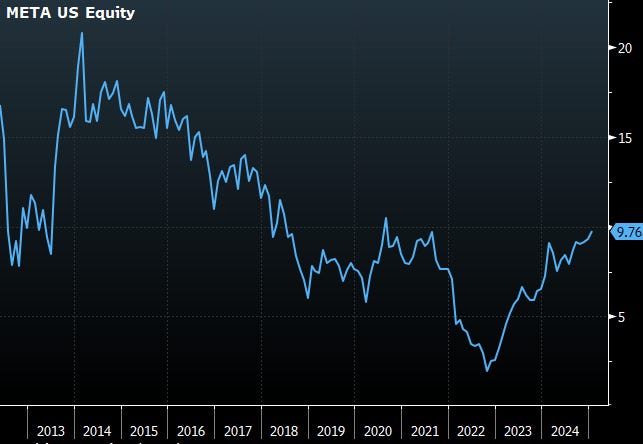

For comparison, take a look at Meta, the world’s most valuable social media company. Meta trades at more than 9x its 2024 revenue, far outpacing ByteDance, which trades at a mere 1.5x revenue2. Much of that valuation gap stems from the “China discount.”

Chinese companies, no matter how successful, tend to trade at much lower valuations than their U.S. counterparts. Geopolitical tensions, regulatory risks, and concerns about governance and financial transparency weigh heavily on their valuations.

If TikTok were owned by a U.S. company, that discount would disappear overnight. The app’s value would skyrocket.

We’ll see what happens. For now, TikTok’s future remains uncertain. A ban, a sale, or the status quo—any outcome seems possible.

Based on analyst estimates. Alphabet’s full-year 2024 financials haven’t been reported yet

ByteDance is a private company. According to Sacra, recent private market stock transactions put the valuation of the firm at $215 billion, while it generated $146 billion in revenue in 2024

The ban is going to happen and Bytedance has said unequivocally it would not sell TikTok and I don't think they will and shouldn't. TikTok is still only 14% of Bytedance income and that can be made up elsewhere. We in the USA are losing out not China. Thank you FB and I hope former Tiktokers do not go to IG.

Sumit, assuming the ban goes through, will you be posting your videos elsewhere?