Profiting From High Interest Rates

Here are some investment ideas for you to consider.

Today, I’m going to talk about how you can profit from the recent surge in interest rates.

But before I get into the investments, here’s a little bit of context that you should know.

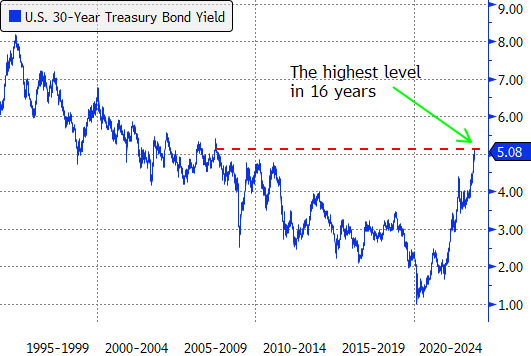

This week, the interest rate on the 10-year U.S. Treasury note topped 5% for the first time in 16 years, while the interest rate on the 30-year Treasury bond neared 5.1%—also for the first time in 16 years.

We haven’t seen long-term interest rates this high in a very long time, and that naturally has a lot of people wondering: how do you take advantage of these high interest rates?

That’s what this post is about.

Now, when it comes to profiting from high interest rates, there are countless ways to do it, but almost all of them can be put into two broad categories.

One way to profit is by generating income from an investment. Think of this as similar to when you put money in a bank account. The bank pays you interest periodically for having money in your account.

The other way to profit is to invest in something that will appreciate in value if and when interest rates go down from today’s high levels.

The classic example of this is a bond. Bonds are essentially loans that can traded among investors, and their price moves in the opposite direction to that of interest rates. So, if rates go down, bond prices go up (and vice versa).

Those are the two approaches to profiting from high interest rates—income and price appreciation—but they’re not mutually exclusive. You don’t have to stick with one approach or the other; you can use both.

In fact, many investments have the potential to generate income and appreciate in value.

That said, in general, most people prioritize one goal over the other. So, consider your top priority as I go through these investment ideas.

Long-Term Treasury Bonds

Up first is the iShares 20+ Year Treasury Bond ETF (TLT). This has been an extremely popular fund among investors who want to bet on an interest rate decline.

TLT owns Treasuries with maturities of 20 to 30 years—so we’re talking very long-term bonds. And since these bonds don’t get paid back for two to three decades, TLT is extremely interest rate sensitive.

If interest rates go up, the price of TLT goes down significantly; and if interest rates go down, the price of TLT goes up significantly.

We’ve seen both of these scenarios play out over the past few years. From the start of 2019 through the middle of 2020, TLT surged as interest rates hit rock bottom levels during the pandemic.

Then from 2021 through today, TLT plunged as interest rates spiked due to high inflation. Anyone who made the unfortunate decision to buy TLT at its peak in 2020 has lost nearly half of their money.

But, that was a very different time. The interest rate on the 30-year Treasury bond was as low as 1% in 2020. Today, it’s over 5%.

That makes TLT a fundamentally different investment today than it was at any time over the past decade, when interest rates were lower.

There is more room for interest rates to fall from 5%, than there was when interest rates were 1%, 2% or 3%. And that means more upside potential for TLT.

Additionally, many investors believe that today's high interest rates will eventually lead to an economic slowdown or a recession, and that this slowdown will, in turn, lead to lower interest rates.

It’s a pretty compelling thesis and that’s why so many investors have bought into TLT this year (a whopping $20 billion has been invested in TLT since the start of 2023).

Investors in the fund are betting that interest rates on long-term bonds are close to their peak and therefore the price of long-term bonds—like the ones held by TLT—are close to their lows.

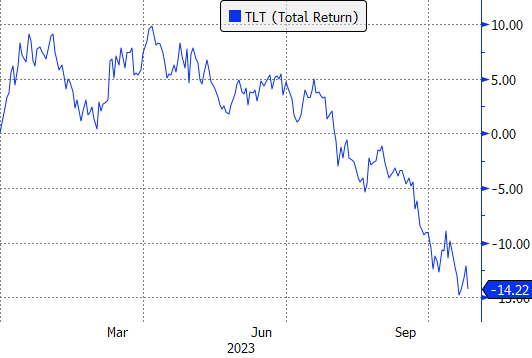

But, as compelling as the TLT investment thesis is, it isn’t risk free. Since the start of the year, TLT has fallen by 14%, and almost anyone who has bought it is losing money.

Why? Because interest rates have gone much higher than most people expected.

That bullish thesis for TLT that I outlined a moment ago, is the same one that a lot of people were espousing when interest rates were 3% to 4% a year ago.

Yet, we didn’t see an economic slowdown, rates continued to move higher, and the price of TLT continued to move lower since then.

Still, that doesn’t take away from the fact that if you believe that long-term interest rates have finally peaked or they’re close to peaking, then TLT is one of the best ways to express that view and potentially profit from it.

Unlike with other types of investments, there’s no credit risk when it comes to TLT since it holds Treasuries issued by the U.S. federal government.

You know that those bonds are going to get paid back; you don’t have to worry about that. Instead, all you have to worry about is where interest rates are going to go.

Risk/Reward

While TLT is primarily a bet on interest rates, you do get a 5% yield when you buy the ETF, which is a nice benefit. If all you want is income, TLT isn’t the right investment for you because its price is so volatile.

But if you buy it with the expectation that rates will fall, it’s nice that you get paid a solid 5% yield while you wait.

That 5% yield also reduces the downside you would experience if interest rates keep going up.

For instance, if interest rates on long-term Treasury bonds decrease 100 basis points, from around 5% to 4% over the next year, TLT would give you a return of about 21%. But if interest rates rise 100 basis points, from 5% to 6%, TLT would only go down by around 11%.

So, that 5% yield on TLT is nice to have, but not everyone might need it or want it. If your goal is to profit from a potential decline in interest rates, maybe there’s no point in bothering with interest payments at all.

That’s the approach that investors in the PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ) are taking.

This ETF holds Treasury STRIPS (Separate Trading of Registered Interest and Principal of Securities), which are Treasury bonds that don’t pay interest in the same way that normal Treasuries do. They’re sold at a discount to face value and then that full face value is paid back at maturity.

Because they don’t make periodic interest payments, STRIPS are even more interest rate sensitive than normal Treasuries.

That’s good if all you care about is profiting from an interest rate decline. If rates drop, ZROZ will rise more than TLT. At current interest rate levels, a 1% change in interest rates will result in roughly a 26% move in ZROZ’s price.

Adding Leverage

You can take this bet on falling interest rates even further than ZROZ does. The Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF) takes it to the extreme.

I’m going to say this once now and I’ll say it again later: do not buy this ETF unless you have a very high tolerance for risk.

TMF is what’s known as a leveraged ETF. It uses derivatives—specifically, futures contracts and swaps— to magnify its gains and losses.

The ETF tracks those same 20 to 30 year Treasury bonds that TLT holds, but with 3x leverage.

What that means is that on a day in which TLT gains 1%, TMF will gain 3%. And on a day in which TLT drops by 2%, TMF will drop by 6%.

If you’re convinced that interest rates are going to go down from here and bond prices are going to shoot up, you might be tempted to buy TMF because it has the potential to deliver some huge returns if you’re right.

A lot of investors have done just that. We’ve seen almost $3 billion invested in this ETF since the start of the year.

But I have to reiterate, this is an extremely risky fund that is not appropriate for most investors. Remember how I said TLT lost nearly half of its value since its peak in 2020? Well, TMF has lost a eye-popping 91% of its value in that same time frame.

If you do buy this ETF, be extremely careful and only invest money that you can afford to lose.

So far, I’ve talked about three investments that stand to benefit if interest rates fall from here.

ETFs like TLT and ZROZ are straight forward ways to bet on declining interest rates. But there’s a whole world of investments that could potentially benefit from rates going down.

For example, many stocks that pay high dividends have underperformed as interest rates have risen. That’s because a lot of people buy those stocks for income, and as interest rates have gone up, those dividends have become less attractive.

A stock paying a 3% dividend might look really great when Treasury bonds are yielding 1%, but when they’re yielding 5%, all of a sudden, that stock doesn’t look as compelling and the bonds starts to look a lot more attractive.

We’ve seen this phenomenon impact stocks in sectors that are known for paying steady dividends—like utilities and consumer staples.

For instance, the Utilities Select Sector SPDR Fund (XLU) and the Consumer Staples Select Sector SPDR Fund (XLP) are down 14% and 7%, respectively, so far this year, sharply underperforming the S&P 500’s 11% gain.

That said, if you think interest rates are going to fall from here, maybe this sell-off in utilities and consumer staples stocks represents an opportunity. If rates go back down, there’s a chance that these stocks could rebound and outperform the broader stock market.

Another group of stocks that could benefit from falling interest rates are those of companies with a lot of debt, since lower rates reduce the amount of interest they have to pay on that debt.

Small cap stocks, like those held by the iShares Russell 2000 ETF (IWM), tend to hold a lot more debt relative to their income than large cap stocks, so that could be an area to look at if you believe rates are headed lower.

Keep in mind, though, that there’s no guarantee that any of the stocks I’ve mentioned— small caps, utilities or consumer staples— will go up if rates go down. These aren’t pure plays on interest rates in the same way that something like TLT is.

When you buy these stocks, you have to account for company risk, sector risk, and stock market risk. Interest rates could go down, but utility stocks could go down also if the economy goes into a recession and the whole stock market tanks.

That’s different than Treasury bonds, which move mechanically with interest rates. If rates rise, they go down. If rates fall, they go up. There’s no ifs ands or buts about it.

The Income Approach

I’ve spent a lot of time talking about ways to profit from high interest rates using one approach, which is betting on a decline in interest rates.

But what if you don’t want to make a directional bet on interest rates and you just want to take advantage of high interest rates by earning income?

This is the approach that’s suitable for most investors. Unless you have a very strong view about interest rates, you shouldn’t be speculating about whether rates are going to go up or go down.

Instead, you should focus on building a portfolio of investments that generates an attractive level of yield and that matches your tolerance for risk.

A good place to start is by investing any unused cash you have in the closest thing there is to a risk-free investment: Treasury bills.

You can do this by buying money market funds like the Vanguard Treasury Money Market Fund (VUSXX) or by buying ultra-short-term Treasury bond ETFs like the iShares 0-3 Month Treasury Bond ETF (SGOV)¹.

Today, these investments are paying over 5% risk free. They have no credit risk because their underlying holdings are backed by the U.S. federal government.

And they have no interest rate risk because their T-bill holdings mature so quickly.

Unlike the price of TLT, which is highly sensitive to interest rate movements, the price of VUSXX and SGOV don’t move at all.

With these funds, you can generate over 5% interest without worrying about the value of your principal moving around.

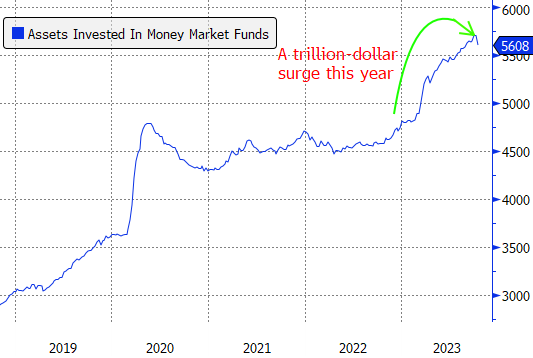

A lot of investors have taken advantage of this; we’ve seen close to $1 trillion go into money market funds and ultra-short-term bond ETFs so far this year.

But as great as these investments are, they aren’t the solution to everything. You can’t stash your cash in these funds and expect that you’ll generate 5% interest forever.

Interest rates might stay high for the next few months or even the next few years— no one really knows.

But one thing is for sure: they are not going to stay in one place forever, and there is the possibility that they can go down from here.

So, if you’re invested in a money market fund, you might be making 5% today. But if interest rates go down, you’ll eventually be making less than that—4%, 3%, or whatever the prevailing rate on Treasury bills is.

This is called reinvestment risk. By buying really short-term bonds like Treasury bills that get paid back quickly, you are exchanging interest rate risk—or the fluctuations in price that come from interest rate movements—for reinvestment risk, or the risk that you’ll have to reinvest your money at a lower interest rate.

There are things you can do to mitigate reinvestment risk, like building bond ladders, where you own bonds of varying maturities.

For example, you might put some money into Treasuries that mature one year from now, Treasuries that mature two years from now, Treasuries that mature three years from now, and so on.

That way, even if interest rates go down, you’ll continue to generate higher rates on the Treasuries you purchased that have yet to mature.

On the other hand, if interest rates go up, you can reinvest the proceeds from the bonds that mature into new, longer-term bonds with higher interest rates.

Laddering is a way to systematically invest in bonds without having to make a call on whether interest rates are going to go up or down.

As you can see, investments in Treasuries—whether it be money market funds, Treasury bond ETFs or individual Treasuries—are a great way to profit from high interest rates. There’s no credit risk and you can pick the level of interest rate risk and reinvestment risk that’s right for you.

But the universe of bonds extends far beyond just Treasuries. There’s everything from municipal bonds to corporate bonds, and more.

These bonds typically offer higher interest rates than Treasuries in exchange for higher credit risk (they’re not guaranteed to be paid back like Treasuries are).

I wrote a comprehensive guide to bonds not too long ago, so check that out if you’re interested in learning more.

Personally, I don’t think taking credit risk in this environment makes a ton of sense given that you can get 5% yields in Treasuries, and the extra yield you get for investing in riskier bonds isn’t that much.

For instance, today you get about 150 basis points (1.5%) more by investing in investment grade corporate bonds than you get in Treasuries, but that’s less than the average premium of 165 basis points that we’ve seen over the past decade.

Another option for yield is to look at dividend stocks that have fallen on the back of higher interest rates, like the utilities and consumer staples stocks I mentioned earlier. Yields on those are around 2.5% to 3.5%.

That’s obviously lower than the yields on Treasuries today, but the advantage is that dividends can grow over time.

Of course, dividend stocks have a completely different risk profile than bonds—so be mindful of that— but they are a way to potentially profit from the current high interest rate environment.

Covered Call Treasury ETF

Because you’ve stuck around and read this post until now, I’ll give you one bonus investment idea: the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW).

This fund does two things—it holds a position in TLT, the 20+ Year Treasury Bond ETF I talked about earlier, and it writes covered call options on that position.

By selling options, TLTW generates additional income for investors. This income can be substantial; the ETF has a yield of 19.5% based on its last twelve months of distributions, while it has a yield of 12.7% based on annualizing its most recent distribution.

But this extra yield isn’t a free lunch; it comes at the cost of capping the price appreciation potential of the ETF.

If interest rates go down and TLT goes up in price, then TLTW won’t capture much of that upside since it’s sold options on its position.

The ETF sells one-month call options that are 2% out of the money, so any increase in TLT’s price beyond 2% in a given month won’t be captured by TLTW.

In other words, if you invest in TLTW, you’re giving up potential price appreciation in exchange for current income. It’s the type of strategy that might appeal to you if you expect interest rates to stay around where they are today or to move just a little bit in either direction.

¹Alternatively, you can achieve something similar by putting your money into FDIC-insured high-yield savings accounts, like those offered by many banks