Trump's Recession? 10 Predictions for the Next Four Years

Now that we’ve all had a chance to digest the U.S. election results, it’s time for some hot takes on what we can expect over the next four years during Trump’s second stint in the Oval Office.

I have ten of these for you; some of them are predictions, while others are more like observations.

Let’s get started!

Hot Take #1: A recession is increasingly likely during Trump’s presidency

Now, I’m generally not a big believer in the idea that the U.S. president can wave a magic wand and single-handedly drive large changes in economic growth— at least in the short-term.

Trump might be a little bit of an exception to that because he’s expressed interest in using this really powerful weapon— tariffs— in a way that could dramatically impact international trade. We’ll see what happens with that.

But this take has nothing to do with Trump’s policies.

Instead, it’s simply an acknowledgement of the fact that we have a capitalist economic system in the U.S., and because of that system, we experience business cycles, or ups and downs in the economy.

The economy tends to get larger over time, but every now and then it gets smaller, and we call those periods recessions.

The last recession we had lasted from February 2020 through April 2020, during the height of the COVID pandemic. The recession before that went on from December 2007 to June 2009, during the financial crisis.

Since 1945, on average, the U.S. has seen a recession every five years.

The period between the end of the financial crisis and the start of the COVID pandemic was the longest period without a recession— 10 years and eight months.

Trump’s second term is scheduled to end in January 2029, which would be just under nine years after the COVID recession.

Nine years is on the upper end of how long economic expansions have historically lasted. Of course, the economy could continue to grow for ten years or even longer, but at some point, there will be a recession.

As we get deeper into Trump’s presidency, the expansion is going to start to feel long in the tooth and something might break.

Let me be clear: I’m not predicting that there will be a recession in the next four years (that would be impossible to do); I’m simply making an observation about business cycles in the U.S.

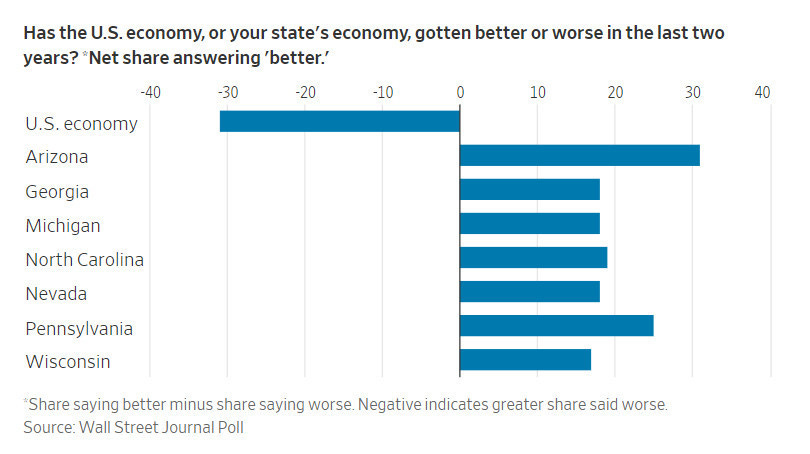

Hot Take #2: Everyone is going to change up how they feel about the economy

Actually, this has already happened. Look at this chart, which shows how Democrats and Republicans are feeling about the economy after Trump got elected.

Suddenly, Republicans are feeling much better about the economy, while Democrats are feeling worse.

It’s the reverse of what happened after Biden got elected four years, and really highlights how peoples’ perceptions about the economy are increasingly colored by their political views.

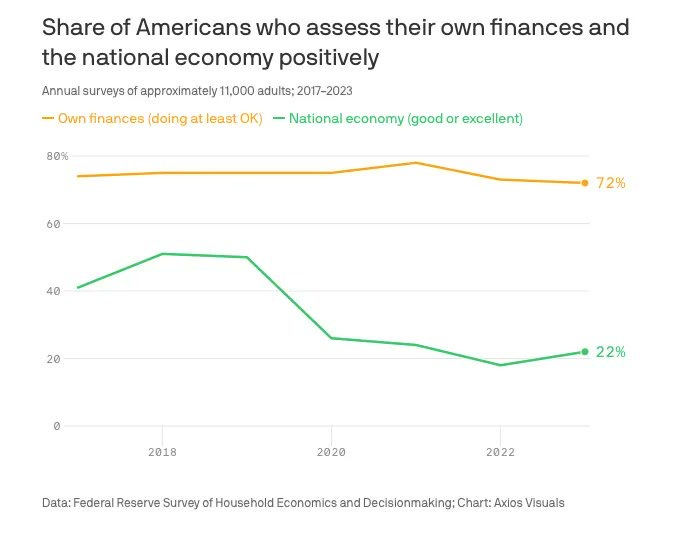

There’s also a story related to this that has nothing to do with politics. Since the COVID pandemic, in general, people have felt much gloomier about the economy than you would expect them to feel based on what’s actually happening with the economy.

Last year, The Economist created a model that used variables— including the unemployment rate, inflation and gas prices— to predict how people felt about the economy.

The model showed that these variables were very good at predicting how people felt for decades, but not since 2020.

Since then, something changed and it’s gotten to the point where people just feel terrible about the economy no matter what the economic indicators suggest.

Even weirder, people say they feel bad about the U.S. economy but pretty good about their own financial situation.

We’ll see if that changes under Trump. It almost certainly is going to change for Republicans, but will the rest of the country also start to feel more optimistic?

Hot Take #3: There’s going to be a lot of drama between Trump and the Fed

It’s no secret: Donald Trump wants more of a say when it comes to monetary policy. He’s explicitly said that he can do a better job than the Federal Reserve in setting interest rates and that he should be able to influence where rates go.

During Trump’s first term, he called Fed Chair Jerome Powell a naive bonehead for raising interest rates, and even threatened to fire him.

I expect more of the same this time around.

Even though the Fed is cutting interest rates right now, at some point— maybe even pretty soon— they’re going to stop. Inflation is still a little bit of concern and I think there is a consensus that interest rates are going to be higher going forward than they were prior to COVID.

Trump strongly favored lower interest rates during his firm term, so he probably isn’t going to like that.

There’s already been talk about how Trump could try to have more sway over the Fed by either firing Powell, demoting him, or replacing him with a “shadow” Fed chair who does what he wants.

Powell recently said that the president doesn’t have the authority to fire him, but that might not stop Trump from trying.

And if that fails, well, Powell’s term as Fed Chair ends in May 2026. So even if Trump isn’t able to get rid of him before then, he could elevate someone else to that position at that time.

There will be an opening on the Fed’s Board of Governors in January 2026, so Trump could appoint someone new to the board then and then make them Fed chair a few months later when Powell’s term is up.

This is going to be something that’s really important to watch. Anything that reduces the Fed’s independence will be seen in a very negative light by markets and could lead to higher inflation, higher interest rates, market volatility, and reduced confidence in the U.S. financial system.

That’s not good; the Fed needs to maintain creditability to do its job effectively.

Hot Take #4: Stocks will sell off at least 10% because of Trump’s trade war

By now, you’re probably aware of Donald Trump’s intention to raise tariffs on imports into the U.S. He did it in his first term and he’s promised to do it on an even larger scale during his second term.

And just like last time, Trump’s tariffs will almost certainly lead to retaliation from other countries, which in turn could lead to more Trump tariffs.

That’s the essence of a trade war— a series of escalating tariffs and other trade restrictions.

Now, I’m not going to get into the whole debate surrounding tariffs in this piece (I’ve said plenty about them in other posts), but regardless of whether you think tariffs are a tool that can lead to a stronger U.S. economy or not, it’s widely accepted that they cause at least some economic pain in the short-term.

The stock market isn’t going to like that. The market is dominated by firms that either depend on imports to make their products and/or export markets to sell their products into.

Anything that increases costs for corporations or hurts their ability to make sales and generate profits is negative for the stock market.

That said, the stock market is very resilient. I do think that barring some type of catastrophic change in trade policy (for instance, Trump cutting off all trade with China or something), the market will absorb the hits from the trade war, just like it did during Trump’s first term.

So, don’t be alarmed if stocks sell off next year and we get all sorts of scary headlines about Trump’s trade war.

The market sells off all the time for various reasons (in fact, in an average year, the stock market drops 16%, while we see at least a 10% sell off in two-thirds of all years).

The trigger is always different, but stock market corrections are completely normal.

Hot Take #5: The dollar will go up

Currency markets are notoriously difficult to predict, so I’m hesitant to make a call on how the dollar’s value might fluctuate versus other currencies.

But it certainly seems to me that all the stars are aligning for the dollar to perform well.

There are a lot of different factors that go into how currencies are priced, but a big one is interest rate differentials.

If interest rates in the U.S. are high relative to interest rates in other countries, that tends to attract money into the country, supporting the dollar.

Trump’s economic agenda includes tax cuts, deregulation and big deficits— which together could put upward pressure on economic growth and consumer prices.

In response, the Federal Reserve and bond markets could keep interest rates relatively high to counteract the inflationary impact of Trump’s policies.

Another big piece of Trump’s economic platform— tariffs— could also be supportive of the dollar.

Tariffs tend to reduce the demand for imports, which reduces the demand for foreign currencies, putting upward pressure on the buck.

Hot Take #6: It’s kind of crazy how no one knows whether TikTok is getting banned or not

Earlier this year, it seemed to be a sure thing that TikTok was going to get banned in the U.S.

Lawmakers hauled in TikTok’s CEO to grill him about the app’s connections to the Chinese government.

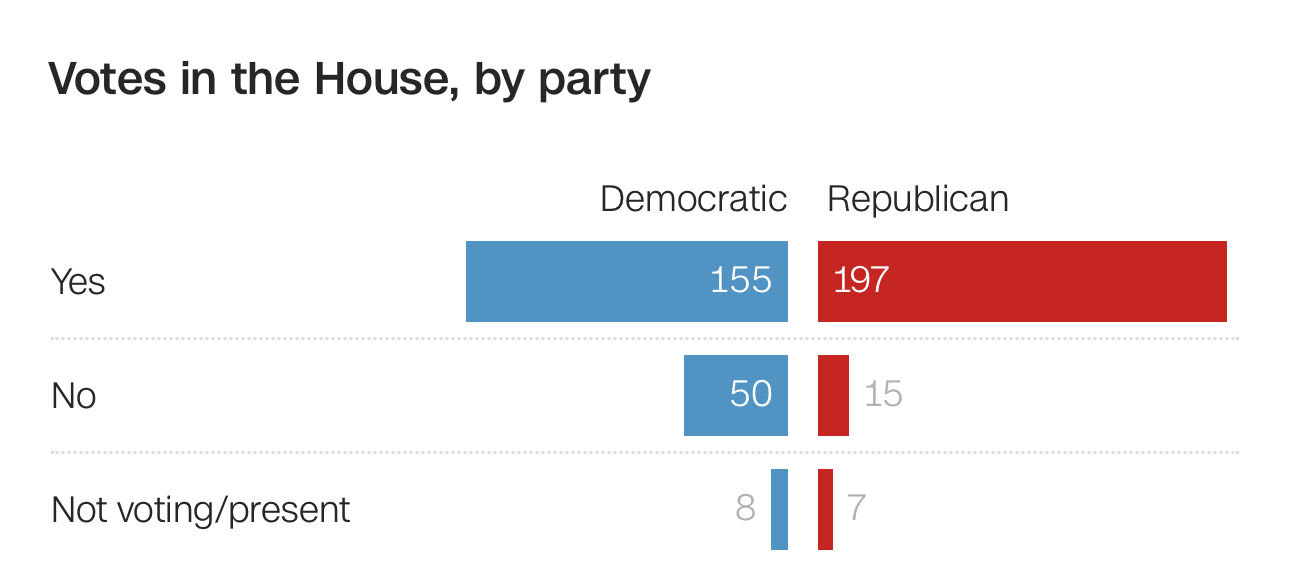

A few weeks later, both Democrats and Republicans in Congress united with President Biden to create a law that bans the app unless TikTok’s parent company, ByteDance, sells it to someone else.

Because the Chinese government didn’t seem willing to allow a forced sale of the app, it looked like TikTok was going to get banned after January 19, the day of the deadline.

But now, we’ve been thrown a curveball.

President Trump— who famously tried to ban TikTok in the U.S. during his first term— changed his tune on the campaign trail this year.

Now he’s saying that he doesn’t want TikTok to get banned because it provides competition to other social media apps— particularly Facebook and Instagram, which are owned by Meta.

In the past, Trump has feuded with Meta CEO Mark Zuckerberg, so his personal relationship with Zuckerberg could be shaping his views here.

Another reason that Trump might have changed his tune on TikTok is because he’s a star on the app now, with almost 15 million followers.

Whatever the reason may be, Trump likes TikTok now. The question is: what lengths will he go to in order to save the app? And, does he even have the authority to save the app?

The most straightforward way for Trump to intervene is by getting Congress to reverse the previous TikTok ban law that was signed by Biden.

But that law was passed with overwhelming bipartisan support, including the vast majority of Republicans in Congress.

If Trump can’t get Congress to pass another law, things get a little trickier.

He could potentially ask his administration to not enforce the TikTok ban law.

But even if he does that, it’s not clear that Apple and Google would play along by leaving TikTok in their app stores.

So, this is going to be a really interesting saga to follow.

Like I said, the deadline for ByteDance to divest TikTok or face a ban in the U.S. is Jan. 19th, a day before Trump’s inauguration.

We’re going to soon find out what Trump will do— if anything —to try to stop the ban.

And if he doesn’t step in, maybe another entity— like the courts— tries to stop the ban. Or maybe ByteDance gets approval from the Chinese government to sell its TikTok operations in the U.S. at the last minute.

A lot of different things could potentially happen. We shall see.

Hot Take #7: Prediction markets will grow to be bigger than the stock market

This one is actually not one of my takes; it’s from the billionaire founder of Interactive Brokers, Thomas Peterffy.

Peterffy recently said that he believes prediction markets could become larger than stock markets within 16 years.

I was shocked when I heard this because today, the U.S. stock market has a market cap of $60 trillion, while the global stock market has a market cap of $100 trillion. And every day, there are hundreds of billions of dollars worth of shares traded in the stock market.

These are just huge, huge numbers, so it’s pretty bold to say that the relatively tiny prediction markets will eventually surpass them.

That said, we all saw the potential of prediction markets in the lead up to the U.S. presidential election, when platforms like Polymarket and Kalshi experienced heavy activity and were widely cited as indicators of who had the best chance of winning the race.

Those prediction markets generally got the election right; they were pointing towards a Trump win and that’s what we got.

Peterffy thinks that the success of prediction markets is going to continue and people are going to increasingly use them to make big bets on everything from whether global temperatures will rise because of climate change to the outcome of major geopolitical conflicts.

As a result, he says that society is going to be better off because we will have more information about the true state of the world.

He makes a good case and I generally I agree with him on that. I’m not ready to say that prediction market are going to be bigger than stock markets, but I certainly see their potential, and have a feeling that we will be hearing a lot more about them going forward.

Hot Take #8: Political ads are kind of useless

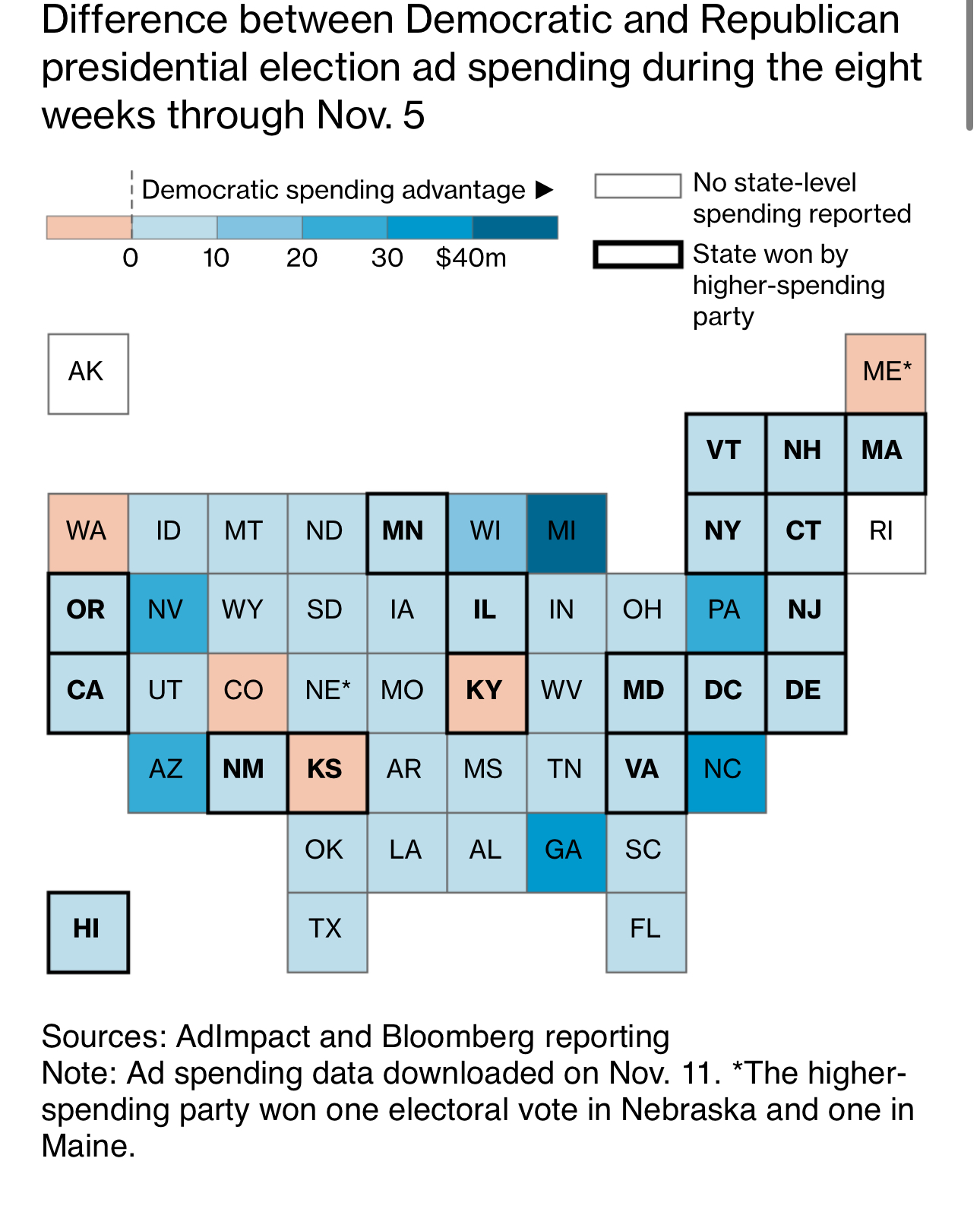

Democrats outspent Republicans by $334 million in the two months leading up to the election.

But in the end, it didn’t matter.

Trump won the election handily— probably because of economic reasons, but also because he was able to get his message out through other channels, like the Joe Rogan podcast and even TikTok.

This map from Bloomberg really highlights this point; Democrats had a big spending advantage in almost every state— including every single swing state— but Harris didn’t win any of the swing states.

As Bloomberg points out, most of the ad dollars went towards broadcast TV, and as we all know, fewer and fewer people are watching traditional broadcast TV (certainly not the younger generations).

In the future, it’s easy to imagine that there will be less emphasis on traditional political advertising and more focus on new forms of media like podcasts, social media, etc.

Hot Take #9: The biggest political risk of Trump’s presidency may have to do with Taiwan

For the past year, the biggest geopolitical story has been the war between Israel and Gaza. Prior to that, it was Russia’s invasion of Ukraine.

Both of those conflicts are still ongoing and there is the potential for escalation— either in the Middle East or in Eastern Europe

But the biggest geopolitical risk during Trump’s presidency might not come from either of those regions, but rather Asia, where China is eyeing Taiwan.

Chinese president Xi Jinping has consistently promised to reunify Taiwan with mainland China; he said so as recently as last month.

China, of course, brought Hong Kong to heel several years ago, and expectations are that as long as Xi remains president, at some point, he could try to make a move on Taiwan.

Would he do it when Trump is the U.S. president? Hopefully not.

But a new president who is hesitant to get the U.S. involved in foreign conflicts may be the opportunity that Xi is looking for.

Unlike Biden, Trump’s support of Taiwan has been ambiguous. He’s claimed that Taiwan stole the United States’ chip manufacturing business and he’s said that the island should pay the U.S. for defense.

He’s also mentioned that he would put tariffs on China if it invaded Taiwan, which doesn’t sound like much of a deterrent.

So, we’ll see what happens. I’m certainly not predicting that China will invade Taiwan in the next four years, but it’s something to keep an eye on.

Especially since, if China ever did invade Taiwan, it could be devastating for the global economy.

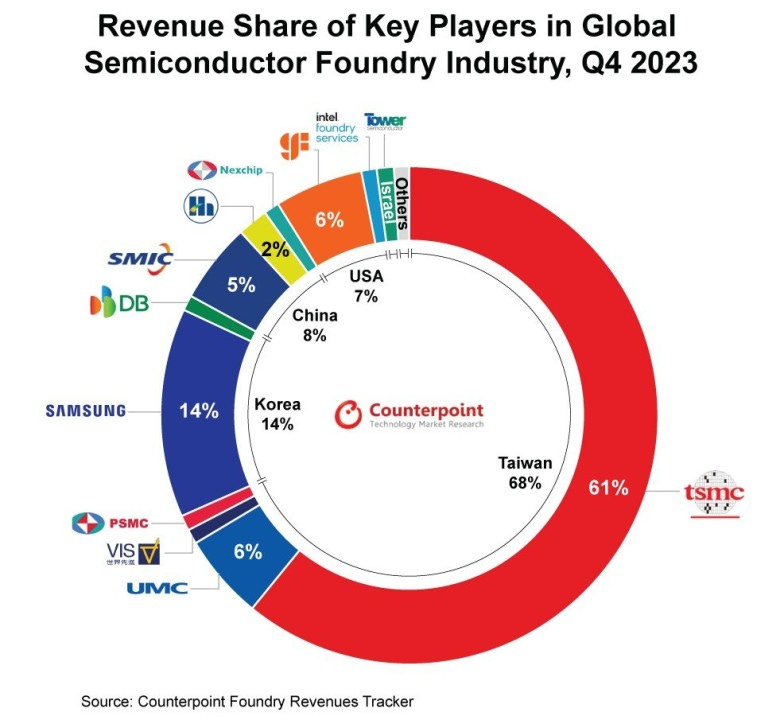

Taiwanese companies produce the majority of the world’s chips, and something like 90% of the world’s most advanced chips that power everything from smart phones to AI applications.

The loss of those semiconductors would cripple the global economy. Let’s hope it doesn’t happen.

Hot Take #10: Trump’s economic policies might not have the effect that people anticipate

Let me ask you this: are Trump’s economic policies good or bad for economic growth? Well, it kind of depends on what you focus on, right?

Some people who focus on his corporate tax cuts and his goal of cutting back on regulations see Trump’s policies as positive for economic growth.

Others who focus on his tariffs see them as negative for growth.

The same goes for inflation. Tariffs tend to push consumer prices up, while deregulation tends to push prices down.

Then you have more ambiguous Trump policies, like the mass deportation of illegal immigrants.

That could either be inflationary if it causes labor shortages, or deflationary, if it causes a sharp drop in the demand for goods and services.

In other words, there are a lot of offsetting forces within Trump’s economic policies. And that’s not even considering the fact that we don’t know exactly what Trump will try to do and will be able to do.

Does he deport 1 million immigrants or 10 million immigrants?

Does he raise tariffs on China to 30% or 100%?

What kind if corporate tax cuts can he get Congress to agree to?

And let’s not forget about the Fed. If Trump’s policies put upward pressure on prices, does the U.S. central bank offset that with higher interest rates?

There are a whole bunch of potential scenarios and it’d be impossible to model them all out with any sort of precision.

So, when someone asks whether Trump is good for the economy or bad for the economy— the truth is that it’s really hard to answer that question, especially right now before we’ve even had a chance to see what Trump actually does.

Nice write up Sumit! I think we are going to have a large 10% dump too. Its coming and lots of Jan vix calls are getting bought up....